Despite the recent rollercoaster in the crypto market, including the dramatic collapse of Terra (LUNA) and its stablecoin UST, interest in cryptocurrency among Americans remains surprisingly strong. A new study by Bank of America reveals a compelling trend: a significant majority are still keen on getting involved with digital currencies. Let’s dive into the details of this fascinating report and what it means for the future of crypto.

Americans Still Bullish on Crypto: What the Numbers Say

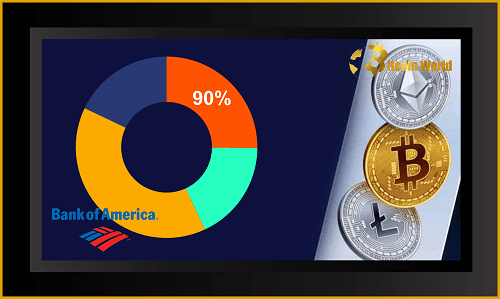

The Bank of America study, conducted earlier this month, surveyed over 1,000 adults in the United States and unearthed some eye-opening statistics:

- 90% are interested in acquiring cryptocurrency: Yes, you read that right! A whopping 90% of respondents expressed interest in acquiring cryptocurrency within the next six months. This indicates a strong underlying belief in the long-term potential of digital assets.

- 40% are already using crypto for payments: Beyond just holding crypto as an investment, a significant 40% of those surveyed are already using cryptocurrencies to make purchases. This highlights the growing utility of crypto in everyday transactions.

- 30% are HODLing for the long haul: Despite market fluctuations, 30% of respondents stated they have no plans to sell their cryptocurrency holdings in the next six months. This demonstrates a strong conviction among a segment of investors who see crypto as a long-term play.

Bank of America’s Perspective: More Than Just an Investment?

The Bank of America study delved deeper into the motivations behind cryptocurrency adoption. The findings suggest that the use of crypto is evolving beyond mere investment.

Payment Power: A notable 39% of respondents reported using cryptocurrencies to pay for online purchases. This is a key takeaway, suggesting that the functionality of crypto as a payment method is becoming increasingly relevant. As the Bank of America analyst pointed out, this trend underscores the rising popularity of crypto-to-fiat solutions.

Bridging the Gap with Crypto-to-Fiat: Think about it – the ability to seamlessly use your crypto for everyday purchases is becoming a reality. The analyst highlighted the Coinbase Visa card as a prime example. This type of card allows users to spend their cryptocurrency anywhere Visa is accepted. The beauty of it? Merchants don’t need to directly accept crypto; the conversion to traditional currency happens behind the scenes.

Too Many Cryptocurrencies? Echoes of the Dot-Com Era

The Bank of America analyst also touched upon the sheer volume of cryptocurrencies and exchanges currently in existence, raising an interesting parallel to the dot-com boom.

“In actuality, we believe there are too many cryptocurrency exchanges. There are an excessive number of cryptocurrencies and tokens,” the analyst stated.

This observation draws a comparison to the late 1990s and early 2000s when the internet landscape was flooded with numerous dot-com companies. Many of these companies ultimately failed, leading to a significant market correction. However, from the ashes emerged the tech giants we know today.

“Perhaps it’s eerily similar to the dot-com period,” the analyst mused. “There were just too many dot-com stocks on the market. There was a major shakeout, and there were truly large dot-com companies that became extremely successful.”

What Does This Mean for Bitcoin Traders and the Crypto Market?

So, what are the key takeaways from this Bank of America study for those involved in the crypto space?

- Continued Mainstream Interest: Despite market volatility, the underlying interest in cryptocurrency remains strong among the general population. This suggests that the recent downturns haven’t deterred a significant portion of potential investors.

- Growing Utility: The increasing use of crypto for payments highlights a shift towards practical application. This could lead to greater adoption and integration into everyday life.

- Potential Market Consolidation: The analyst’s comparison to the dot-com era suggests that we might see a consolidation in the crypto market. Not all cryptocurrencies and exchanges will survive in the long run. Focusing on projects with strong fundamentals and real-world utility could be a wise strategy.

- Opportunity for Innovation: The demand for seamless crypto-to-fiat solutions presents a significant opportunity for innovation in the financial technology sector.

Looking Ahead: The Future of Crypto Adoption

The Bank of America study paints a compelling picture of the current state of cryptocurrency adoption in the United States. While the market may experience its ups and downs, the fundamental interest and the increasing utility of cryptocurrencies suggest a promising future. The key will be navigating the potential market consolidation and focusing on the long-term value proposition of this evolving asset class.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.