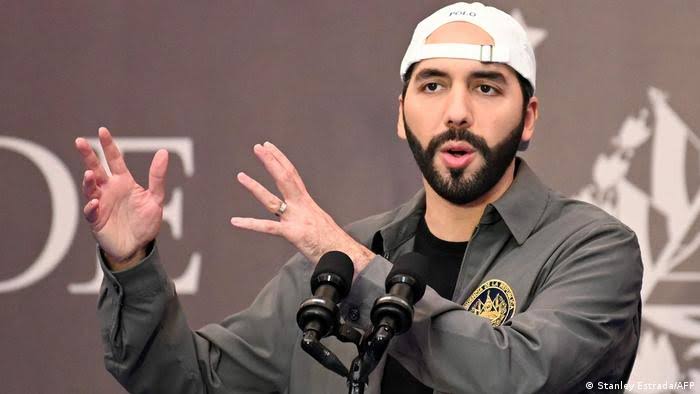

Is El Salvador’s Bitcoin experiment paying off? President Nayib Bukele seems to think so, and he’s not shy about letting the world know, especially when challenged by Bitcoin skeptics. In a recent Twitter exchange with prominent gold advocate Peter Schiff, Bukele didn’t just defend his country’s Bitcoin strategy; he dropped some truth bombs about just how well it’s performing compared to traditional gold reserves.

The Twitter Tussle: Bukele vs. Schiff on Bitcoin

The conversation ignited when Peter Schiff, known for his bearish stance on Bitcoin and bullish views on gold, commented on El Salvador’s latest Bitcoin purchase. Over the weekend, as Bitcoin prices dipped, El Salvador seized the opportunity to ‘buy the dip’, adding another 100 BTC to their holdings. Schiff, ever critical, questioned President Bukele directly:

“There’s a lot more dips coming. How much taxpayer money do you intend to waste?”

President Bukele’s response was swift and decisive, showcasing his confidence in Bitcoin:

“None.”

“We’re already in the green from our last purchase, in less than 24 hours.”

But Bukele didn’t stop there. He then delivered a knockout punch, directly comparing Bitcoin’s performance to El Salvador’s gold reserves:

“You know boomer, we have 44,106 oz of gold in our reserves…”

“Worth $79 million, down 0.37% from a year ago. If we had sold it a year ago…”

“and bought bitcoin, it would now be valued at $204 million.”

In essence, Bukele highlighted a missed opportunity. Had El Salvador invested in Bitcoin instead of holding gold a year prior, their reserves would have more than doubled in value. This bold statement underscores the potential gains (and risks) associated with cryptocurrency investments, especially when compared to traditional safe-haven assets like gold.

Bitcoin vs. Gold: A Stark Contrast in Returns

Bukele’s comparison is a powerful illustration of the shifting financial landscape. For decades, gold has been the go-to asset for hedging against inflation and economic uncertainty. However, the rise of Bitcoin has presented a compelling alternative, particularly in terms of potential returns. Let’s break down the comparison:

| Asset | El Salvador’s Reserves | Value (Current) | Value Change (Year-over-Year) | Hypothetical Bitcoin Value (If invested a year ago) |

|---|---|---|---|---|

| Gold | 44,106 oz | $79 Million | Down 0.37% | N/A |

| Bitcoin (Hypothetical) | Equivalent value to gold reserves a year ago | $204 Million | Significant Increase (Calculated by Bukele) | $204 Million |

This table clearly shows the dramatic difference in performance. While gold has remained relatively stagnant, Bitcoin has experienced explosive growth. Bukele’s point is clear: in the current market, Bitcoin has proven to be a far more lucrative investment than gold, at least in the short to medium term.

Echoes from Microstrategy: Saylor’s Bitcoin Bet

President Bukele isn’t alone in recognizing Bitcoin’s superior performance over gold. Michael Saylor, CEO of Microstrategy, a company that has heavily invested in Bitcoin, made a strikingly similar observation back in September:

“If I had chosen gold instead of bitcoin last year, it would have been a multi-billion dollar mistake.”

Microstrategy’s conviction in Bitcoin is evident in their continued accumulation of the digital asset. In late November, they added another 7,002 BTC to their portfolio, bringing their total holdings to a staggering 121,044 coins. This aggressive accumulation further underscores the belief among some institutional investors that Bitcoin represents a significant opportunity for growth and value storage.

El Salvador’s Bitcoin Adoption: A Global Experiment

El Salvador’s decision to adopt Bitcoin as legal tender in September alongside the U.S. dollar was a groundbreaking move, making them the first country in the world to take such a step. This decision has placed El Salvador at the forefront of the cryptocurrency revolution, turning the nation into a real-world laboratory for Bitcoin adoption.

However, this pioneering move has not been without its critics and challenges. The International Monetary Fund (IMF) issued warnings last week regarding the risks associated with using Bitcoin as legal tender. Concerns range from price volatility and potential risks to financial stability to the use of cryptocurrencies for illicit activities.

Despite the IMF’s reservations and the inherent volatility of the crypto market, President Bukele remains steadfast in his belief in Bitcoin. His recent Twitter exchange and public statements suggest a strong conviction that Bitcoin is not just a fleeting trend but a significant financial innovation that can benefit his nation.

Is Bitcoin the New Gold?

While it’s too early to definitively declare Bitcoin as the ‘new gold,’ the comparison made by President Bukele and Michael Saylor highlights a crucial point: Bitcoin is increasingly being considered as a store of value and a hedge against inflation, roles traditionally held by gold. Bitcoin’s limited supply, decentralized nature, and growing adoption are contributing to this narrative.

However, it’s important to remember that Bitcoin and gold are fundamentally different assets. Gold is a tangible commodity with thousands of years of history as a store of value. Bitcoin is a digital asset, a technological innovation still in its relatively early stages of adoption. Bitcoin’s price volatility remains significantly higher than gold’s, making it a riskier investment.

Ultimately, whether Bitcoin will fully replace or even surpass gold as the preferred store of value remains to be seen. El Salvador’s experiment will be closely watched by the global financial community, providing valuable insights into the real-world implications of widespread Bitcoin adoption.

For now, President Bukele is clearly celebrating Bitcoin’s gains, using them to defend his country’s bold financial strategy and engage in some good-natured ribbing of Bitcoin skeptics like Peter Schiff. One thing is certain: El Salvador’s Bitcoin gamble has sparked a global conversation about the future of money and the evolving role of cryptocurrencies in the global economy.

Galaxy Interactive Rises Additional $325M Fund For Metaverse and Next Gen…>>

Related Posts – Bank DBS’s Crypto Business Grows Massively Due To Growing Demand From Investors

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.