Decentralized Finance (DeFi) is a constantly evolving landscape, and recent developments in the crypto space are keeping everyone on their toes. One such noteworthy event is Uniswap’s deployment on the Polygon network in December 2021. Initially, it seemed like a match made in crypto heaven, but the story is getting more nuanced as we delve deeper. Let’s break down what’s happening with Uniswap on Polygon and what it means for the DeFi ecosystem.

Uniswap’s Explosive Entry into Polygon’s Territory

Imagine stepping into a new market and quickly making your presence felt. That’s precisely what Uniswap did on Polygon. Just weeks after its integration, this DeFi heavyweight started carving out a significant piece of Polygon’s market share. According to reports from OurNetwork, Uniswap’s market share on Polygon surged dramatically. In just a week, it jumped from around 20% to nearly 30%, and then further climbed to approximately 45% at the time of reporting. This rapid ascent is quite remarkable, showcasing Uniswap’s strong brand recognition and the demand for its services within the Polygon ecosystem.

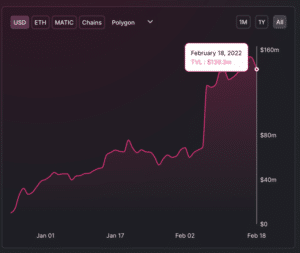

The Total Value Locked (TVL) on Uniswap on Polygon mirrored this impressive growth. February 2022 witnessed a significant surge in TVL, peaking at a substantial $139.3 million on February 18th. This spike indicates a strong influx of assets into Uniswap on Polygon, reflecting increased user confidence and activity.

Source: DeFi Llama

Polygon: A Growing Hub for Crypto Activity

Uniswap’s expansion isn’t just beneficial for itself; it’s also a positive sign for Polygon. Polygon has been experiencing impressive growth in user adoption. In the month leading up to the report, Polygon attracted a whopping 2.36 million unique addresses. This surge in unique addresses points towards Polygon becoming an increasingly popular platform for crypto users.

Interestingly, Polygon seems to be gaining traction within the gaming community. Reports suggest that several gaming titles on Polygon are attracting significant player bases, with seven titles boasting over 10,000 monthly active players. This highlights Polygon’s versatility and its appeal beyond just DeFi applications.

Competitive Landscape: Who’s Leading the dApp Race on Polygon?

While Uniswap is making waves, it’s important to understand its position within the broader Polygon dApp ecosystem. Let’s take a look at the top decentralized applications (dApps) on Polygon based on user activity.

Sunflower Farmers, QuickSwap, and SushiSwap Leading in User Count

One notable example mentioned is Sunflower Farmers, a game that garnered significant attention, although its popularity reportedly led to some revenue imbalances. When examining the top dApps by user count on Polygon, QuickSwap, Sunflower Farmers, and SushiSwap were significantly ahead of Uniswap. For context, Uniswap had 16.6k users in the week prior to the report. This data indicates that while Uniswap is growing, other platforms still command larger user bases on Polygon.

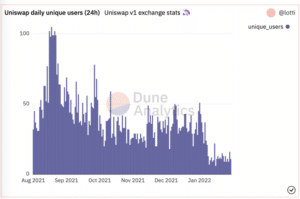

Source: Dune Analytics

Are There Clouds on the Horizon? Challenges for Uniswap on Polygon

Despite the initial positive momentum, the relationship between Uniswap and Polygon isn’t entirely without its challenges. Looking at user trends, there are some concerning signals. Since August 2021, the number of daily unique users on Uniswap has been on a downward trend. This decline became particularly pronounced in early 2022, with a stark figure of just 16 unique users recorded on February 19th. Such a low user count raises questions about the long-term sustainability of this growth trajectory.

Furthermore, Uniswap has reportedly experienced a substantial outflow of funds, with approximately $485 million lost since the beginning of February. This significant capital outflow is serious enough to have reportedly caused even large Uniswap holders, often referred to as “whales,” to become hesitant and move to the sidelines. Adding to the concerns, the network’s overall growth has slowed down to a 17-month low. These factors suggest potential headwinds for Uniswap’s continued expansion on Polygon.

MATIC Price Update

Lastly, let’s briefly touch upon the price of Polygon’s native token, MATIC. At the time of reporting, MATIC was trading at $1.53. This price point followed a 2.55% decrease in the preceding 24 hours and a 10.81% drop over the previous seven days. These price fluctuations are typical in the volatile crypto market and are worth noting for those tracking Polygon’s overall performance.

Related Posts – Ferrari joins the NFT universe through a collaboration with a Swiss…

Key Takeaways: Uniswap and Polygon – A Story of Growth and Uncertainty

Uniswap’s integration with Polygon started with a bang, demonstrating rapid market share acquisition and significant TVL growth. Polygon itself is benefiting from increased user activity and a growing ecosystem, including a burgeoning gaming scene. However, the data also reveals potential challenges. Declining daily unique users, substantial fund outflows, and a slowdown in network growth indicate that Uniswap’s journey on Polygon may not be a smooth, upward trajectory. The DeFi space is dynamic, and the coming months will be crucial in determining whether Uniswap can sustain its initial momentum on Polygon and overcome these emerging challenges. Keep an eye on this space, as the Uniswap-Polygon story is still unfolding!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.