Hold onto your hats, crypto enthusiasts! The digital gold rush is back, and Bitcoin is leading the charge. After a period of market slumber, Bitcoin has spectacularly smashed through the $40,000 barrier, soaring to levels not seen since April 2022. This isn’t just a minor price tick; it’s a seismic shift that has the crypto world buzzing with excitement. Are we witnessing the dawn of a new bull run? Let’s dive into what’s fueling this impressive surge and what it means for you.

Bitcoin Breaches $40K: A Milestone Moment

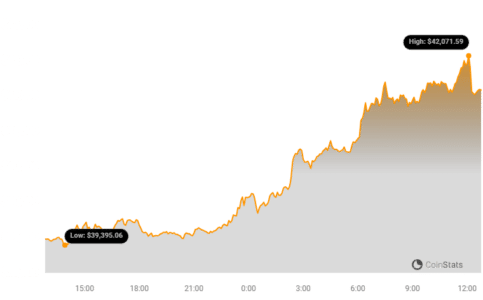

In a market known for its rollercoaster rides, Bitcoin’s recent performance is nothing short of exhilarating. As of today, Bitcoin is trading above $41,000, marking a significant 3.38% leap in just 24 hours. This powerful move isn’t happening in isolation. Bitcoin’s dominance in the crypto sphere remains strong, currently commanding over 50% of the entire crypto market capitalization.

- Key Milestone Reached: Bitcoin has decisively broken through the $40,000 resistance level, a psychological and technical barrier that had held strong for months.

- Strong Market Performance: A 3.38% surge in the last 24 hours underscores the robust buying pressure and renewed investor confidence in Bitcoin.

- Dominant Market Position: Bitcoin’s 50.04% market dominance highlights its continued leadership in the cryptocurrency space.

What’s Igniting the Bitcoin Bull Run?

So, what’s the secret sauce behind this impressive rally? Several factors are converging to create the perfect storm for Bitcoin’s upward trajectory:

1. Dovish Signals from Central Banks

Remember the cautious optimism we discussed a few months back? Well, it’s turning into reality. U.S. central bankers have hinted at a more dovish stance, suggesting a potential pause or even reversal in interest rate hikes. This is music to the ears of investors. Why? Because lower interest rates make riskier assets like Bitcoin more attractive compared to traditional fixed-income investments.

2. The Bitcoin ETF Hype Train is Gaining Speed

The anticipation surrounding a spot Bitcoin Exchange Traded Fund (ETF) is reaching fever pitch. Imagine being able to invest in Bitcoin through a regulated and easily accessible ETF, just like traditional stocks. This is the game-changer everyone is waiting for, and the possibility is becoming increasingly real.

Currently, a whopping 13 entities have filed applications for a spot Bitcoin ETF, all vying for the SEC’s green light. Industry analysts are buzzing with predictions, with many pointing to a potential approval window before January 10th, 2024. The approval of a Bitcoin ETF would be a watershed moment, potentially unlocking billions of dollars of institutional investment and further legitimizing Bitcoin as an asset class.

3. Shaking Off the ‘Weekend Market Curse’

Historically, weekends haven’t always been kind to the crypto market, often associated with negative price narratives. However, this time, the weekend vibes couldn’t dampen Bitcoin’s bullish spirit. This resilience signals a fundamental shift in market sentiment and strength.

Is This Really a Bull Run? Decoding the Sentiment

The million-dollar question: Are we officially in a bull run? While no one has a crystal ball, the signs are undeniably bullish. Bitcoin breaking the $40,000 mark is more than just a price point; it’s a psychological victory. It represents a resurgence of hope and a palpable bullish sentiment sweeping through the crypto ecosystem.

Investors who weathered the recent market volatility are now witnessing a dramatic turnaround. Optimism is back in the air, fueled by the potential for long-term growth and stability in the crypto market. The Fear and Greed Index, a measure of market sentiment, currently sits at a ‘Greedy’ 74, indicating strong positive momentum.

Bitcoin Fear and Greed Index is 74 – Greed

Current Value: 74

Last Value: 72

1 day ago: 72

1 week ago: 63

1 month ago: 51

1 year ago: 25 – Fear

Extreme fear means investors are too worried. That could be a buying opportunity.

