Arbitrum (ARB) recently surged past a critical resistance level, sparking excitement among investors. After a long period, ARB’s price movement suggests a potential upward trend. But, is this momentum sustainable? Can ARB realistically reach $2 soon? Let’s dive into the data and analyze the factors influencing Arbitrum’s price action.

Arbitrum Breaks Resistance: A Bullish Signal?

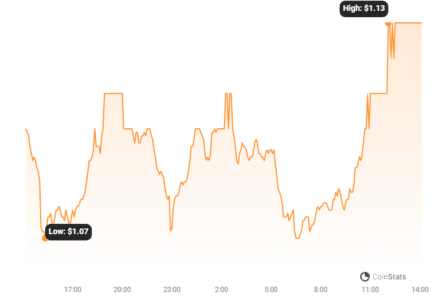

Crypto Tony, a well-known crypto influencer, highlighted ARB’s breakthrough of the $1.07 resistance level on X (formerly Twitter). This marks the first time ARB has surpassed this level since August 2023, fueling speculation about further price increases.

According to CoinMarketCap, ARB’s price has indeed been on the rise, increasing by over 2% in the last 24 hours. As of writing, ARB is trading at $1.10, with a market capitalization exceeding $1.39 billion. However, a closer examination reveals a more nuanced picture.

Diverging Signals: Price Up, Volume Down

While ARB’s price has increased, its trading volume has decreased, suggesting a lack of strong conviction among investors. Furthermore, market sentiment has shifted towards bearish, with bullish sentiment declining by over 52% in the past 24 hours. Social engagement has also decreased.

Positive Indicators: Network Growth and Whale Activity

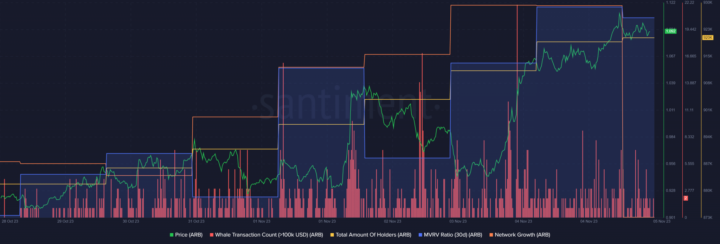

Despite the bearish signals, several metrics remain positive. Arbitrum’s AltRank has improved, indicating a higher likelihood of sustained price growth. The MVRV ratio has also increased significantly, and network growth remains robust, with new addresses being created to trade ARB.

Whale and investor confidence in ARB appears to be holding strong. The increase in ARB’s whale transaction count and overall number of holders over the past week supports this observation.

Read Also: BNB Price Shows Signs of Life But $250 Is The Key To More Upsides

Technical Analysis: Potential Roadblocks Ahead?

Arbitrum’s Relative Strength Index (RSI) has entered the overbought zone, which could trigger selling pressure and a price decline. The Bollinger Bands also suggest that ARB’s price has reached its upper limit, increasing the likelihood of a trend reversal. However, the MACD indicates a clear bullish advantage, and the Chaikin Money Flow (CMF) confirms ongoing price increases.

Can Arbitrum Reach $2? A Balanced Perspective

While ARB has shown promising signs with its recent resistance breakthrough and positive network growth, the declining trading volume and bearish sentiment raise concerns. Technical indicators present a mixed picture, with some suggesting a potential pullback while others indicate continued bullish momentum.

Factors Supporting a $2 Target:

- Strong network growth and increasing adoption.

- High whale and investor confidence.

- Potential for further development and partnerships within the Arbitrum ecosystem.

Challenges to Overcome:

- Declining trading volume and shifting market sentiment.

- Overbought RSI and potential trend reversal signals.

- Overall market volatility and regulatory uncertainty.

Conclusion: A Cautiously Optimistic Outlook

Arbitrum’s recent price surge is encouraging, but a balanced perspective is crucial. While the potential for ARB to reach $2 exists, it depends on overcoming existing challenges and maintaining positive momentum. Investors should conduct thorough research and consider their risk tolerance before making any investment decisions.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.