In the fast-paced world of cryptocurrency, where fortunes are made and lost in the blink of an eye, errors can be incredibly costly. Just ask the Bitcoin user who apparently made a monumental slip-up, paying an eye-watering 83.6 Bitcoin – that’s a cool $3.1 million – as a transaction fee! This jaw-dropping amount isn’t just a large fee; it’s a new record in US dollar terms for a single Bitcoin transaction, leaving the previous high of $500,000 in the dust. Let’s dive into this crypto curiosity and explore what happened, why it’s raising eyebrows, and what it means for Bitcoin users.

What Exactly Happened? The Million-Dollar Mistake

Imagine intending to send a certain amount of Bitcoin and accidentally adding a few extra zeros to the transaction fee. For most of us, that might mean an extra dollar or two. But for one Bitcoin user, it seems to have translated into a multi-million dollar error. Here’s a quick rundown of the situation:

- Record-Breaking Fee: A Bitcoin transaction processed at 9:59 a.m. UTC incurred a fee of 83.65 BTC.

- Staggering Dollar Value: At the time of the transaction, this fee was worth approximately $3.1 million.

- Transaction Details: The user sent 55.77 BTC ($2.1 million) and paid 83.65 BTC ($3.1 million) as fee.

- Massive Overpayment: According to Bitcoin explorer Mempool.space, the fee was overpaid by a staggering 120,528 times the typical amount.

The transaction itself involved moving Bitcoin from a relatively new address, activated just earlier that day, to another address also created recently in October. This adds a layer of intrigue to the already puzzling event.

Who Pocketed the Mammoth Fee?

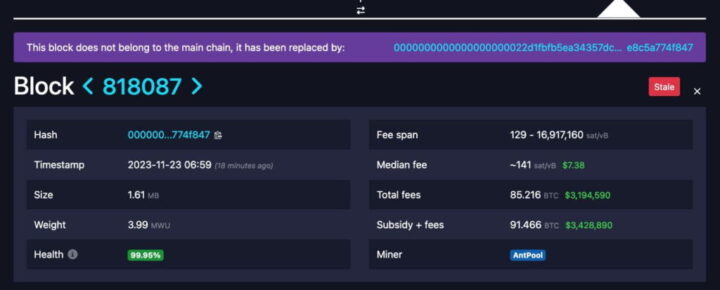

Transactions on the Bitcoin network are processed by miners, who verify and add them to the blockchain. In return for their computational work, miners collect transaction fees. In this case, the mining pool AntPool mined the block (block 818,087) containing this record-breaking transaction and, consequently, received the $3.1 million fee. As of now, the transaction has garnered multiple confirmations, solidifying its place on the blockchain.

Interestingly, while all this was unfolding, there was a brief moment of blockchain drama. A failed attempt to fork the blockchain at block height 818087 occurred, causing the block status to temporarily change to “Stale.” However, it seems the issue was resolved, and the block was effectively replaced by an exact copy, confirming its validity. It’s like a brief hiccup in the Bitcoin network’s heartbeat, quickly corrected.

Was it Really a Mistake? The “Fat Finger” Theory

Given the sheer size of the fee, the overwhelming consensus is that this was likely a “fat finger” error – a mistake made while manually entering the transaction details. Think of it like accidentally typing an extra zero when making an online purchase, but on a scale that could buy you a luxury mansion.

We’ve seen similar incidents before. Back in September, crypto services provider Paxos made a similar overpayment of $500,000. In that instance, F2Pool, the miner who processed the transaction, displayed commendable goodwill and agreed to reimburse the fee to Paxos. This sets a precedent, but will AntPool follow suit?

See Also: Crypto Bank Silvergate Repays Deposits as Part of Liquidation Plans

Will AntPool Return the $3.1 Million?

As of now, AntPool has remained silent on the matter. The crypto community is keenly watching to see if they will consider reimbursing the hefty fee. While miners are under no obligation to return overpaid fees, the reputational benefits of doing so, as F2Pool demonstrated, can be significant.

The question remains: Will AntPool follow the precedent set by F2Pool? Or will this Bitcoin user be left with a multi-million dollar lesson in transaction vigilance? Only time will tell.

Bitcoin Transaction Fees: How They Work and Why They Matter

This incident throws a spotlight on Bitcoin transaction fees and how they function within the network. For those new to Bitcoin, here’s a breakdown:

- Prioritization Mechanism: Bitcoin transaction fees are essentially a tip you offer to miners to prioritize your transaction. Miners are incentivized to include transactions with higher fees in the next block.

- Free Market: Bitcoin operates on a free-fee-bid market. Senders can set any fee they deem appropriate. The higher the fee, the faster the transaction is likely to be confirmed, especially during times of network congestion.

- Essential for Network Security: Transaction fees are a crucial component of Bitcoin’s long-term security model. As block rewards (newly minted Bitcoin given to miners) decrease over time, transaction fees are expected to become the primary incentive for miners to continue securing the network.

- User Responsibility: It’s the user’s responsibility to set appropriate transaction fees. Most Bitcoin wallets automatically suggest a fee based on network conditions, but users can manually adjust it.

Key Takeaways and Actionable Advice

This extraordinary transaction fee serves as a stark reminder of the importance of double (and triple!) checking transaction details before hitting that “send” button in the crypto world. Here are some actionable insights:

- Double-Check Everything: Always meticulously review the recipient address and the transaction fee before sending Bitcoin or any cryptocurrency.

- Use Reputable Wallets: Opt for well-regarded and user-friendly wallets that provide clear fee estimations and confirmation steps.

- Understand Fee Structures: Take the time to understand how transaction fees work on the Bitcoin network and be aware of current network conditions that might affect fees.

- Consider Test Transactions: For large or critical transactions, consider sending a small test transaction first to ensure you have the process correct and the address is accurate.

In Conclusion: A Costly Lesson in Crypto Vigilance

The $3.1 million Bitcoin transaction fee is more than just a headline-grabbing error; it’s a valuable lesson for the entire crypto community. It underscores the need for vigilance, carefulness, and a solid understanding of how cryptocurrency transactions work. Whether this was a genuine mistake or something else entirely, it has certainly sparked conversations about transaction fees, user responsibility, and the potential for goodwill within the Bitcoin ecosystem. As we wait to see if AntPool will respond to the situation, one thing is clear: in the world of crypto, every decimal point and every click counts, especially when millions are at stake.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.