Is XRP facing a bearish downturn? Recent observations suggest a potential sell-off as massive XRP holders, often referred to as ‘whales,’ are seemingly shifting their funds to cryptocurrency exchanges. Let’s dive into what’s happening and what it could mean for XRP’s future.

Whale Movements: What’s the Buzz About?

Crypto data tracker Whale Alert recently flagged a series of significant XRP transactions. These weren’t just small ripples; we’re talking about substantial movements that have caught the crypto community’s attention:

- Massive Internal Transfer: A whopping 100,000,000 XRP was moved internally within Ripple Labs.

- Exchange Inflows: Following this, 23,400,000 XRP and 24,700,000 XRP were sent to crypto exchanges Bitstamp and Bitso, respectively.

🚨 100,000,000 @Ripple #XRP transferred from Ripple to unknown wallet

— Whale Alert (@whale_alert) November 9, 2023

While the exact motives behind these large transactions remain shrouded in mystery, the crypto world often interprets movements to exchanges as a precursor to selling. Why? Because exchanges are the primary platforms for trading and converting crypto assets into fiat or other cryptocurrencies.

Profit-Taking After a Price Surge?

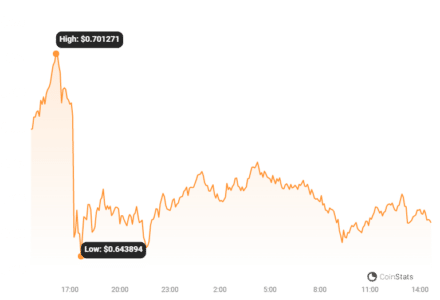

To understand the potential sell-off, we need to look at XRP’s recent price performance. XRP has been on a notable upswing, surging by over 30% in the past month. This rally propelled XRP to a high of $0.72, a level not seen since July. What was significant about July? It was when Judge Analisa Torres delivered a landmark ruling, stating that XRP’s programmatic sales on secondary markets were not securities. This legal clarity was a major boost for XRP.

For many long-term XRP holders, enduring the uncertainties of the SEC lawsuit has been a long and patient game. This recent price surge to $0.72 might be the moment they’ve been waiting for – an opportunity to realize some profits after years of ‘HODLing’.

XRP Price Check: Where Does it Stand Now?

As of now, XRP is trading around $0.6514. This reflects a 6.55% decrease in price over the last 24 hours. This price correction could be a direct reaction to the observed whale movements and the potential sell-off sentiment.

Is an XRP Recovery on the Horizon?

Despite the current price dip and concerns about whale sell-offs, there’s still a sense of optimism surrounding XRP’s potential for recovery. Why is this the case?

The factors that ignited XRP’s price surge earlier in the year are still very much in play. Let’s consider these key elements:

- Legal Victory: The partial court victory against the SEC remains a significant positive catalyst. It provided much-needed clarity and reduced regulatory uncertainty around XRP.

- XRPL Advancements: Ripple Labs continues to develop and expand the XRP Ledger (XRPL). These advancements are crucial as they bring real-world utility to XRP. Increased utility can drive demand and potentially boost XRP’s price in the long term.

These fundamental factors suggest that the recent price correction might be a temporary setback. As XRPL adoption grows and the positive sentiment from the legal win persists, XRP could be poised for another bullish phase.

Looking Ahead: What to Watch For

For those keeping a close eye on XRP, here are some key aspects to monitor:

- Whale Activity: Continue tracking large XRP movements to exchanges. Sustained inflows could indicate further sell-off pressure.

- XRPL Developments: Stay updated on new projects and partnerships building on the XRP Ledger. Real-world use cases are vital for long-term growth.

- Market Sentiment: Overall crypto market sentiment plays a role. A broader bullish trend could lift XRP along with other cryptocurrencies.

In Conclusion: Navigating XRP’s Current Waters

XRP is currently navigating a mixed landscape. Whale movements are hinting at potential sell-offs, leading to a price correction. However, the underlying factors that fueled its previous surge – the partial legal victory and XRPL advancements – are still robust. Whether this dip is a temporary retracement before another rally, or the start of a deeper correction, remains to be seen. As always in the crypto market, vigilance and informed decision-making are key.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.