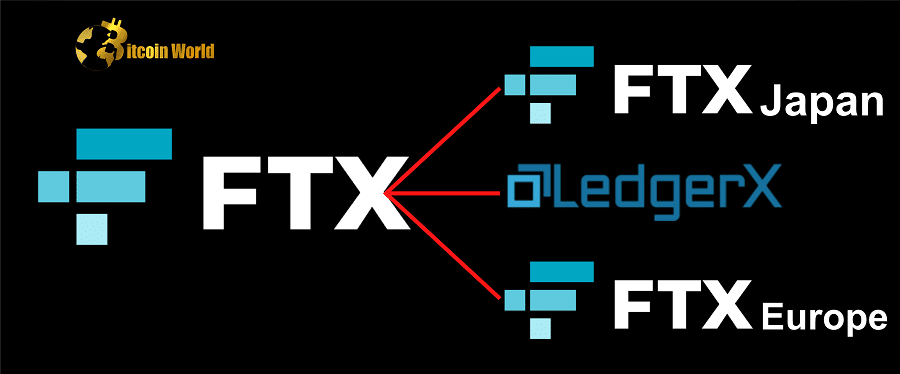

The FTX saga continues to unfold, and the latest chapter involves a rapid move to sell off some potentially valuable pieces of its once-sprawling crypto empire. Just weeks after the dramatic bankruptcy filing, FTX is seeking court approval to offload four key businesses: its Japanese and European arms, derivatives exchange LedgerX, and stock-clearing platform Embed. But why the rush? Let’s dive into the details and understand what’s driving this urgent sale.

Why the Sudden Fire Sale? Unpacking FTX’s Urgent Need to Sell

According to court documents filed on December 15th, FTX’s legal team is pushing for a swift sale, and their reasoning is pretty compelling. They argue that time is of the essence, and delays could seriously damage the value of these assets. Here’s a breakdown of the key reasons behind the urgency:

- Regulatory Pressure Cooker: FTX’s lawyers highlight that each of these businesses is currently under intense scrutiny from regulators. FTX Japan, for example, is facing business suspension and improvement orders. FTX Europe isn’t faring any better, with suspended licenses and operations. This regulatory heat creates a ticking clock.

- License at Risk: The longer these businesses remain inactive or under suspension, the greater the danger of losing crucial operating licenses permanently. Imagine trying to sell a car without an engine – licenses are the engines of these financial platforms.

- Customer and Employee Exodus: Since FTX’s bankruptcy bombshell on November 11th, these businesses have likely seen a significant drop in customers and employee departures. In the financial world, trust is paramount, and bankruptcy filings erode that trust quickly. Selling now could offer a chance to revive operations and retain some value.

- Recent Acquisitions – A Silver Lining?: Interestingly, the lawyers point out that these businesses were acquired relatively recently and operate somewhat independently from the core FTX operations. This separation could actually simplify the sale process, making a quick transaction more feasible.

Which Businesses are on the Auction Block? A Closer Look

Let’s take a closer look at the four businesses FTX is hoping to sell:

| Business | Description | Key Highlights |

|---|---|---|

| FTX Japan | FTX’s Japanese branch. |

|

| FTX Europe | FTX’s European branch. |

|

| LedgerX | A US-based derivatives exchange. |

|

| Embed | A stock-clearing platform. |

|

Why Sell Now? Maximizing Value in a Crisis

FTX’s argument boils down to preserving and maximizing value for stakeholders in a very difficult situation. The core idea is that selling these operating businesses now, while they still hold some appeal, is better than letting them deteriorate further and potentially become worthless.

Think of it like selling a house in a declining market. Waiting too long could mean a much lower sale price, or even no sale at all. In FTX’s case, the “declining market” is represented by:

- Eroding Business Value: Suspended operations, lost customers, and regulatory uncertainty all chip away at the inherent value of these businesses.

- License Revocation Risk: Permanent loss of licenses would render these entities significantly less attractive to potential buyers.

- Bankruptcy Fallout: The overall negative sentiment surrounding FTX’s bankruptcy can impact the perceived value of any assets associated with the company.

Who’s Interested? And What’s Next?

Despite the turmoil, there seems to be significant interest in acquiring these FTX assets. Reports suggest that over 110 parties are eyeing various parts of the 134 companies involved in the bankruptcy proceedings. FTX has already signed confidentiality agreements with 26 counterparties, indicating serious interest in these specific businesses.

LedgerX, in particular, stands out as a potentially hot commodity. Its reputation as a well-managed and financially sound entity within the troubled FTX group makes it an attractive target. The fact that it was seemingly insulated from the wider FTX collapse adds to its appeal.

Looking Ahead: A Glimmer of Hope for FTX Creditors?

The proposed asset sales represent a critical step in the FTX bankruptcy proceedings. While it’s a clear sign of the empire’s dismantling, it also offers a potential path to recover some value for creditors. Whether these sales will generate significant funds and how they will be distributed remains to be seen.

For the crypto industry, this episode serves as a stark reminder of the risks associated with centralized exchanges and the importance of regulatory compliance. The FTX saga is far from over, but the urgent asset sales highlight the desperate measures being taken to salvage what’s left and navigate the complex aftermath of a major crypto implosion.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.