The crypto market is experiencing a serious case of the jitters. With the Fear and Greed Index hovering around a chilling 16, many crypto investors are feeling the pressure. Whispers of mass sell-offs and miners offloading their holdings are adding fuel to the fire. So, the big question on everyone’s mind is: are we nearing the end of this bear market for Bitcoin?

Is the Bitcoin Bear Market Reaching Its Lowest Point?

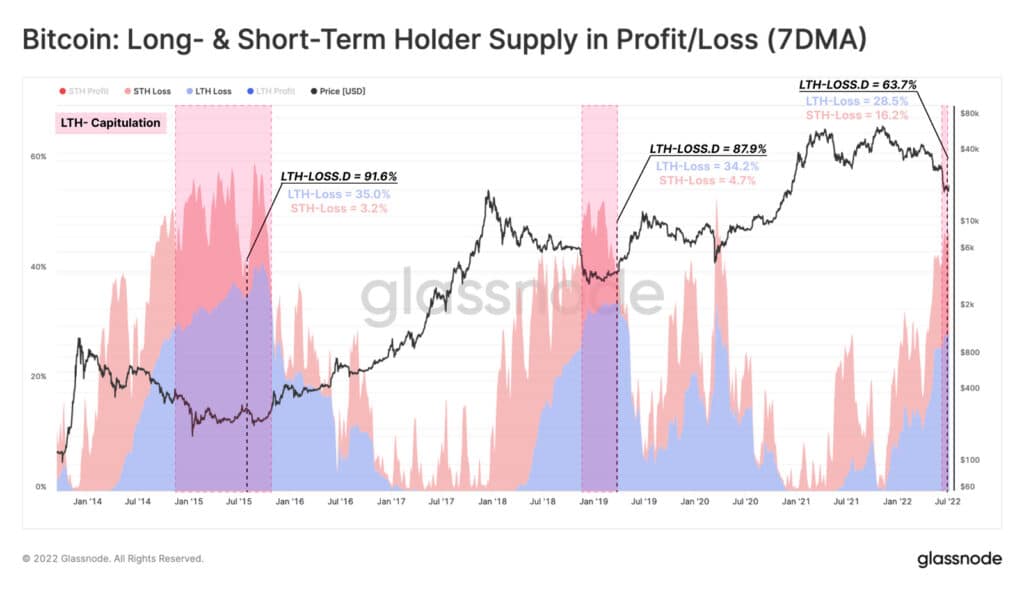

According to on-chain data from GlassNode, the current bear market seems to be targeting the resilience of long-term Bitcoin holders (LTHs). Historically, a true market bottom often materializes when even these steadfast holders become sensitive to price fluctuations and start selling. Let’s delve into what this means.

Essentially, the theory is that a bear market needs to shake out even the most committed participants to reach its absolute nadir. These are the individuals who are typically unfazed by short-term price swings. Currently, LTHs hold a significant 28% of the total Bitcoin supply, while short-term holders (STHs) hold about 16%. This is a crucial data point to consider.

Consider this comparison:

| Holder Type | Current Bear Market Holding | Previous Bear Market Holding |

|---|---|---|

| Long-Term Holders (LTH) | 28% | 34% |

| Short-Term Holders (STH) | 16% | 3-4% |

Interestingly, despite the increased adoption of Bitcoin and its significant price appreciation since the last bear market, long-term holders haven’t significantly reduced their holdings. This suggests a strong underlying bullish sentiment among this group. In simple terms, many LTHs appear to be waiting for further price dips to accumulate even more Bitcoin. They’re playing the long game, embodying the “Hodl” philosophy.

What About Bitcoin Miners and Their Role in the Market?

Bitcoin miners have undoubtedly felt the brunt of this bear market. Their operational costs remain relatively constant, while the price of Bitcoin has declined significantly, squeezing their profit margins. This often leads to miners selling their Bitcoin holdings to cover expenses.

However, recent data suggests a potential shift in miner behavior. While they were selling around 7900 BTC per month earlier in the downturn (around May), their selling pressure has decreased to approximately 1350 BTC per month. This could indicate a couple of things:

- **Increased Efficiency:** Miners might be finding ways to operate more efficiently and reduce their need to sell.

- **Stronger Hands:** Some miners might have stronger financial reserves and are choosing to hold onto their Bitcoin in anticipation of future price recovery.

How Does This Bear Market Compare to Previous Ones?

Looking back at the last significant bear market, the period of intense market capitulation lasted around four months. Considering the current market dynamics, it’s possible that this bear market might take a bit longer to reach its bottom, perhaps around five to six months from its initial stages. This suggests that we might not be at the absolute bottom just yet.

Key Takeaways and Actionable Insights for Crypto Traders:

- **Monitor LTH Behavior:** Keep a close eye on the behavior of long-term Bitcoin holders. Significant selling pressure from this group could signal that the market bottom is approaching.

- **Track Miner Activity:** While miner selling has decreased, it’s still a factor. Watch for any significant increases in miner outflows.

- **Consider Historical Patterns:** Bear markets have historical precedents. While past performance doesn’t guarantee future results, understanding previous cycles can provide valuable context.

- **Focus on Fundamentals:** In times of market uncertainty, it’s crucial to focus on the underlying fundamentals of Bitcoin and the broader cryptocurrency ecosystem.

- **Manage Risk:** Implement sound risk management strategies, such as diversification and position sizing, to navigate market volatility.

In Conclusion: Patience and Vigilance are Key

Predicting the exact bottom of a bear market is notoriously difficult, if not impossible. However, by analyzing on-chain data, understanding the behavior of different market participants like long-term holders and miners, and considering historical patterns, we can gain a better understanding of where we might be in the current cycle. While the Fear and Greed Index reflects current market sentiment, remember that bear markets are a natural part of the Bitcoin cycle. Staying informed, remaining patient, and practicing sound risk management are crucial for navigating these challenging times and positioning yourself for potential future opportunities in the crypto market.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.