When investors are getting too greedy, that means the market is due for a correction. pic.twitter.com/tE5395Y5xw— Bitcoin Fear and Greed Index (@BitcoinFear) December 3, 2023

By the Numbers: Bitcoin’s Impressive Rally

Let’s look at the data to appreciate the magnitude of Bitcoin’s comeback:

- Current Price: Around $41,546 (and fluctuating upwards!). Check real-time prices here.

- 24-Hour Trading Volume: A robust $18.89 billion, indicating strong market activity.

- 24-Hour Price Increase: +3.38%

- 7-Day Price Increase: +9.17%

The Broader Crypto Market is Riding the Wave

Bitcoin’s surge is lifting the entire crypto market. The global crypto market capitalization has jumped to $1.59 trillion, a 2.61% increase in the last 24 hours and a whopping 77.74% increase year-over-year. Even stablecoins, while representing a smaller slice of the pie at $130 billion, are part of this expanding ecosystem.

See Also: Bitcoin Soared Beyond $39K, Is Bitcoin Poised For Another Bull Run?

Bitcoin’s 2023 Comeback Story

This year has been a remarkable turnaround for Bitcoin. After enduring the ‘crypto winter’ of 2022, triggered by events like the FTX collapse, Bitcoin has more than doubled in value. It’s not just Bitcoin; other risk-on assets like gold and interest-rate sensitive investments are also experiencing a surge, fueled by expectations of the US Federal Reserve easing monetary policy in 2024.

Ethereum (ETH) is also joining the party, currently priced at $2,217.08, with a 2.58% increase in the last 24 hours. While both Bitcoin and Ethereum are still below their all-time highs from 2021, the current momentum is undeniable.

Ethereum’s Bullish Momentum:

- Current Price: $2,217.08 (Check real-time prices here)

- 24-Hour Trading Volume: $15.59 billion

- 24-Hour Price Increase: +2.58%

- 7-Day Price Increase: +8.18%

See Also: Bitcoin Cash Price Soared Over 10% And Broke The $245 Resistance

Expert Predictions: How High Could Bitcoin Go?

Market analysts are increasingly optimistic about Bitcoin’s future. Markus Thielen, Head of Research at Matrixport, predicts Bitcoin could reach $60,000 by April 2024 and potentially skyrocket to $125,000 by the end of 2024. Thielen points to historical patterns, noting that past crypto bear markets have been followed by three-year bull runs, with 2023 marking the beginning of a new cycle.

I called for $BTC $45k by year-end, but $42k is more likely.

We are heading for $60k by March/April.

And $125k by year-end 2024.

Bitcoin Bull Market has started.

I can feel it in my bones. #Bitcoin #BTC pic.twitter.com/rdgK5s2lZl

— Aurelien Ohayon (@AurelienOhayon) December 2, 2023

The ETF Race Heats Up: 13 Contenders Await Approval

The race to launch the first spot Bitcoin ETF in the US is intensifying. Pando Asset, a Swiss asset manager, is the latest entrant, bringing the total number of proposals to 13. While most applicants are in a waiting game, giants like BlackRock and Grayscale are actively engaging with the SEC to finalize the details of their ETF offerings.

Bloomberg ETF analysts are predicting a high probability – around 90% – that multiple ETF applications will be approved simultaneously by January 10th. This potential mass approval could trigger a significant influx of capital into the Bitcoin market.

Crypto Equities and Corporate Bitcoin Holdings Soar

The bullish sentiment is not confined to cryptocurrencies alone. Crypto-related stocks are also experiencing significant gains. Companies like Woori Technology Investment in South Korea and Monex Group in Japan are benefiting from the renewed crypto enthusiasm. In the US, software giant MicroStrategy and exchange platform Coinbase have seen their year-to-date gains exceed a staggering 270%.

MicroStrategy, known for its massive Bitcoin holdings, now possesses approximately $6.5 billion worth of Bitcoin, further solidifying its position as a major corporate player in the crypto space.

Conclusion: Buckle Up for the Ride?

Bitcoin’s surge past $40,000 is a powerful signal. Fueled by ETF anticipation, dovish central bank signals, and a broader market resurgence, the crypto bull may indeed be awakening. While volatility is inherent in the crypto market, the current momentum suggests a potentially exciting period ahead. Whether this is the start of a sustained bull run remains to be seen, but one thing is clear: Bitcoin is back in the spotlight, and the crypto world is watching with bated breath.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.