Buckle up, crypto enthusiasts! If you blinked, you might have missed it – Bitcoin, the king of cryptocurrencies, just took a significant tumble. After cruising comfortably, BTC experienced a sharp downturn, hitting levels not seen since early May. Let’s dive into what triggered this price drop, examine the current market situation, and break down the crucial liquidation data.

Bitcoin’s Sudden Dip: What Happened?

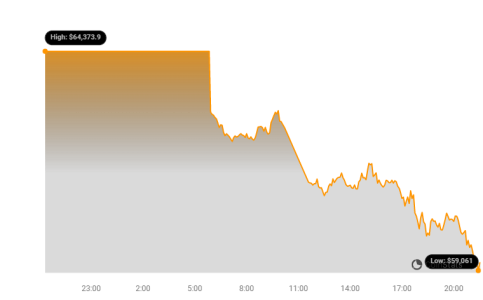

The cryptocurrency market is known for its volatility, but today’s dip felt particularly sharp. Bitcoin spearheaded a widespread market downturn, sending ripples of red across the crypto landscape. Take a look at the performance chart:

Bitcoin’s price descended to a low of $60,567, a level reminiscent of early May. As of writing, it’s hovering around $60,734, marking a daily decrease of approximately 4%. To put this in perspective, while Bitcoin was facing headwinds, traditional safe-haven assets like gold saw a slight uptick. Gold gained 0.32% in the last 24 hours, reaching $2,328 per ounce.

The Mt. Gox Factor: A Blast from the Past?

One of the primary catalysts for this Bitcoin price slump can be traced back to a name that sends shivers down the spines of long-term crypto holders: Mt. Gox. For those unfamiliar, Mt. Gox was once the dominant cryptocurrency exchange, infamously hacked years ago, resulting in the theft of hundreds of thousands of Bitcoins.

Now, after years of legal proceedings, Mt. Gox is finally preparing to distribute Bitcoin (BTC) and Bitcoin Cash (BCH) to its creditors. This impending distribution is widely considered a significant factor in the recent price decline. Even before this news gained traction, Bitcoin was already showing signs of weakness, gradually retreating from the $70,000 mark.

Why is Mt. Gox Distribution Causing a Price Drop?

The logic behind the market’s reaction is quite straightforward:

- Anticipation of Sell Pressure: Creditors of Mt. Gox are expected to receive substantial amounts of BTC and BCH. The market anticipates that many of these creditors, some of whom have been waiting for over a decade, might choose to sell their newly acquired crypto to realize profits or simply recoup their losses from the exchange’s collapse.

- Psychological Impact: The sheer volume of BTC and BCH potentially entering the market at once creates a psychological overhang. Traders and investors become wary of increased selling pressure, leading to preemptive selling and further downward momentum.

Bitcoin Cash (BCH), another cryptocurrency slated for distribution by Mt. Gox, also experienced a significant drop, recording an approximate 8% decline.

German Government’s Bitcoin Moves: Adding Fuel to the Fire?

Adding to the Mt. Gox concerns, recent reports indicate that the German government has been transferring substantial amounts of its Bitcoin holdings to cryptocurrency exchanges. While the exact reasons behind these transfers remain unclear, the market has interpreted this as another potential source of sell pressure. Large-scale movements of Bitcoin by government entities can understandably trigger uncertainty and contribute to market jitters.

Liquidation Cascade: The Domino Effect of Price Drops

As Bitcoin’s price tumbled, it triggered a wave of liquidations in the futures market. When traders use leverage (borrowed funds) to amplify their trading positions, price drops can lead to margin calls and forced liquidations. In the past 24 hours, a staggering $313 million worth of crypto assets were liquidated. Interestingly, a significant portion, $277 million, of these liquidations were from long positions – meaning traders who were betting on Bitcoin’s price to rise were caught off guard by the sudden downturn.

Altcoins in the Red Sea (Mostly)

Bitcoin’s woes dragged down the broader altcoin market as well. Across the board, most altcoins experienced sharp declines, mirroring Bitcoin’s downward trajectory. However, in a sea of red, a few altcoins managed to buck the trend, showing resilience or even gains. These exceptions included Fantom (FTM), Injective (INJ), LEO, WIF, and TIA, suggesting pockets of strength or unique catalysts within the altcoin space.

Key Takeaways and What to Watch For

The recent Bitcoin price decline is a multifaceted event, driven by a combination of factors:

- Mt. Gox Distribution: The impending release of BTC and BCH to creditors is a major overhang, creating anticipation of increased sell pressure.

- German Government BTC Transfers: Large transfers to exchanges are adding to market uncertainty.

- Liquidation Cascade: Price drops triggered significant liquidations, amplifying the downward momentum.

- Broader Market Sentiment: These events are unfolding within a context of fluctuating global economic conditions and evolving regulatory landscapes for cryptocurrencies.

What’s next? Keep a close eye on:

- Mt. Gox Distribution Timeline: Any concrete dates or announcements regarding the distribution will likely further impact market sentiment.

- Bitcoin’s Price Action: Monitor if Bitcoin can find support at current levels or if further declines are on the horizon.

- Altcoin Performance: Observe how altcoins react to Bitcoin’s movements and if any sectors show relative strength.

- Macroeconomic Factors: Keep an eye on broader economic news and how it might influence risk assets like cryptocurrencies.

The cryptocurrency market remains dynamic and unpredictable. While price drops can be unsettling, they also present opportunities. Staying informed, understanding market dynamics, and managing risk are crucial for navigating these turbulent waters. Keep your eyes peeled and stay tuned for further updates as the situation unfolds!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.