Shibarium, the much-anticipated Layer 2 network for Shiba Inu, launched to much fanfare a few months ago. Designed to boost transaction speeds and lower costs for the Shiba Inu ecosystem, Shibarium’s performance is closely watched by the SHIB army. However, recent data reveals some concerning trends in Shibarium’s network activity, leading to questions about its impact on Shiba Inu (SHIB) prices. Let’s dive into what’s happening and what it could mean for SHIB holders.

Shibarium’s Block Creation: What’s the Downtrend?

In the blockchain world, the creation of new blocks is a fundamental indicator of network activity. Think of it like this: each block is a page in a ledger, recording transactions. More activity means more transactions, and thus, more pages (blocks) are added to the ledger. A drop in block creation can signal a slowdown in network usage. And that’s precisely what Shibarium has been experiencing.

According to ShibariumScan, a prominent analytics platform for the network, the number of new blocks being forged on Shibarium has taken a noticeable dip. In just two days, the network witnessed a significant decrease of over 38% in block production. Let’s break down the numbers:

- **Peak Activity:** Early November saw robust block creation, hitting a high of 17,212 blocks on November 7th.

- **The Decline Begins:** Starting November 8th, the number of new blocks started to decrease.

- **Sharp Drop:** By November 9th, the network produced only 10,627 blocks.

- **Percentage Decline:** This represents a substantial 38.25% reduction in block creation within a short 48-hour period.

To put it into perspective, block creation was consistently strong throughout October and the initial days of November. This sudden drop raises concerns about potential factors influencing network activity.

Read Also: Bitcoin Surges to $37,000, but Traders Still Express Concerns Over Price Action

Block Size Increase: A Silver Lining?

Interestingly, while block creation decreased, another metric showed a contrasting trend: average block size. This metric, measured in bytes, reflects the amount of data contained within each block. Here’s what the data reveals:

- **Increasing Size:** The average block size on Shibarium has been on a steady incline.

- **From 934 to 1,340 Bytes:** It rose from 934 bytes to 1,340 bytes recently.

- **October Peak Comparison:** While still below the October peak of 2,820 bytes, it’s still a noteworthy increase.

What does this mean? A larger block size *could* indicate that while fewer blocks are being created, those blocks are packed with more data. This might suggest that the *nature* of transactions on Shibarium is changing, even if the *volume* of blocks is down. However, further investigation is needed to confirm this.

Why the Block Creation Dip? Potential Factors

Several factors could contribute to the decrease in block generation on Shibarium. One potential explanation lies in user activity:

- **Decline in New Accounts:** Data suggests a decrease in new users joining the Shibarium network.

- **Drop in Active Accounts:** Similarly, the number of actively used accounts has also declined.

- **November 9th Numbers:** On November 9th, only 20 new accounts and 588 active accounts were recorded.

A reduction in both new and active users would naturally lead to fewer transactions and, consequently, fewer blocks being created. This could be a temporary fluctuation or signal a broader trend that needs monitoring.

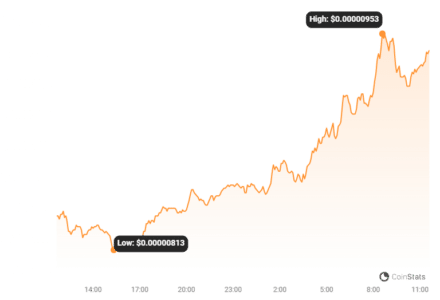

SHIB Price Under Pressure: Is Shibarium to Blame?

Now, let’s address the elephant in the room: the impact on Shiba Inu (SHIB) prices. It’s true that SHIB has experienced price declines recently. However, directly attributing this solely to the Shibarium block decrease might be an oversimplification. Here’s why:

- **Broader Market Influence:** The crypto market is interconnected. Bitcoin (BTC), the leading cryptocurrency, has also seen price corrections, falling below the $37,000 mark.

- **Market-Wide Downturn:** Bitcoin’s movements often influence the entire cryptocurrency market, including meme coins like SHIB.

- **Profit-Taking:** After periods of price increases, traders often take profits, leading to temporary price dips. This is a normal market dynamic.

That being said, Shibarium’s performance *can* indirectly affect SHIB sentiment. If users perceive issues with Shibarium’s network activity, it could dampen enthusiasm for the Shiba Inu ecosystem as a whole.

On a positive note, despite the price dip, Shiba Inu’s trading volume has surged by over 40% in the last 24 hours. This indicates continued interest in SHIB, even amidst price fluctuations. It could suggest that traders are seeing the dip as a buying opportunity.

Currently, SHIB is trading around $0.00000942, and market indicators suggest bulls are still holding some control. If Bitcoin recovers, we could see SHIB regain upward momentum.

Looking Ahead: Shibarium and SHIB’s Future

The recent decrease in Shibarium block creation is a development worth watching. While it may not be the sole driver of SHIB’s price fluctuations, it’s an important indicator of network health and user engagement. Here’s what to keep an eye on:

- **Continued Monitoring:** Track ShibariumScan and other analytics platforms for block creation, active users, and transaction data.

- **Ecosystem Developments:** Stay updated on new projects, partnerships, and updates within the Shiba Inu ecosystem, including Shibarium.

- **Market Sentiment:** Observe overall cryptocurrency market trends and Bitcoin’s price action, as these significantly influence SHIB and other altcoins.

Shibarium is still relatively new, and network activity can fluctuate. The Shiba Inu community’s strength and ongoing development efforts remain crucial for the long-term success of both Shibarium and SHIB. Whether this block creation dip is a temporary blip or a sign of a more persistent trend remains to be seen. As always, in the volatile world of crypto, staying informed and doing your own research is paramount.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.