Thinking about diving into the world of Bitcoin trading? You’ve likely stumbled upon the term ‘Dollar-Cost Averaging,’ or DCA. It’s a popular strategy, but is it the golden ticket for every Bitcoin enthusiast? Let’s break down the ins and outs of DCA to help you decide if it’s the right path for you.

What Exactly is Dollar-Cost Averaging (DCA)?

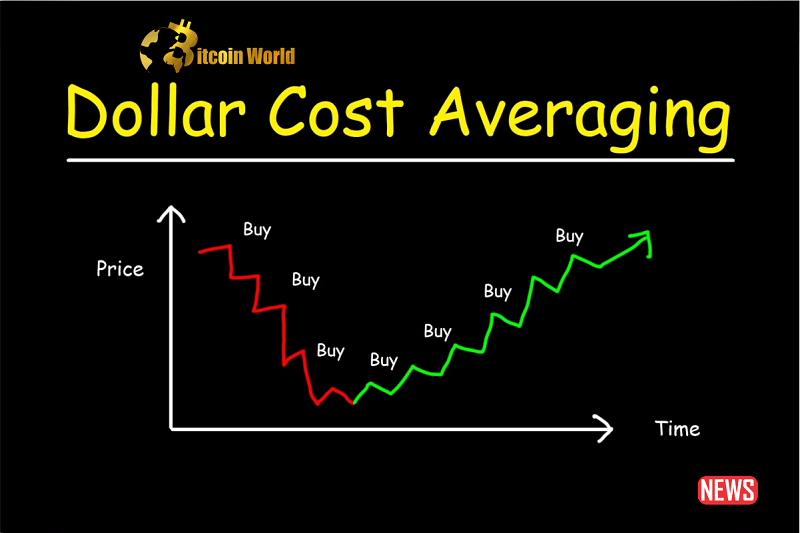

Imagine you want to invest in Bitcoin, but you’re wary of buying a large chunk all at once, especially with Bitcoin’s famous price swings. DCA offers a different approach. It’s like spreading out your purchases over time. Instead of putting all your eggs in one basket, you buy a fixed amount of Bitcoin at regular intervals – think weekly, bi-weekly, or monthly – regardless of the current price.

The Upsides of DCA: Why Investors Love It

So, why is DCA such a talked-about strategy? Here’s a look at the key benefits:

- Taming the Volatility Beast: Bitcoin’s price can feel like a rollercoaster. DCA helps smooth out those dramatic highs and lows. By investing consistently, you reduce the risk of buying a large amount right before a price dip. Think of it as averaging out your purchase price over time.

- Emotional Discipline in a Wild Market: Ever felt the urge to panic sell when the market dips or FOMO into a price surge? DCA acts as a built-in discipline. You stick to your predetermined schedule, preventing emotional, impulsive decisions driven by market hype or fear.

- Buying Low, Selling (Potentially) High: Over time, with DCA, you naturally buy more Bitcoin when prices are lower and less when they’re higher. This can lead to a lower average purchase price compared to trying to time the market perfectly – a feat notoriously difficult to achieve.

- Less Time Spent Staring at Charts: Constantly monitoring market fluctuations can be exhausting. DCA simplifies things. Set your investment schedule, and you don’t need to be glued to price charts every minute. It’s a more hands-off approach.

- Potential Tax Benefits: While not guaranteed, spreading out your Bitcoin purchases and sales over time can potentially offer some tax advantages by distributing capital gains over different periods. Always consult with a tax professional for personalized advice.

The Downsides of DCA: What to Keep in Mind

While DCA offers significant advantages, it’s not a flawless strategy. Here are some potential drawbacks:

- Missing Out on Immediate Gains: Imagine Bitcoin’s price skyrockets right after you make your first DCA purchase. If you had invested a lump sum initially, you would have benefited more from that immediate price surge. DCA can mean slower initial gains in a rapidly rising market.

- Potential Missed Opportunities During Market Dips: While DCA encourages buying during dips, your fixed investment amount might limit how much you capitalize on significant price drops. A lump sum investment during a major dip could potentially yield higher returns.

- Transaction Fees Can Add Up: Every time you buy Bitcoin through an exchange, you typically incur transaction fees. With DCA’s regular purchases, these fees can accumulate over time, potentially impacting your overall returns. Consider exchanges with lower fees if you plan on using DCA.

- Slower Overall Growth: In a consistently upward-trending market, investing a lump sum earlier will generally outperform DCA in terms of total returns. DCA’s gradual approach can lead to slower overall growth compared to a well-timed large investment.

- Less Flexibility: Once you’ve set your DCA schedule and investment amount, it requires consistent adherence. If your financial situation changes or you spot a compelling investment opportunity outside of Bitcoin, adjusting your DCA strategy might feel less flexible than managing a lump sum investment.

DCA in Action: An Example

Let’s say you decide to invest $100 in Bitcoin every month. Here’s how it might play out over three months with varying Bitcoin prices:

| Month | Bitcoin Price | Amount Invested | Bitcoin Purchased |

|---|---|---|---|

| January | $40,000 | $100 | 0.0025 BTC |

| February | $35,000 | $100 | 0.002857 BTC |

| March | $45,000 | $100 | 0.002222 BTC |

| Total | 0.007579 BTC | ||

As you can see, you bought more Bitcoin when the price was lower in February and less when it was higher in March. This illustrates the core principle of averaging your cost over time.

Is DCA Right for You? Key Considerations

Deciding whether DCA is the right strategy depends on your individual circumstances and investment goals. Ask yourself these questions:

- What’s your risk tolerance? If you’re risk-averse and prefer a more cautious approach, DCA can be a good fit.

- How much capital do you have available? If you have a large sum to invest, you’ll need to weigh the potential benefits of lump-sum investing against the risk mitigation of DCA.

- What are your investment goals and timeframe? Are you investing for the long term? DCA is often favored for long-term strategies.

- How comfortable are you with market volatility? If price swings make you anxious, DCA can provide a sense of stability.

Actionable Insights: Making DCA Work for You

- Choose a Reputable Exchange: Select a cryptocurrency exchange with reasonable transaction fees to minimize costs associated with regular purchases.

- Set a Realistic Investment Schedule: Determine how often you can comfortably invest a fixed amount without straining your finances. Consistency is key.

- Stick to Your Plan: Resist the urge to deviate from your DCA schedule based on short-term market fluctuations.

- Consider Automating Your Purchases: Many exchanges offer automated DCA features, making the process even simpler and more disciplined.

- Regularly Review Your Strategy: While consistency is important, periodically review your DCA strategy to ensure it still aligns with your financial goals.

The Bottom Line: DCA as a Tool in Your Bitcoin Toolkit

Dollar-Cost Averaging isn’t a magic bullet, but it’s a powerful tool in the Bitcoin investor’s arsenal. It’s particularly beneficial for those looking to navigate Bitcoin’s volatility and build their holdings over time without the stress of trying to time the market. By understanding its pros and cons and aligning it with your individual circumstances, you can make an informed decision about whether DCA is the right strategy to help you achieve your Bitcoin investment goals. Remember, informed investing is empowered investing.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.