Navigating the exciting yet volatile world of Decentralized Finance (DeFi) can feel like charting a course through uncharted waters. The DeFi ecosystem, a dynamic arena where financial innovation thrives, is constantly evolving, presenting both incredible opportunities and inherent risks. Think of it as a vast, open-source laboratory where the future of finance is being built, brick by blockchain brick, away from traditional intermediaries. It’s a market that’s not just buzzing with activity; it’s booming, already rivaling the economic output of some nations! But with this rapid growth comes complexity. Every day, a wave of new projects emerges, each tackling similar challenges with unique approaches. For investors, this landscape can be both exhilarating and daunting. Where do you even begin to look for the gems amidst the noise? That’s where informed choices come in. Smart money is constantly on the move, seeking out the most promising blockchains and protocols to invest in. But for the average crypto enthusiast, especially those new to DeFi or short on research time, this can feel like trying to solve a complex puzzle without all the pieces. And let’s be honest, the experimental nature of DeFi means there are real risks involved – protocol failures, security vulnerabilities, and market volatility are all part of the game. So, how do you cut through the hype and identify projects with real potential? Finbold has done some of the groundwork for you. We’ve pinpointed two DeFi cryptocurrencies that stand out as compelling buys in 2024, offering a blend of innovation and growth potential.

See Also: The Price Of Metis Surges 50% In The Past 24 Hours

Solana (SOL): The DeFi Powerhouse Built for Speed

Solana (SOL) has undeniably been a star performer in the cryptocurrency space, particularly throughout 2023. Its remarkable surge isn’t just hype; it’s backed by solid technological foundations and a growing ecosystem. What makes Solana stand out in the crowded DeFi arena? Scalability is a key factor. Compared to earlier blockchains like Ethereum, Solana offers a significantly more scalable network and infrastructure specifically designed for DeFi applications. This improved scalability is crucial for DeFi to truly reach mass adoption, as it translates to faster transaction speeds and lower fees – pain points that Ethereum has historically struggled with. This efficiency has been a major catalyst for Solana’s impressive growth.

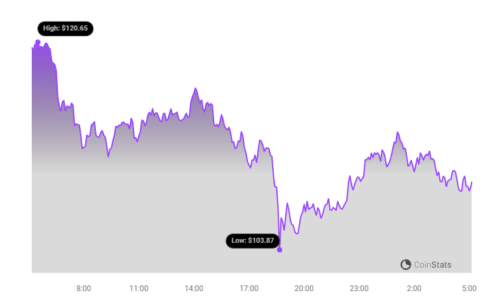

Let’s look at the numbers. Starting the year at around $9.96 per token, SOL witnessed an astounding climb, reaching approximately $120 by December 26th. Even with some fluctuations, Solana’s year-to-date (YTD) growth has been nothing short of spectacular, soaring by over 1,072%. This impressive price action reflects growing investor confidence and adoption of the Solana ecosystem.

Solana’s rise has propelled it to the 4th position among the most valuable cryptocurrencies, overtaking major players like BNB Chain (BNB) and other competitors. This isn’t just about market capitalization; it’s a testament to the vibrant and active DeFi ecosystem flourishing on Solana. For those looking to engage with DeFi on Solana, Orca, its native decentralized exchange (DEX), is a prime example of the platform’s utility and popularity. Orca has become a go-to DEX for many Solana users, offering a user-friendly experience and a wide range of trading opportunities.

Solana’s Challenges: Are There Clouds on the Horizon?

Despite the bullish narrative, it’s important to approach Solana with a balanced perspective. Renowned crypto analysts are raising concerns that SOL might be currently overextended at its present price levels. This suggests that a price correction or period of consolidation could be on the cards. Another significant factor to consider is the lingering presence of FTX and Alameda Research. These entities still hold substantial Solana tokens, creating a potential liquidation risk. Should they decide to liquidate their holdings, it could exert significant downward pressure on SOL’s price.

Furthermore, SOL’s tokenomics include a relatively high inflation rate. This constant token issuance can create ongoing selling pressure, which investors need to be aware of. While inflation can be necessary for network security and staking rewards, excessive inflation can dilute the value of existing tokens over time.

See Also: This Trader Made $5.7 Million After Investing 30 Solana Tokens (SOL)

Radix (XRD): The Underdog with a DeFi-Centric Architecture

On the other side of the DeFi spectrum, we have Radix (XRD). Often considered an overlooked and potentially undervalued project, Radix is yet to achieve widespread recognition despite its innovative approach to decentralized finance. Similar to Solana, Radix tackles the scalability challenge head-on. It employs sharding technology to enhance network throughput, resulting in faster transaction settlements and lower transaction fees. This focus on scalability positions Radix as a strong contender in the race to build a more efficient DeFi infrastructure.

