The FTX saga continues to unfold, and the latest chapter involves a major player in the legal world. Renowned New York law firm Sullivan & Cromwell (S&C) is now in the crosshairs of a class action lawsuit, facing serious allegations of collusion with the now-infamous cryptocurrency exchange FTX. Yes, you read that right. The very firm that once served as legal counsel for FTX is being accused of being complicit in its multi-billion dollar downfall. Let’s dive into the details of this explosive legal battle.

Sullivan & Cromwell Accused of FTX Collusion: What’s the Case About?

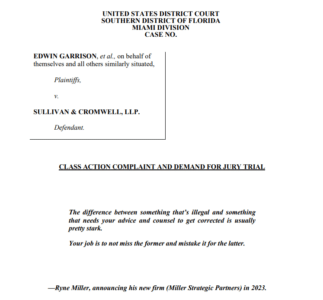

Imagine being caught in the FTX collapse, watching your investments vanish. Now, picture a lawsuit aiming to hold not just FTX insiders, but also their legal advisors accountable. That’s precisely what’s happening. A newly filed class action complaint in the U.S. District Court for the Southern District of Florida is making waves.

Spearheaded by Edwin Garrison and other plaintiffs, the lawsuit alleges that Sullivan & Cromwell wasn’t just a passive observer. Instead, it claims S&C played a crucial, even “instrumental,” role in the massive fraud scheme that led to FTX’s dramatic implosion. In essence, the lawsuit paints a picture of S&C as more than just legal counsel – alleging they were an accessory to the financial devastation experienced by countless FTX investors.

This isn’t a light accusation. The lawsuit is a hefty 75-page document, meticulously detailing alleged collusion and a deliberate turning of a blind eye. It aims to implicate both the prestigious law firm and key figures within FTX. Are we talking about a simple oversight, or something far more calculated? The lawsuit leans heavily towards the latter.

Aiding and Abetting Fraud: The Core Allegations Against S&C

At the heart of this legal storm are serious allegations. The lawsuit claims Sullivan & Cromwell didn’t just fail to uphold legal and ethical standards – it actively undermined them. Plaintiffs argue that S&C allegedly perpetuated the very deception that led to the FTX crisis.

What exactly are they accusing S&C of? The charges are extensive and severe, ranging from:

- Aiding and Abetting Fraud: This is a central claim, suggesting S&C knowingly assisted in the fraudulent activities at FTX.

- RICO Violations: Yes, you read that right – RICO, the Racketeer Influenced and Corrupt Organizations Act, is being invoked. This act is typically used to combat organized crime, suggesting the plaintiffs believe the alleged misconduct was systemic and organized.

These are not accusations to be taken lightly. The plaintiffs are clearly determined to expose the extent to which legal advisors might be entangled in what’s become one of the most significant financial disasters of the digital currency era.

The lawsuit doesn’t just make broad claims. Garrison and the other plaintiffs are pointing to specific instances of alleged wrongdoing. They highlight significant financial transactions and internal communications that, they argue, S&C *must* have been aware of, given their close advisory role with FTX leadership. Think about it: as legal counsel, S&C would have had a deep look into FTX’s operations. The lawsuit suggests they saw red flags and ignored them, or worse, were complicit.

Furthermore, the plaintiffs emphasize that S&C’s relationship with FTX wasn’t just casual. Citing Bloomberg data, they claim S&C profited handsomely from this association, allegedly pocketing around $8.5 million in fees in the 16 months leading up to FTX’s collapse. This raises a critical question: did the pursuit of profit cloud S&C’s judgment and ethical obligations?

The $180 Million Windfall: Did Sullivan & Cromwell Benefit From FTX’s Bankruptcy?

The lawsuit takes an even more critical stance when it comes to S&C’s role *after* FTX’s downfall. According to Garrison, Sullivan & Cromwell has reportedly raked in over $180 million since being appointed to oversee the FTX bankruptcy proceedings. That’s a staggering figure, representing roughly 10% of S&C’s total reported revenue for 2022. Some reports indicate that between November 2022 and November 2023 alone, S&C invoiced over $153 million for their bankruptcy services, averaging a monthly revenue of nearly $11.8 million from the FTX case.

This financial aspect is fueling further scrutiny. The narrative takes a darker turn with accusations surrounding Ryne Miller, a former Sullivan & Cromwell attorney who transitioned to become FTX’s general counsel. The lawsuit alleges that Miller, upon joining FTX, directed significant legal work back to his former firm. This raises eyebrows about potential conflicts of interest and whether this arrangement benefited S&C at the expense of FTX and its users.

The legal filing also questions Miller’s potential knowledge of questionable financial activities, including the alleged “back door” that facilitated the transfer of FTX customer funds to Alameda Research, FTX’s sister trading firm. Was S&C aware of these transactions, either directly or through Miller? These are the questions the lawsuit seeks to answer.

Conflict of Interest Concerns: Echoes in the Senate and Courts

The concerns about potential conflicts of interest aren’t confined to this lawsuit. They’ve resonated throughout the industry and even reached the halls of the U.S. Senate. There have been previous calls for an independent examiner to investigate potential conflicts within the FTX bankruptcy proceedings. Why? Because the perception of impartiality is crucial in such high-stakes cases, especially when significant sums of money and reputations are on the line.

A significant development occurred in January 2024 when the Third Circuit Court of Appeals mandated that FTX undergo an investigation by an independent examiner. This decision is seen as a major victory for those seeking transparency and a potential reshaping of industry norms regarding bankruptcy proceedings and legal oversight.

Adding another layer of intensity, the creditors are strategically requesting jury trials for all triable claims. This signals a clear intent to pursue a complex and potentially dramatic courtroom battle. Are we heading towards a showdown that could have far-reaching implications for both Sullivan & Cromwell and the broader crypto industry?

Sullivan & Cromwell to Oversee Binance? Timing is Everything.

The timing of this class action lawsuit is particularly noteworthy. It surfaces just as reports emerge suggesting Sullivan & Cromwell is poised to take on a significant role overseeing Binance Holdings Ltd., another major player in the crypto exchange world. Yes, the same firm facing accusations of FTX collusion might be tasked with monitoring Binance.

Sources indicate that S&C is the frontrunner to become Binance’s independent monitor, beating out numerous competitors in the legal and consulting fields for this coveted position. Leading the oversight team is reportedly Sharon Cohen Levine, a former federal prosecutor. While official confirmation is still awaited, indications suggest that S&C’s appointment is imminent, with the Justice Department reportedly nearing a final decision.

This potential appointment raises a critical question: Can a law firm facing serious allegations of misconduct in one major crypto bankruptcy case be truly impartial and effective as an independent monitor in another? The unfolding lawsuit against Sullivan & Cromwell adds a layer of complexity and intrigue to the ongoing FTX saga and its ripple effects across the crypto landscape. The coming months will be crucial in determining the trajectory of this legal battle and its potential impact on the reputations and future roles of major players in both the legal and cryptocurrency industries.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.