Hold onto your hats, crypto enthusiasts! The market’s been buzzing with a major shake-up. Solana (SOL), the blockchain project often hailed as an ‘Ethereum killer,’ has just hit a significant milestone. It’s officially climbed to the fourth spot in the cryptocurrency rankings, overtaking Binance Coin (BNB)! This isn’t just a minor shuffle; it’s a powerful statement about the evolving landscape of digital assets and the growing prominence of Solana’s ecosystem.

Solana vs. BNB: A Market Cap Showdown

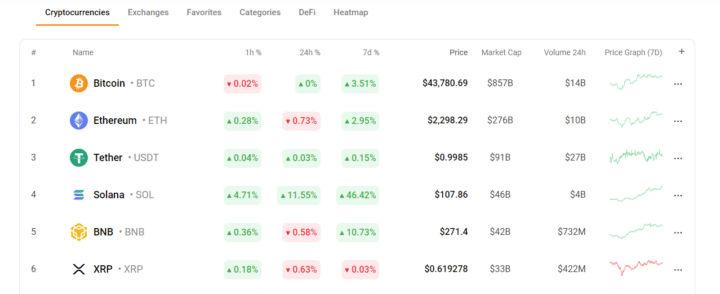

The crypto world witnessed this changing of the guard between December 22nd and 23rd. Let’s dive into the numbers to understand the scale of this shift. According to Coinstats, Solana now boasts a market capitalization of a whopping $46 billion, while BNB trails slightly behind at $42 billion. That’s a clear victory for SOL in this round of the crypto race!

But market cap isn’t the only metric where Solana is shining. Let’s look at the trading activity:

- Solana (SOL): Impressive 24-hour trading volume of $3.15 billion.

- BNB: A more modest 24-hour trading volume of $772.54 million.

Furthermore, Solana has seen a remarkable 28% increase in value over the past week. This surge in momentum is undeniably what propelled it to claim the coveted fourth position in the crypto hierarchy.

See Also: Paxos To Launch New Stablecoin, USDP, On Solana After Shutting Down BUSD

While Solana and BNB are battling for position, Tether (USDT) holds firmly in third place with a substantial $91.25 billion market cap. Bitcoin (BTC) and Ethereum (ETH) remain the undisputed leaders, commanding market capitalizations of $853.79 billion and $274.90 billion, respectively.

What’s Driving Solana’s Stellar Growth?

This leap in ranking isn’t just luck; it’s a reflection of something bigger happening within the crypto space. Solana’s rise signals a growing wave of interest and investment in its ecosystem. But what exactly is fueling this surge?

One key factor is the impressive growth of Solana’s Total Value Locked (TVL). TVL is a crucial metric in Decentralized Finance (DeFi), representing the total value of cryptocurrencies deposited in DeFi protocols. Solana’s increasing TVL indicates strong confidence and activity within its DeFi ecosystem. In fact, the entire DeFi sector has become so significant that its combined value even rivals the GDP of some countries, currently holding over $52 billion worth of crypto assets!

Justin Bons, founder of Cyber Capital, a pioneering European cryptocurrency fund, highlights a significant shift in market sentiment. He believes the crypto world is increasingly focusing on layer-1 scalability.

According to Bons in a post on X (formerly Twitter), the market is pivoting towards blockchains that prioritize scalability at their core:

The market is starting to understand the importance of Layer 1 scalability!

This is why @solana is pumping & taking market share from @ethereum

The future of crypto is Layer 1 scalability!

Layer 2s are a crutch to compensate for the lack of Layer 1 scalability & security https://t.co/L8rV7p9z1r

— Justin Bons 🛡️ (@Justin_Bons) December 22, 2023

Projects like Solana are designed to deliver a smoother, faster, and more cost-effective experience for users engaging with DeFi and Web3 applications. They achieve this through innovative technologies that boost network capacity directly at the base layer, rather than relying heavily on Layer-2 solutions like those often associated with Ethereum.

See Also: Solana Witnessed Increased Activity On Solana-based DEXs

What Does This Mean for Crypto Investors?

The cryptocurrency market is in constant motion. Solana’s ascent is a powerful reminder that adaptability and continuous learning are crucial for investors. These shifts, while sometimes challenging, are also the engines of progress, creating new opportunities and driving innovation. As Justin Bons aptly puts it, “What is happening in cryptocurrency now is awesome.”

Key Takeaways:

- Solana’s Rise: Solana has overtaken BNB to become the 4th largest cryptocurrency by market cap, signaling strong growth and investor interest.

- Layer-1 Scalability Focus: The market is increasingly valuing blockchains like Solana that prioritize scalability at the base layer for DeFi and Web3 applications.

- Evolving Market: The crypto landscape is dynamic. Investors should stay informed and be prepared to adapt to new trends and opportunities.

- DeFi Growth: Solana’s growth is linked to the overall expansion and increasing importance of the DeFi ecosystem.

In Conclusion: Solana’s move into the top four cryptocurrencies is more than just a ranking change. It represents a significant shift in the crypto narrative, highlighting the growing importance of scalability and the potential of projects designed for a faster, more efficient decentralized future. Keep a close eye on Solana – its journey is likely far from over!

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.