However, Radix goes beyond just scalability. Its “asset-oriented” approach to tokens and smart contracts is a truly groundbreaking feature within the DeFi space. This unique model directly addresses many of the limitations and complexities found in other layer-1 blockchains. By optimizing how users interact with their digital assets, Radix aims to create a more intuitive and user-friendly DeFi experience. Imagine a DeFi world where managing your assets is as seamless and straightforward as using modern web applications – that’s the vision behind Radix.

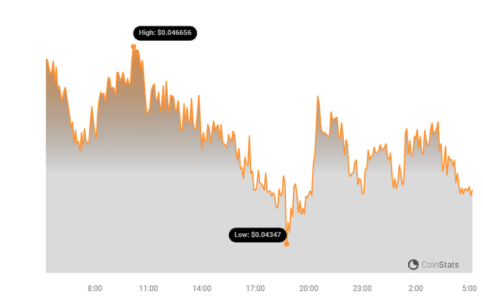

Despite its technological advancements, Radix’s native token, XRD, experienced a more subdued 2023 compared to Solana’s explosive growth. Currently trading around $0.044, XRD has seen a more modest YTD increase of approximately 50%. While positive, this growth is significantly less dramatic than Solana’s, highlighting Radix’s position as a project still in the early stages of adoption and market recognition.

Radix: High Potential, Higher Risk?

It’s crucial to understand that Radix currently operates as a low-liquidity and low-market capitalization cryptocurrency. Its DeFi ecosystem is still in its nascent stages, with a Total Value Locked (TVL) of around $20 million, considerably smaller than Solana’s $1.5 billion. This lower TVL and liquidity mean that XRD is inherently more speculative and potentially more volatile than more established cryptocurrencies. Investing in Radix at this stage carries a higher degree of risk, but also the potential for significant upside if the ecosystem gains traction.

Radix’s core design philosophy is to provide an unparalleled user experience for DeFi. Whether XRD will successfully achieve this ambitious goal remains to be seen. However, there are early signs of promise within its ecosystem. Several protocols are beginning to attract investor attention, including Ociswap (OCI), CaviarNine (FLOOP), and Weft Finance (WEFT). These emerging projects suggest a growing developer and user base within the Radix network, which could be a precursor to more substantial growth.

Solana vs. Radix: Which DeFi Crypto is Right for You in 2024?

Choosing between Solana and Radix for your DeFi investments in 2024 depends heavily on your risk tolerance and investment strategy. Both offer unique value propositions within the DeFi space, but they cater to different investor profiles.

| Feature | Solana (SOL) | Radix (XRD) |

|---|---|---|

| Scalability | Highly Scalable, proven in practice | Highly Scalable (Sharding), technologically advanced |

| Ecosystem Maturity | Mature, large DeFi ecosystem, high TVL | Emerging ecosystem, low TVL, high growth potential |

| Market Cap & Liquidity | High market cap, high liquidity | Low market cap, low liquidity, more speculative |

| Token Performance 2023 | Exceptional growth, over 1000% YTD | Modest growth, around 50% YTD |

| Key Risks | Potential overextension, FTX/Alameda liquidation risk, inflation | Low liquidity, speculative nature, ecosystem still developing |

| User Experience Focus | Good, improving | Core focus on superior DeFi user experience |

| Investment Profile | Growth-oriented, potentially more established DeFi exposure | High-growth potential, higher risk, early-stage DeFi exposure |

Solana presents itself as a more established and battle-tested DeFi platform. It’s ideal for investors seeking exposure to a thriving DeFi ecosystem with proven scalability and a strong track record. However, be mindful of potential price corrections and the risks associated with token inflation and large holders.

Radix, on the other hand, is a higher-risk, higher-reward play. It’s suited for investors who are comfortable with speculation and believe in the potential of its innovative, asset-oriented architecture. Investing in Radix is essentially betting on the future growth and adoption of its DeFi ecosystem. The potential upside could be significant if Radix succeeds in its mission to revolutionize DeFi user experience.

Final Thoughts: DeFi Investment in 2024 – Proceed with Caution and Research

Both Solana and Radix offer compelling opportunities within the DeFi space in 2024. However, as with any cryptocurrency investment, particularly in the rapidly evolving world of DeFi, caution and thorough research are paramount. Remember that the information provided here is not financial advice. The cryptocurrency market is inherently volatile, and DeFi adds another layer of complexity and risk. Before making any investment decisions, conduct independent research, consider your own risk tolerance, and ideally, consult with a qualified financial professional. The future of finance is being built now, and DeFi is at the forefront, but navigating this frontier requires both excitement and a healthy dose of prudence.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.