Hold onto your crypto! News just broke that Poloniex, a well-known cryptocurrency exchange, has reportedly been hit by a massive security breach. We’re talking over $100 million in digital assets potentially swiped from their wallets. In the fast-paced world of crypto, hacks are a constant threat, but this one is making serious waves. Let’s dive into what we know so far about the Poloniex incident, how it unfolded, and what it means for you and the broader crypto landscape.

What Exactly Happened at Poloniex?

According to blockchain sleuths, strange outflows were detected from a crypto wallet linked to Poloniex on November 10th. Think of it like noticing unauthorized withdrawals from your bank account, but on a much larger, crypto scale. Security firms quickly jumped in, analyzing the transactions on blockchain explorers like Etherscan, and the picture became clear: this wasn’t just a glitch. It looked like a full-blown hack.

- Initially, the estimated losses were around $60 million, already a significant sum.

- However, as investigators dug deeper, the true scale of the theft became apparent. The amount ballooned to over $100 million, possibly even reaching $120 million!

- The wallet in question, identified as “Poloniex 4” on Etherscan, became the center of attention as funds rapidly vanished.

Read Also: China’s Largest Bank’s US Branch Suffers Ransomware LockBit Attack

How Did the Hackers Pull This Off?

While the full details are still emerging, blockchain security experts at CertiK suspect a “private key compromise.” Imagine a private key as the ultimate password to a crypto wallet. If hackers get their hands on it, they have full control. CertiK suggests this is the most likely scenario, giving the attackers the keys to the Poloniex digital kingdom.

#CertiKSecurityAlert 🔺

Our analysis indicates that the recent $POLONIEX outflows are likely a result of a private key compromise.

Funds have been transferred to 4 externally owned accounts, with some funds converted to $ETH.

We are continuing to monitor the situation. pic.twitter.com/9mQqkiCWhL

— CertiK Alert (@CertiKAlert) November 10, 2023

What Kind of Crypto Was Stolen?

The hackers weren’t picky! They grabbed a diverse range of digital assets, maximizing their haul in a short window. Here’s a breakdown of what’s reported to be missing:

- Stablecoins: Around $40 million worth. These are cryptocurrencies designed to maintain a stable value, often pegged to the US dollar.

- Bitcoin (BTC) and Ether (ETH): Nearly $30 million combined. These are the two biggest cryptocurrencies by market cap.

- Low Liquidity Coins: The thieves didn’t stop at the big names. They even snatched up less popular cryptocurrencies, some of which are difficult to sell due to low trading volume. In some cases, these coins were essentially unsellable because there weren’t enough buyers in the market!

Poloniex hot wallet drainer:

– 39M $USDT

– 29M $ETH

– 20M $BTC

– 20M others pic.twitter.com/R6jWzLzZ9W— DEFIYIELD App (@TheDEFIac) November 10, 2023

How Did Poloniex React?

Poloniex acted swiftly to contain the damage, at least to some extent. Upon detecting the unusual outflows, they reportedly blocked the affected wallet. However, in the initial hours, official communication was noticeably absent, leaving users anxious for information.

Poloniex is conducting maintenance on our ETH/ERC-20 hot wallet. All other markets are operating normally.

— Poloniex Exchange (@PoloSupport) November 10, 2023

Cointelegraph reached out to Poloniex for an official statement but, at the time of reporting, had not received a response.

Justin Sun Steps In: Will Users Get Their Money Back?

While Poloniex remained officially silent at first, Justin Sun, the controversial figure who recently acquired the exchange, took to X (formerly Twitter) to address the situation. He confirmed that a hack had occurred and stated that his team was on it.

Poloniex is currently undergoing maintenance. Our team is investigating the incident. We will update as soon as possible.

— H.E. Justin Sun 🌐🌈 (@justinsuntron) November 10, 2023

Crucially, Sun reassured users that all affected subscribers would be fully refunded. He emphasized that Poloniex is in a “healthy financial position” and is even exploring collaborations with other exchanges to try and recover the stolen funds. This promise of reimbursement is a significant development for concerned Poloniex users.

