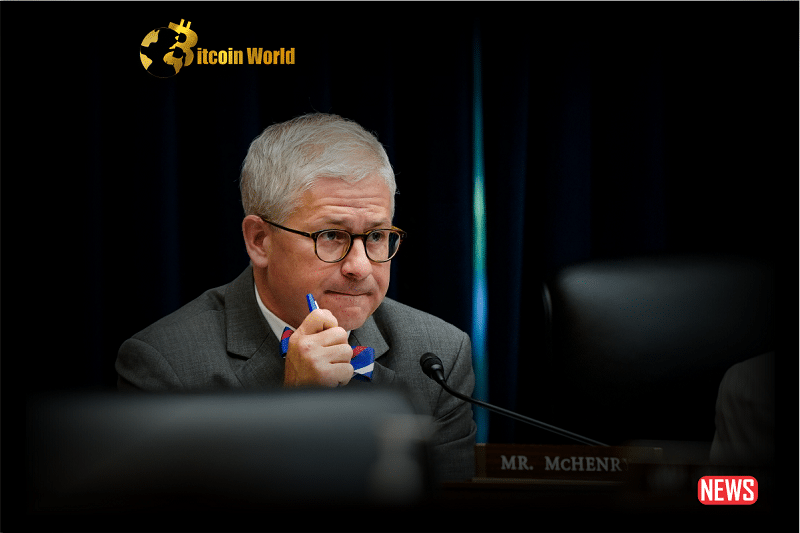

The world of digital assets is buzzing with anticipation! Could we finally see some clear regulatory guidelines in the US? It looks like things are moving forward, with House Financial Services Committee Chair, Patrick T. McHenry, announcing a vote on a crucial digital asset bill as early as mid-July. Let’s dive into what this could mean for the future of cryptocurrencies and digital assets.

What’s the Big Deal with This Digital Asset Bill?

This isn’t just any piece of legislation. The proposed Digital Asset Market Structure Discussion Draft aims to bring much-needed clarity to the often murky waters of crypto regulation. Think of it as an attempt to create a rulebook for digital assets in the US. Here are some of the key objectives:

- Defining the Landscape: The bill seeks to classify cryptocurrencies as either securities or commodities. This distinction is critical as it determines which regulatory body has primary oversight.

- Exchange Regulations: Expect stricter rules for cryptocurrency exchanges, aiming to provide more security and transparency for users.

- CFTC Gets More Power: A significant part of the proposal involves granting the Commodity Futures Trading Commission (CFTC) jurisdiction over digital commodities.

- SEC’s Role Clarified: The bill also aims to define the Securities and Exchange Commission’s (SEC) authority, specifically concerning “digital assets offered as part of an investment contract.”

McHenry’s Push for Bipartisan Support

Chair McHenry has emphasized the importance of a bipartisan approach, encouraging collaboration among committee members. He’s acknowledged that the current version is a draft and there’s still room for discussion and consensus. His goal is to finalize and markup a version of the legislation after the July 4th recess, with the House reconvening on July 11th. This signals a clear intention to move forward with regulation in this space.

Concerns from the Other Side: What’s Maxine Waters Saying?

Not everyone is entirely on board. Former House Financial Services Committee Chair, Maxine Waters, has voiced concerns about the potential impact on the SEC’s ability to combat fraud in the crypto space. Her main worry? The idea of providing provisional registration to crypto firms. She argues this could allow bad actors to slip through the cracks, harming consumers and investors. It highlights the delicate balancing act between fostering innovation and protecting the public.

The SEC’s Recent Actions: A Backdrop to the Bill

This legislative push comes on the heels of the SEC filing lawsuits against major crypto exchanges, Binance and Coinbase. The accusations are serious, including operating without proper registration as exchanges, brokers, or clearing agencies. Binance and its CEO, Changpeng Zhao, also face charges of misleading investors and operating unlawfully. These lawsuits underscore the SEC’s current approach to enforcement and add another layer of complexity to the regulatory discussion.

Gensler’s Stance: Registration is Possible

In response to the lawsuits, SEC Chair Gary Gensler has maintained that exchanges can register with the agency, directly countering claims from some platforms that it’s not feasible. This difference in perspective is a key point of contention in the ongoing debate.

What’s Next? Key Takeaways and Actionable Insights

As the House Financial Services Committee prepares for this pivotal vote in July, here’s what you need to know and some potential implications:

- Potential Benefits: Clearer regulations could bring more stability and legitimacy to the digital asset market, potentially attracting institutional investors and fostering wider adoption.

- Potential Challenges: Overly strict regulations could stifle innovation and drive crypto businesses overseas. Finding the right balance is crucial.

- Impact on Exchanges: Expect significant changes in how cryptocurrency exchanges operate in the US, potentially leading to increased compliance costs and operational adjustments.

- Investor Protection: The primary goal of these regulations is to protect investors from fraud and manipulation. The effectiveness of these measures will be closely watched.

The Road Ahead: What to Expect

The upcoming vote is a significant milestone, but it’s likely just one step in a longer journey towards comprehensive digital asset regulation. Here’s a quick look at what might happen next:

- Committee Vote: The immediate focus is on the vote in the House Financial Services Committee.

- House Vote: If the bill passes the committee, it will move to a vote in the full House of Representatives.

- Senate Consideration: Even if the House approves the bill, it will still need to be considered and potentially amended by the Senate.

- Potential Amendments: Expect further discussions and potential amendments to the bill as it moves through the legislative process.

In Conclusion: A Pivotal Moment for Digital Assets

The planned vote on the digital asset bill in July marks a crucial moment for the cryptocurrency industry in the United States. The outcome will have far-reaching consequences, shaping the regulatory landscape and influencing the future of digital assets. Whether you’re a seasoned crypto investor, a blockchain enthusiast, or simply curious about this evolving space, keeping a close eye on these developments is essential. The decisions made in the coming weeks and months will undoubtedly leave a lasting impact on the world of digital finance.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.