Navigating the complex world of cryptocurrency regulations can feel like deciphering a constantly evolving code, wouldn’t you agree? Especially when you look at different countries and their approaches. Recently, Russia, a significant player in the global landscape, has been at a crossroads regarding the future of digital assets. Are they going to embrace crypto or banish it? Let’s dive into the latest developments coming out of Moscow.

Russia’s Crypto Crossroads: Regulation or Prohibition?

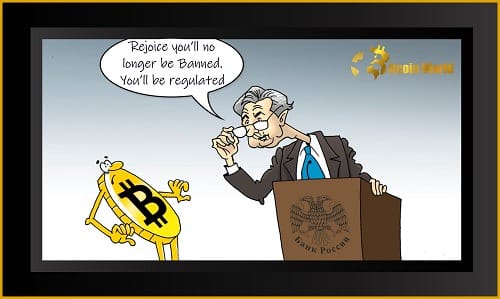

For months, the crypto community has been watching Russia with bated breath. The tug-of-war between complete prohibition and regulated acceptance has been intense. On one side, you have the Central Bank of Russia (CBR) advocating for a strict ban on crypto mining and circulation. On the other, the Finance Ministry champions the cause of regulated digital assets, viewing them more like traditional fiat currencies. This internal debate has kept everyone guessing about Russia’s ultimate crypto trajectory.

Now, it seems a crucial step has been taken towards clarity. A working group within Russia’s Parliament, the State Duma, has voiced its support for a regulated crypto market. This development, reported by Cointelegraph and various local media outlets, suggests a potential shift away from the outright ban initially pushed by the CBR.

But what exactly does this mean? Let’s break down the key takeaways:

- Parliamentary Backing for Regulation: A dedicated working group in the State Duma, comprising around 50 specialists, has concluded that regulating crypto transactions is the more sensible path forward for Russia.

- Rejection of Outright Ban: The group explicitly stated that “effective and transparent” regulation is preferable to a complete prohibition. This is a significant departure from the CBR’s earlier hardline stance.

- Support for Finance Ministry’s Approach: Crucially, the working group’s stance aligns with the Finance Ministry’s vision. The Ministry has been advocating for treating digital assets under a regulatory framework similar to fiat currencies.

- Focus on Control Mechanisms: The emphasis is on establishing “mechanisms to regulate cryptocurrency transactions.” This suggests a focus on creating a framework for monitoring and controlling crypto activities within Russia.

Central Bank vs. Finance Ministry: A Battle of Ideologies?

The contrasting viewpoints of the CBR and the Finance Ministry highlight a fundamental debate about the nature of cryptocurrency and its role in the economy. Let’s understand their positions better:

| Institution | Position on Cryptocurrency | Rationale |

|---|---|---|

| Central Bank of Russia (CBR) | Advocates for a complete ban on crypto mining and circulation. | Concerns about financial stability, investor protection, and the potential use of crypto for illicit activities. They view crypto as a threat to the Ruble and the traditional financial system. |

| Finance Ministry | Supports regulation of digital assets, treating them similarly to fiat currencies. | Believes in harnessing the potential of crypto innovation while mitigating risks through appropriate regulations. They see potential economic benefits and tax revenue generation from a regulated crypto market. |

The working group’s support for the Finance Ministry’s approach indicates a potential shift in the government’s overall stance. It suggests that the pragmatic view of regulated adoption might be gaining ground over the more restrictive approach favored by the Central Bank.

What Does This Mean for Crypto Traders and the Russian Market?

This development could be a positive signal for the crypto market in Russia and globally. Here’s what it might imply:

- Reduced Uncertainty: The clarity of a regulatory path is generally welcomed by markets. It reduces the uncertainty associated with a potential outright ban, which could stifle innovation and investment.

- Potential for Growth: Regulation, if implemented effectively, can legitimize the crypto industry and attract more mainstream adoption in Russia. This could lead to growth in crypto trading, investment, and related businesses.

- Investor Confidence: A regulated environment can boost investor confidence. Clear rules and guidelines provide a framework for safe and compliant participation in the crypto market.

- Global Crypto Market Impact: Russia is a significant economy. Its approach to crypto regulation can influence other nations and the overall global crypto landscape. A move towards regulation in Russia could be seen as a positive trend for the industry worldwide.

What Kind of Regulations Can We Expect?

While the working group supports regulation, the specifics are still to be defined. However, based on the discussions and the Finance Ministry’s stance, we can anticipate regulations that might include:

- Licensing and Registration: Crypto exchanges and other crypto businesses operating in Russia might be required to obtain licenses and register with regulatory authorities.

- Anti-Money Laundering (AML) and KYC Compliance: Expect stringent AML and Know Your Customer (KYC) requirements to prevent illicit activities and ensure transparency.

- Taxation Framework: Clear tax rules for crypto transactions and holdings will likely be established.

- Investor Protection Measures: Regulations might include measures to protect crypto investors from fraud and market manipulation.

- Transaction Monitoring: Mechanisms to monitor and track crypto transactions, as emphasized by the working group, are expected to be a key component of the regulatory framework.

The Road Ahead: Challenges and Opportunities

While the working group’s decision is a step forward, the journey towards comprehensive crypto regulation in Russia is just beginning. Challenges and opportunities lie ahead:

- Balancing Innovation and Control: The key challenge will be to create regulations that effectively manage risks without stifling innovation and the potential benefits of cryptocurrency.

- Inter-Agency Collaboration: Effective regulation will require collaboration between the Parliament, the Central Bank, the Finance Ministry, and other relevant agencies to ensure a cohesive and practical framework.

- Industry Input: Engaging with the crypto industry and incorporating their expertise in the regulatory process will be crucial for creating workable and effective rules.

- Global Alignment: Considering international standards and best practices in crypto regulation can help Russia create a framework that is globally compatible and attractive to international crypto businesses.

In Conclusion: A Cautiously Optimistic Outlook for Crypto in Russia

The decision by the State Duma working group to support crypto regulation over a ban marks a significant shift in Russia’s approach to digital assets. While the Central Bank’s concerns are still in the mix, the momentum seems to be building towards a regulated crypto market. This development offers a cautiously optimistic outlook for crypto enthusiasts, traders, and businesses interested in the Russian market. The specifics of the regulations are still awaited, but the direction appears to be set – Russia is likely to embrace, rather than reject, the crypto revolution, albeit with a firm hand on the regulatory reins. Keep watching this space for further updates as Russia’s crypto journey unfolds!

Related Posts – Ferrari joins the NFT universe through a collaboration with a Swiss…

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.