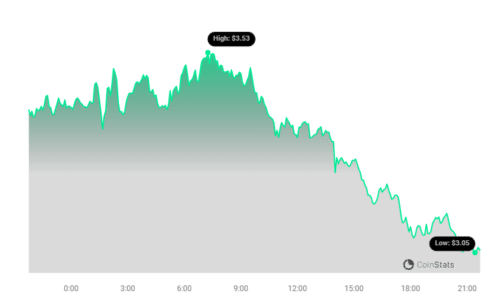

Cryptocurrency markets are known for their rollercoaster nature, and NEAR Protocol (NEAR) is currently experiencing a downward turn. Over the past 24 hours, the price of NEAR has decreased by a significant 8.03%, landing at $3.14. This isn’t just a one-day blip; it’s part of a broader trend, as NEAR has seen a 21.0% decrease over the last week, sliding down from $3.91. Let’s dive into the numbers and understand what these movements might indicate for NEAR Protocol and its investors.

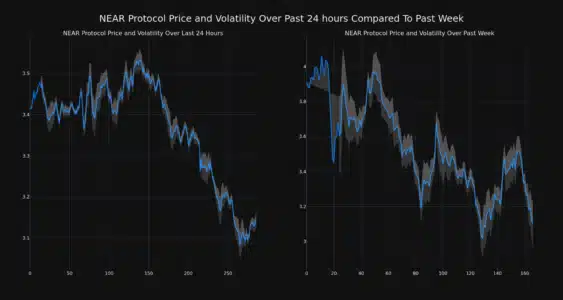

To get a clearer picture of what’s happening, let’s look at price movement and volatility. The chart below provides a visual comparison:

Decoding NEAR Protocol’s Price Action: Daily vs. Weekly Volatility

The charts showcase NEAR’s price fluctuations over the last 24 hours (left) and the past week (right). Notice those gray bands? Those are Bollinger Bands, a popular tool used to measure volatility. Essentially, they show how much the price of NEAR Protocol has been fluctuating around its average price over these periods.

What do Bollinger Bands tell us about NEAR’s volatility?

- Wider Bands = Higher Volatility: When the gray bands widen, it signifies increased price swings. A larger gray area means NEAR’s price has been jumping around more dramatically during that time frame.

- Narrower Bands = Lower Volatility: Conversely, if the bands were to narrow, it would suggest a period of relative price stability.

See Also: BUSD Stablecoin Drops From Its Top Five Spot As Binance Drum Support For TUSD And FDUSD

Trading Volume and Circulating Supply: Key Indicators to Watch

Price isn’t the only metric to consider. Let’s examine the trading volume and circulating supply of NEAR Protocol, as these can offer further clues about market sentiment and potential future price movements.

Trading Volume: A significant decrease of 58.0% in NEAR’s trading volume over the past week is noteworthy. Lower trading volume can sometimes amplify price swings, as fewer transactions might lead to quicker price drops or rises when buying or selling pressure increases. It could also suggest decreased interest or activity around NEAR in the short term.

Circulating Supply: On the other hand, the circulating supply of NEAR has slightly increased by 0.53% to over 1.01 billion coins. An increase in circulating supply, without a corresponding increase in demand, can sometimes put downward pressure on price, as there are more coins available in the market.

NEAR Protocol’s Market Standing

Despite the recent price drop, NEAR Protocol still holds a respectable position in the cryptocurrency market. Currently, NEAR is ranked #29 in market capitalization, with a market cap of $3.18 billion. This ranking indicates its relative size and importance within the broader crypto ecosystem. However, market rankings are dynamic and can change rapidly, especially in volatile periods.

What Does This Mean for NEAR Protocol?

The recent data paints a picture of downward price pressure on NEAR Protocol. Several factors could be contributing to this:

- Broader Market Sentiment: The entire cryptocurrency market can be influenced by overall market sentiment. Negative news or a general downturn in Bitcoin or Ethereum prices often drags altcoins like NEAR down with them.

- Profit Taking: After periods of growth, some investors may choose to take profits, leading to selling pressure and price decreases.

- Specific News or Developments: Any specific news or developments related to NEAR Protocol itself, whether positive or negative, can impact its price. It’s important to stay updated on the latest news surrounding the project.

- Volatility is Normal: It’s crucial to remember that volatility is inherent in the cryptocurrency market. Price fluctuations, both upward and downward, are expected.

Navigating Crypto Volatility: Key Takeaways

For those invested in or considering investing in NEAR Protocol, here are a few key points to keep in mind:

- Stay Informed: Keep up-to-date with the latest news and analysis on NEAR Protocol and the broader crypto market.

- Understand Volatility: Be prepared for price fluctuations. Cryptocurrency investments carry risk, and prices can move quickly.

- Do Your Own Research (DYOR): Never rely solely on short-term price movements. Conduct thorough research into the fundamentals of NEAR Protocol, its technology, team, and long-term potential.

- Consider Long-Term Perspective: Many crypto investors adopt a long-term perspective, focusing on the underlying technology and adoption rather than short-term price swings.

In Conclusion: NEAR Protocol is currently experiencing a period of price decline and increased volatility. While the recent data points to downward pressure, it’s essential to consider the broader context of the cryptocurrency market and conduct thorough research before making any investment decisions. Keep an eye on trading volume, circulating supply, and overall market sentiment to better understand NEAR’s future price trajectory.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.