In a curious turn of events in the ever-dynamic world of finance, Cathie Wood’s ARK Invest, known for its bullish stance on disruptive technologies and cryptocurrency, made a significant move by purchasing shares of SoFi Technologies (SOFI). What makes this intriguing? It happened on the very day SoFi announced its departure from the crypto trading arena. Let’s dive into the details of this investment and what it might signify.

ARK Invest Doubles Down on SoFi: A Fintech Play Beyond Crypto?

On November 29th, ARK Invest, spearheaded by the well-known Bitcoin proponent Cathie Wood, executed a purchase of 200,275 SoFi shares. This allocation, valued at approximately $1.47 million based on SoFi’s closing price of $7.35 per share on that day, was directed towards the ARK Fintech Innovation ETF (ARKF). This information comes directly from ARK Invest’s trade notifications, providing transparency into their investment activities.

This purchase is particularly noteworthy because it coincided with SoFi Technologies’ official announcement to discontinue its cryptocurrency services by December 19, 2023. SoFi, in its statement, explained this strategic shift as a result of “careful consideration,” advising customers to transition their crypto holdings to Blockchain.com, an online crypto wallet platform.

Why buy SoFi when they’re exiting crypto? This is the million-dollar question. It seems ARK Invest’s confidence in SoFi extends beyond its foray into the volatile crypto market. Perhaps ARK views SoFi as a robust fintech platform with strong fundamentals in other areas, making its long-term prospects attractive regardless of its crypto service termination.

ARK’s Long-Term Bet on SoFi: A Deeper Look

Interestingly, this recent purchase is not an isolated incident. ARK Invest has been consistently accumulating SoFi shares throughout 2023. To date, ARKF holds a substantial 1,772,991 SOFI shares, representing an investment of around $13 million at current market prices. This continuous accumulation signals a strong conviction in SoFi’s potential within the fintech landscape.

See Also: ARK Invest Sold Another $5.2M In Coinbase Stock Amid 18-month High

SoFi’s Stock Performance: Riding the Fintech Rollercoaster

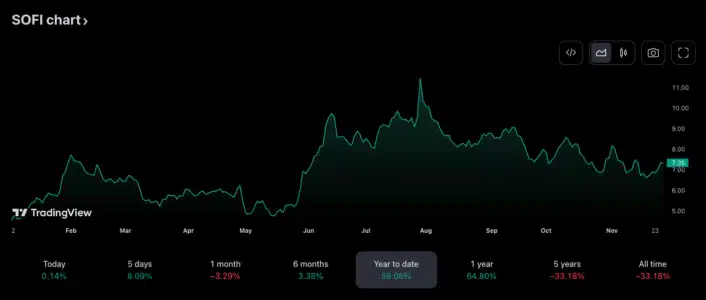

SoFi’s stock (SOFI) has experienced significant price fluctuations throughout 2023, mirroring the broader volatility in the tech and fintech sectors. Starting the year at a modest $4.5, SoFi shares surged to a high of $11.45 in July, demonstrating considerable growth and investor enthusiasm. However, this upward trend was followed by a gradual decline, with the stock price dipping below $7 in mid-November. This price movement highlights the inherent risks and rewards associated with investing in growth-oriented fintech companies.

Here’s a quick recap of SoFi’s stock journey in 2023:

- Start of Year: Around $4.5

- Peak (July): $11.45

- Mid-November: Below $7

ARK Invest’s Fintech Strategy: Balancing Bets Across the Sector

Beyond SoFi, ARK Invest’s recent trading activity reveals a broader strategy within the fintech space. On the same day as the SoFi purchase, ARK also added 221,759 shares of Robinhood (HOOD) to its portfolio. Robinhood, known for its popular trading app, also offers cryptocurrency trading services in the United States and has announced expansion plans into the U.K.

Fintech Portfolio Balancing Act:

- Buying: SoFi (SOFI), Robinhood (HOOD)

- Selling: Coinbase (COIN)

Interestingly, while increasing its stakes in SoFi and Robinhood, ARK Invest continued to reduce its holdings in Coinbase (COIN). On November 29th, approximately 38,000 COIN shares were sold from the ARKF ETF, amounting to nearly $5 million. This simultaneous buying and selling activity suggests a strategic portfolio rebalancing within the fintech sector, possibly reflecting ARK’s evolving views on different players and their future potential in the financial landscape.

Key Takeaways: What Does This Mean for Investors?

ARK Invest’s investment in SoFi, especially amidst the crypto service shutdown, raises several important points for investors to consider:

- Confidence in SoFi’s Core Business: ARK’s purchase signals a belief in SoFi’s fundamental strengths beyond cryptocurrency, potentially in its lending, banking, and financial services platform.

- Strategic Portfolio Allocation: ARK’s simultaneous moves in SoFi, Robinhood, and Coinbase highlight a dynamic approach to fintech investments, adapting to market changes and company-specific developments.

- Contrarian Investing: Buying SoFi on the day of a negative crypto announcement could be seen as a contrarian bet, suggesting ARK sees long-term value where others might see short-term setbacks.

- Focus on Fintech Innovation: Despite exiting crypto services, SoFi remains a significant player in fintech innovation, and ARK’s investment underscores the continued growth potential of this sector.

In Conclusion: ARK Invest’s Vision Beyond the Crypto Hype

Cathie Wood’s ARK Invest’s decision to increase its stake in SoFi Technologies, even as SoFi steps back from crypto services, is a compelling reminder that investment strategies are often nuanced and forward-looking. It appears ARK is betting on SoFi’s broader fintech capabilities and long-term growth trajectory, rather than solely on its cryptocurrency offerings. This move provides valuable insights into how seasoned investors like ARK Invest are navigating the evolving fintech landscape, making strategic decisions based on a comprehensive view of company value and future potential, even amidst market shifts and sector-specific headwinds. As always, these moves by ARK Invest are closely watched by the market, offering clues and sparking conversations about the future of fintech and investment strategies in the digital age.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.