In the fast-paced world of Decentralized Finance (DeFi), even established platforms can face unexpected turbulence. Aave, a leading DeFi lending protocol, recently hit the brakes on some of its key operations. But before you panic about your crypto holdings, let’s break down what happened, why Aave took action, and what it means for you.

Aave Hits Pause: What Markets Are Affected?

On Saturday, November 4th, Aave announced via X (formerly Twitter) that it was temporarily pausing several of its markets. Think of it like a safety check – when something unexpected pops up, you stop to investigate. Here’s a quick rundown of the affected areas:

- Aave V2 Ethereum Market: Operations halted.

- Aave V3 Avalanche: Suspension of certain assets.

- Aave V3 Polygon, Arbitrum, and Optimism: Freezing of specific assets.

You might be wondering, “Why these specific markets?” Aave hasn’t explicitly detailed the vulnerable feature yet, but these measures were taken swiftly after a bug report surfaced. It’s all about being proactive in the face of potential risks.

Precautionary measure: We have paused Aave V2 Ethereum market and suspended certain assets on Avalanche market, following a problem report on a specific feature. V3 markets on Ethereum, Base and Metis, and V2 markets on Polygon and Avalanche are unaffected.

We will share…

— Aave (@AaveAave) November 4, 2023

According to Aave, this is a precautionary measure. Think of it as hitting the pause button to ensure everything is safe before resuming play. Crucially, Aave clarified that certain markets remain unaffected, including:

- Aave V3 markets on Ethereum, Base, and Metis

- Aave V2 markets on Polygon and Avalanche

Reassuringly, blockchain security firm PeckShield echoed Aave’s statement, indicating that user funds are not currently at risk. This is a significant point – it suggests the issue is being addressed before it could escalate into something more serious.

#PeckShieldAlert #Aave Aave Protocol has paused some markets (Aave V2 ETH, certain assets of Aave V3 Avalanche, Aave V3 Polygon/Arbitrum/Optimism) as a precautionary measure after receiving a problem report on a specific feature.

So far, no funds at risk. https://t.co/cR4Lhj8S8Q— PeckShieldAlert (@PeckShieldAlert) November 5, 2023

What Exactly Went Wrong? Unpacking the Vulnerability

While Aave has been transparent about pausing operations, they’ve remained tight-lipped about the specifics of the bug. Details are expected to be released after the issue is fully resolved. Their official statement indicates:

“A governance proposal to restore the normal operation of the protocols will be submitted shortly. A detailed postmortem will be released once the issue is fully resolved.”

This approach is common in such situations. Disclosing vulnerability details prematurely could potentially expose the protocol to further risks. Aave’s priority is to fix the issue and then provide a comprehensive explanation to the community.

Read Also: Georgia National Bank Picks Ripple As It’s Official Tech Partner For CBDC

Impact on Users: Can You Still Access Your Funds?

If you’re an Aave user in the affected markets, you might be wondering about your access to your assets. The good news is that Aave has confirmed that users can still withdraw and repay their holdings in the frozen asset pools. However, you won’t be able to supply or borrow new funds from these pools until the issue is resolved and operations resume.

In simple terms:

- Withdrawals and Repayments: Functioning as normal for paused assets.

- Supplying and Borrowing: Temporarily disabled for paused assets.

Aave has clearly stated, “On paused assets, no action can be done until unpaused.” So, while your funds aren’t locked away, you’ll need to wait for the all-clear before resuming full activity in the affected markets.

AAVE Price Holds Steady: Market Confidence Intact?

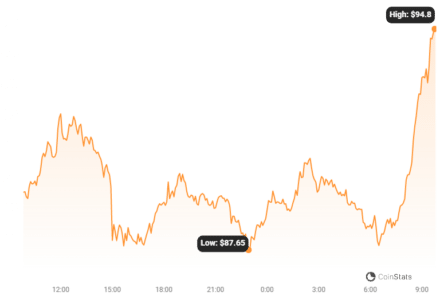

Interestingly, despite the news of a protocol vulnerability, the price of AAVE, the platform’s native token, has remained relatively stable. At the time of writing, AAVE is trading around $94.15, showing a minor 0.9% dip in the last 24 hours.

This resilience in price could indicate a few things:

- Confidence in Aave’s Response: The market might be interpreting Aave’s swift action as responsible and effective risk management.

- Limited Perceived Impact: The vulnerability might be seen as contained and not posing a systemic threat to the entire Aave ecosystem.

- Broader Market Trends: The overall crypto market sentiment could be overshadowing the specific Aave news.

Looking at the bigger picture, AAVE has actually performed well recently, with a price surge of over 10% in the past week, briefly touching $100 – a level not seen since February. While the immediate price reaction to the bug news is muted, a quick and effective resolution could potentially reignite positive momentum for AAVE.

Key Takeaways and What’s Next

The Aave situation serves as a timely reminder of the inherent complexities and evolving security landscape within DeFi. Here are the key takeaways:

- Proactive Security Measures: Aave’s swift response in pausing markets demonstrates a commitment to user safety and proactive risk mitigation.

- Transparency is Key: While details are pending, Aave’s communication about the situation is crucial for maintaining community trust.

- Resilience of DeFi: The stable price of AAVE suggests a degree of market confidence in the protocol’s ability to overcome this challenge.

- Importance of Due Diligence: For users, this highlights the ongoing need to stay informed and understand the risks associated with DeFi platforms.

As we await further updates from Aave, the focus will be on the speed and effectiveness of the resolution. The DeFi community will be watching closely to see how Aave navigates this challenge and reinforces its position as a leading platform in the decentralized lending space.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.