The cryptocurrency market is a whirlwind of volatility, and SUI, a relatively new entrant, is no exception. After hitting a near all-time high, SUI’s price experienced a significant pullback, leaving investors wondering: Is this just a temporary dip in a bullish trend, or the start of a deeper correction? Let’s dive into the recent price action of SUI, analyze key technical indicators, and explore what analysts are saying to decipher the potential future direction of this promising crypto asset.

SUI’s Price Rollercoaster: From Peak to Pullback

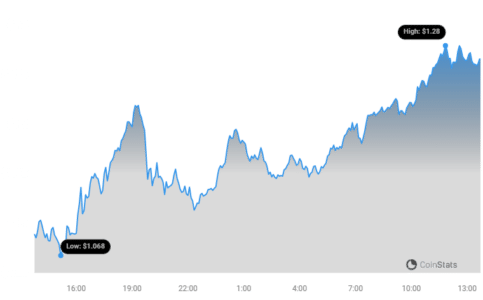

Just when SUI enthusiasts were celebrating its climb towards its all-time high, the market threw a curveball. On January 15th, SUI reached a peak of $1.45, tantalizingly close to its all-time high set back in May. However, this peak proved to be a point of exhaustion for the bulls. The price subsequently retraced, confirming the $1.40 level as a significant resistance zone. This downturn culminated in a low of $1 on January 22nd, causing some concern amongst investors.

- Peak and Fall: SUI price peaked near its all-time high on January 15th, hitting $1.45 before reversing course.

- Resistance Confirmation: The $1.40 level acted as strong horizontal resistance, triggering the price decline.

- Low Point: The price correction bottomed out at $1 on January 22nd, marking a significant pullback.

The Bounce Back: Is There Hope for SUI Bulls?

Amidst the market downturn, SUI demonstrated resilience. From the $1 low, the price staged a notable recovery, bouncing back sharply on January 22nd. This upward movement broke through a short-term descending resistance trendline, suggesting a potential shift in momentum. Adding to the positive signals, the bounce validated the 0.382 Fibonacci retracement level as support, a key indicator often watched by traders to gauge potential trend reversals. This level acted as a springboard, propelling SUI upwards and painting a bullish candlestick on the daily chart, further reinforcing the positive momentum.

- Sharp Rebound: SUI price rebounded strongly from the $1 low on January 22nd.

- Resistance Breakout: The bounce broke above a short-term descending resistance trendline, signaling potential bullish momentum.

- Fibonacci Support: The 0.382 Fibonacci retracement level held as support, validating the bounce.

- Bullish Candlestick: A bullish candlestick formation on the daily chart further confirmed the upward momentum.

RSI Confirmation: Momentum on the Upswing?

To further assess the strength and sustainability of this bounce, we turn to the Relative Strength Index (RSI). The RSI is a crucial momentum indicator used by traders to identify overbought or oversold conditions in the market. Readings above 50 generally suggest bullish momentum, while readings below 50 indicate bearish control. Crucially, the RSI for SUI also bounced right at the 50 level, coinciding perfectly with the price bounce. This synchronization between price action and RSI momentum lends further credence to the recent upward movement, suggesting it’s not just a fluke but potentially a shift in market sentiment.

See Also: Solana Meme Coin Dogwifhat Soars 30% on Bitget Exchange Listing, SOL and BONK See Gains

- RSI as Momentum Gauge: The RSI helps traders gauge market momentum and identify overbought/oversold conditions.

- Bullish RSI Threshold: RSI readings above 50 typically indicate bullish momentum.

- RSI Bounce at 50: SUI’s RSI bounced at the 50 level, aligning with the price bounce.

- Confirmation of Movement: The RSI bounce strengthens the legitimacy of the SUI price recovery.

Analyst Outlook: Bullish Sentiments Prevail?

What are the experts saying about SUI’s next move? A glimpse into crypto analyst circles on platforms like X (formerly Twitter) reveals a predominantly bullish outlook. Nihilus, a prominent crypto trader, believes SUI is poised for a further bounce, targeting a price of $1.50. This sentiment suggests confidence in SUI’s potential to overcome current resistance levels and resume its upward trajectory.

$SUI #SUI

Bounced as expected, next target is 1.50 pic.twitter.com/a8zJ0bV0yG

— Nihilus (@nihilus_XBT) January 22, 2024

Adding to the bullish narrative, KriyaDEX, a decentralized exchange, highlighted the thriving DeFi ecosystem within SUI. They point to a wealth of opportunities within SUI DeFi, ranging from lending and LSDs (Liquid Staking Derivatives) to DEXs, anticipating potential airdrops, points programs, and $SUI emissions. This positive outlook on the underlying ecosystem suggests fundamental strength that could support future price appreciation.

Sui DeFi is thriving 🔥

From lending to LSDs to DEXs, there's an array of opportunities – anticipated airdrops, points, $SUI emissions and much more! pic.twitter.com/tLPU4h7y1S

— KriyaDEX (@KriyaDEX) January 24, 2024

SUI Price Prediction: Breakout or Rejection at $1.23?

While the short-term bounce and analyst sentiment offer encouraging signs, the six-hour chart presents a more nuanced picture. Technical analysis of this timeframe reveals that SUI has indeed broken out from a descending resistance trendline, a positive development. However, the price now finds itself grappling with a confluence of resistances around the $1.23 mark. This area is formed by the 0.5 Fibonacci retracement level, a key retracement zone, and a horizontal resistance area, creating a significant hurdle for SUI to overcome.

The crucial question now is: Will SUI successfully break through this $1.23 resistance cluster, paving the way for further gains? Or will it face rejection, leading to another pullback?

A successful breakout above $1.23 could signal a continuation of the bullish momentum, potentially opening the door for SUI to retest its recent highs and even target new all-time highs. Conversely, a rejection at this level could indicate that the recent bounce was indeed a bull trap, and further downside might be in store. Traders should closely monitor price action around this critical $1.23 level for clues about SUI’s next move.

Key Takeaways and Actionable Insights for SUI Traders

- Monitor $1.23 Resistance: This level is critical. A breakout suggests further upside, while rejection could lead to a pullback.

- RSI Confirmation: Keep an eye on the RSI to gauge momentum strength. Sustained readings above 50 are bullish.

- DeFi Ecosystem Strength: SUI’s thriving DeFi ecosystem provides fundamental support. Positive developments in this space could be bullish for the price.

- Analyst Sentiment: Pay attention to analyst opinions, but always conduct your own research and due diligence.

- Manage Risk: Cryptocurrency trading is inherently risky. Always use appropriate risk management strategies.

In Conclusion: Navigating SUI’s Price Path

SUI’s price action is currently at a crossroads. The recent bounce offers hope for bulls, and analyst sentiment is generally positive. However, the $1.23 resistance level presents a significant challenge. Whether SUI can overcome this hurdle will likely determine its short-term trajectory. Traders should remain vigilant, monitor key levels, and stay informed about both technical indicators and fundamental developments within the SUI ecosystem to navigate this dynamic market effectively. The coming days will be crucial in revealing whether SUI’s recent bounce is a genuine recovery or just a temporary reprieve in a larger market correction.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.