Poloniex Offers a White Hat Bounty – A Chance for the Hacker to Return the Loot?

In a follow-up tweet thread, Poloniex officially acknowledged the hack and reiterated the promise of user reimbursements. But here’s where it gets interesting: they offered a 5% white hat bounty to the hacker if they return the stolen assets, estimated to be around $120 million. That’s a potential $6 million payday for simply returning the funds! Poloniex stated they would give the hacker seven days to take them up on the offer before involving law enforcement. It’s a calculated risk – hoping to incentivize the return of the funds with a hefty reward, rather than engaging in a potentially lengthy and uncertain recovery process.

Poloniex is investigating an incident involving our ETH hot wallet. We are working diligently to restore normal operations. Our team is actively investigating and will provide updates as we have them.

To ensure the security of user assets, we have temporarily suspended deposit and withdrawal services. Other pic.twitter.com/17cZuPzlst

— Poloniex Exchange (@PoloSupport) November 10, 2023

Déjà Vu? Another Justin Sun Exchange Hacked!

Adding another layer of complexity, this isn’t the first time an exchange linked to Justin Sun has faced a major hack. Just a few months prior, HTX (formerly Huobi), another exchange under Sun’s umbrella, was also hacked for 5,000 ETH. While smaller than the Poloniex incident, it still represents a significant loss of user funds and raises questions about the overall security measures across Sun’s crypto ventures.

Tron (TRX) Price Surges Amidst the Chaos – A Strange Twist?

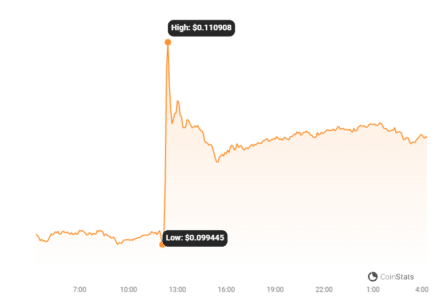

In a bizarre turn of events, Tron (TRX), the native cryptocurrency of another of Justin Sun’s projects, actually saw a 20% price increase on the very day of the Poloniex hack! According to Coinstats, TRX jumped from $0.09 to $0.11. It’s unclear why TRX experienced this price surge amidst the negative news surrounding Poloniex. It could be speculative trading, market irrationality, or perhaps unrelated market dynamics at play. Whatever the reason, it’s a peculiar detail in this unfolding saga.

What Does This Mean for Crypto Users?

The Poloniex hack serves as a stark reminder of the inherent risks in the cryptocurrency world. Here are some key takeaways:

- Security is Paramount: Exchange security is not just a technical issue; it’s about protecting user assets and maintaining trust in the crypto ecosystem.

- Private Key Security: The suspected private key compromise highlights the critical importance of secure key management. For exchanges and individual users alike, safeguarding private keys is non-negotiable.

- Transparency and Communication: While Poloniex eventually addressed the hack, the initial silence created uncertainty and anxiety. Prompt and transparent communication during security incidents is crucial for building confidence.

- Diversification and Risk Management: Events like this underscore the importance of not keeping all your crypto eggs in one basket. Diversifying across exchanges and considering cold storage solutions can mitigate risks.

- Justin Sun’s Response: Sun’s promise to reimburse users is a positive step. The crypto community will be watching closely to see if Poloniex follows through and how they plan to prevent future incidents.

The Bottom Line

The Poloniex hack is a major event, even in the often-turbulent world of crypto. The potential loss of over $100 million is significant, and the incident raises serious questions about exchange security. While Justin Sun’s commitment to refund users offers a glimmer of hope, the crypto community will be keenly observing how this situation unfolds. This hack is a wake-up call, reinforcing the need for robust security practices, transparency, and user awareness in the ever-evolving crypto landscape. Stay tuned for further updates as more information emerges about the Poloniex hack and its aftermath.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.