Navigating the crypto world can feel like traversing a minefield, and recent events on the BNB Chain serve as a stark reminder of the risks involved. Holders of the WEWE token experienced a brutal shock as they witnessed a dramatic price collapse, widely suspected to be a rugpull. This incident has not only left investors reeling but has also raised serious questions about the security and reputation of the BNB Chain itself. Let’s dive into what happened and what it means for the BNB ecosystem.

What Exactly Happened with the WEWE Token?

On a day that many BNB Chain users will want to forget, the WEWE token experienced a catastrophic price drop of 98.82%. Imagine watching nearly all of your investment vanish in an instant – that’s the harsh reality faced by WEWE holders. This drastic plunge is a classic hallmark of a rugpull, a type of crypto scam where developers abandon a project and abscond with investors’ funds, typically after artificially inflating the token’s price.

- Sudden Price Collapse: WEWE token price plummeted by a staggering 98.82%.

- Suspected Rugpull: Evidence points towards a rugpull scenario, leaving investors with significant losses.

- BNB Chain Impact: The incident casts a shadow on the BNB Chain’s reputation and user trust.

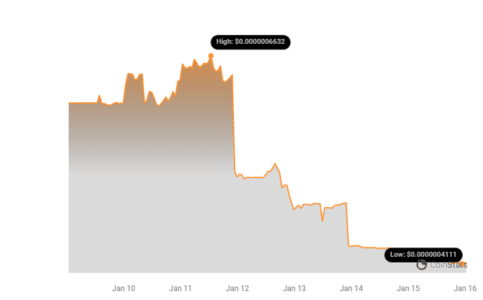

The timeline of events began to unfold on January 15th, when AegisWeb3, a cybersecurity firm, flagged a significant sell-off by multiple addresses on the BNB Chain. This triggered alarm bells, suggesting coordinated malicious activity. The chart below visually represents the WEWE token’s price nosedive:

This visual representation paints a clear picture of the dramatic and sudden nature of the price decline, reinforcing the rugpull narrative.

How Does This Rugpull Affect the BNB Chain’s Reputation?

Incidents like the WEWE rugpull have repercussions that extend beyond just the affected token holders. They can significantly damage the reputation of the entire blockchain ecosystem on which the token resides. For the BNB Chain, a platform striving for mainstream adoption, maintaining user trust is paramount.

- Erosion of Trust: Rugpulls breed distrust among users, making them hesitant to invest in other BNB Chain projects.

- Negative Sentiment: As indicated by Santiment analysis, negative sentiment surrounding BNB has increased, outweighing positive comments.

- Reduced User Activity: Data from Token Terminal reveals a 6.4% decrease in network growth and a 24.2% drop in revenue within 24 hours of the incident, suggesting user disengagement.

Santiment’s sentiment analysis highlights the shift in public perception:

This negative sentiment, coupled with declining user activity, poses a serious challenge to the BNB Chain’s long-term growth and sustainability. Are users losing faith in the platform’s ability to protect them from such scams?

Is This an Isolated Incident or a Recurring Problem on BNB Chain?

Unfortunately, the WEWE rugpull isn’t an isolated event on the BNB Chain. A history of similar incidents paints a concerning picture. As highlighted in our previous reports, other tokens like OMNI and a meme coin have also fallen victim to rugpulls on this blockchain.

See Also: Solana Users Hit With Rugpull By MangoFarmSOL Farming Protocol

See Also: CLINKSINK Drainer Campaigns Stole About $1M Worth Of SOL

This pattern raises serious questions about the vetting processes and security measures in place for tokens launching on the BNB Chain. Is enough being done to protect users from these types of scams? The recurrence suggests a systemic issue that needs to be addressed proactively.

BNB Chain’s Rugpull History: A Quick Look

- WEWE Token (Recent): 98.82% price drop, suspected rugpull.

- OMNI Token (December 25th): Previous rugpull incident contributing to the negative trend.

- Meme Coin (August 27th): Another rugpull incident, further highlighting the issue.

BNB Price Resilience: A Silver Lining?

Despite the WEWE rugpull and the broader concerns about user trust, there’s a somewhat surprising element to this story. The price of BNB, the native token of the BNB Chain, actually showed resilience in the face of this negative news. It grew by 3.73% to reach $316.89 at the time of reporting.

This positive price movement could be attributed to several factors, including the overall bullish momentum in the cryptocurrency market. However, it’s crucial to remember that price action alone doesn’t negate the underlying issues of security and trust. While the BNB token price might be recovering, the damage to user sentiment and the need for enhanced security measures remain critical concerns.

Moving Forward: Restoring Trust and Enhancing Security

The WEWE rugpull serves as a crucial wake-up call for the BNB Chain ecosystem. Addressing the issue of rugpulls and restoring user trust requires a multi-faceted approach. Here are some key areas that need attention:

- Enhanced Token Vetting: Implementing stricter due diligence and vetting processes for new tokens launching on the BNB Chain is crucial.

- Improved Security Measures: Strengthening security protocols and infrastructure to detect and prevent malicious activities is paramount.

- User Education: Educating users about the risks of rugpulls and how to identify potentially fraudulent projects is essential for investor protection.

- Transparency and Communication: Open and transparent communication from the BNB Chain team regarding security incidents and measures being taken to address them is vital for rebuilding trust.

In Conclusion: Lessons from the WEWE Rugpull

The WEWE token rugpull on the BNB Chain is a stark reminder of the risks inherent in the decentralized finance (DeFi) space. While the crypto market offers exciting opportunities, it also comes with vulnerabilities. This incident underscores the importance of vigilance, due diligence, and robust security measures within blockchain ecosystems. For the BNB Chain, addressing the root causes of these rugpulls and actively working to restore user trust will be crucial for its continued success and growth in the competitive crypto landscape. The resilience of the BNB token price offers a glimmer of hope, but sustained effort to enhance security and transparency is the real key to long-term recovery and user confidence.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.