Buckle up, crypto enthusiasts! Bitcoin (BTC) is ending April with a bit of a whimper after a month of price corrections. It’s like the crypto king is taking a breather before the next big move, closing out its first bearish month since last August. With May just around the corner, the Bitcoin price forecast is looking… well, let’s call it ‘dynamic’.

But it’s not all doom and gloom! There’s a silver lining on the horizon – actually, make that a Hong Kong lining. The launch of spot Bitcoin ETFs in Hong Kong tomorrow is expected to inject some serious long-term bullish vibes into the market. Think of it as adding fuel to the crypto fire.

However, before we get too excited, it’s worth noting that many traders are playing it cool, waiting for some big news to drop from the United States. Keep your eyes peeled for Wednesday, folks! That’s when the US Federal Reserve will be unveiling their latest interest rate decisions and the highly anticipated FOMC statement. Expect some market fireworks as everyone digests this data, especially with the uncertainty around those much-discussed Fed rate cuts later in the year.

See Also: Four Reasons Why Ethereum Is Not a Security: Consensys

Is Bitcoin’s Bull Run Over Already?

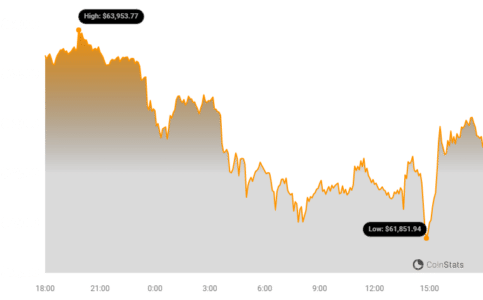

Remember when Bitcoin hit that glorious all-time high of around $74k last month? Ah, good times. Since then, it’s been in correction mode, leaving many wondering – has the peak already passed?

Veteran trader Peter Brandt, known for his insightful market analysis, suggests we might have already seen the top. He points to an ‘exponential decay’ pattern in Bitcoin’s rallies, based on diminishing returns. Essentially, each bull cycle gives us a little less than the last. According to Brandt’s historical analysis, this pattern indicates Bitcoin might have already peaked just above $70,000.

However, before you hit the panic button, Brandt himself admits this exponential decay scenario is not a certainty, giving it only a 25% probability. The crypto world is complex, and Bitcoin’s price is swayed by numerous factors, including the increasing mainstream adoption of crypto and Web3 technologies. Plus, those Hong Kong ETFs could be a game-changer.

As previously reported by Coinspeaker, the Hong Kong spot Bitcoin ETFs are set to start trading on April 30th. This is a big deal because it adds even more buying pressure to the market, alongside the already significant demand from US-based ETF providers. Think of it as a double dose of bullish momentum.

In fact, Brandt noted that he believes there’s a strong possibility Bitcoin will rally beyond $100k in the coming months, despite his earlier analysis. Talk about a potential plot twist!

Giovanni Santostasi, a respected Bitcoin trader and investor with a Ph.D. in Astrophysics, shares a similar bullish outlook. According to Giovanni’s analysis, Bitcoin price could skyrocket to a staggering $210k by the end of 2025, followed by a correction down to around $83k.

Giovanni’s prediction is based on a deep dive into past Bitcoin bull cycles after each halving, using scientific methods to identify patterns and trends. It’s not just guesswork; it’s data-driven optimism!

See Also: Spot Bitcoin ETFs Set To Hit Australia’s Stock Exchange In 2024

What’s the Next Move? Altseason on the Horizon?

As Bitcoin navigates this period of price consolidation post-halving, short-term investors are increasingly looking towards altcoins. Why? Because history often rhymes, and crypto history suggests altcoins can see explosive growth during certain phases of the market cycle.

The ETH/BTC pair, a widely watched indicator of crypto market sentiment, is flashing ‘altseason’ signals. This ratio essentially shows the strength of Ethereum relative to Bitcoin. When it rises, it often indicates that money is flowing into altcoins.

And guess what? The ETH/BTC pair has rebounded over 4% in the past week, currently hovering around 0.0507. This upward movement suggests that altcoins might be gearing up for a run.

However, crypto analyst Benjamin Cowen urges caution. He warns investors to be prepared for a potential altcoin pullback in the coming months before any significant rebound. Volatility is the name of the game in crypto, so brace yourselves!

ETH/BTC is starting to signal altseason again. pic.twitter.com/2yWl6N04gX

— IntoTheCryptoverse (@intocryptoverse) April 29, 2024

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.