Is the crypto market feeling the pressure from government wallets? On July 4th, blockchain watchers spotted a significant move: Germany transferred a hefty 1300 Bitcoin to major crypto exchanges like Coinbase, Kraken, and Bitstamp. This isn’t an isolated incident; it’s part of a series of German BTC transfers, raising eyebrows and sparking discussions about potential sell pressure on Bitcoin. Let’s dive into what’s happening and what it could mean for the market.

German Government Moves $175 Million in Bitcoin: What’s the Buzz?

Blockchain sleuths at PeckShieldAlert first flagged the transfer, pinpointing the movement of 1,300 BTC from a wallet labeled as belonging to the German government. In today’s market, this stash is worth around $75.69 million. This single transfer is a significant chunk, but it’s just a piece of a larger puzzle.

🇩🇪 Germany Gov labeled wallet transferred 1,300 $BTC ($75.6M) to @coinbase, @krakenfx, and @bitstamp in the past 24 hours

400 $BTC to Coinbase

400 $BTC to Kraken

500 $BTC to BitstampGermany still holds ~40,359 $BTC (~$2.3B) pic.twitter.com/EOu19y9y7W

— PeckShieldAlert (@PeckShieldAlert) July 6, 2024

Arkham Intelligence data provides a breakdown of where the 1,300 BTC landed:

- Coinbase: 400 BTC (approximately $23.24 million)

- Kraken: 400 BTC (approximately $23.24 million)

- Bitstamp: 500 BTC (approximately $29.05 million)

But wait, there’s more! Further digging by Mempool.space revealed another substantial transfer of 1,700 BTC, valued at around $98.76 million, to an external address. Adding it all up, Germany moved a total of 3,000 BTC on July 4th alone!

This isn’t the first time Germany has been moving Bitcoin. Let’s recap recent activity:

- July 2: 282.74 BTC (worth $17.6 million) transferred to Coinbase, Kraken, and Bitstamp.

- June 26: 250 BTC (worth $15.4 million) moved to Bitstamp and Kraken.

Where did all this Bitcoin come from? It turns out these digital assets have a history. They originate from a massive seizure back in 2013 when the German Federal Criminal Police Office (BKA) confiscated nearly 50,000 Bitcoin from the operators of Movie2k.to, a notorious movie piracy website. Back then, it was worth a fraction of today’s value, but now, this hoard is estimated at over $2 billion!

Despite these recent movements, Germany is still holding a significant Bitcoin reserve. Current data from Arkham Intelligence indicates they possess 40,359 BTC, currently valued at a staggering $2.30 billion.

Are German BTC Transfers Triggering Bitcoin’s Price Drop?

The crypto community is buzzing with speculation: are these German BTC transfers signaling a potential sell-off? Many observers suggest that the government might be gearing up to liquidate more of its Bitcoin holdings, using these recent wallet activities as a precursor. The fear is that a large-scale sell-off could exert downward pressure on the Bitcoin market.

History shows us that big sell-offs can indeed shake the BTC market. Remember last month when the US government moved 11.84 BTC and then a much larger 3,940 BTC to Coinbase Prime? This happened around the same time as the Mt. Gox repayment news started circulating.

For those unfamiliar, Mt. Gox was a major crypto exchange that suffered a massive hack in 2014, losing 850,000 Bitcoin. Now, after years of legal proceedings, Mt. Gox is set to repay its creditors starting in July. We’re talking about a whopping $9.4 billion worth of Bitcoin owed to approximately 127,000 creditors.

Bloomberg ETF analyst Eric Balchunas pointed out that Mt. Gox creditors are likely to sell their newly received Bitcoin quickly. This potential influx of Bitcoin onto the market could further increase selling pressure and negatively impact Bitcoin’s price.

Important to remember these Mt Gox distributions will be in BTC & Bitcoin Cash. So there will be selling pressure on BOTH (altho bcash is already priced in as zero, whereas btc is obv not). Ppl are also just more likely to sell btc anyway. https://t.co/8dCg1xjU2v

— Eric Balchunas (@EricBalchunas) June 26, 2024

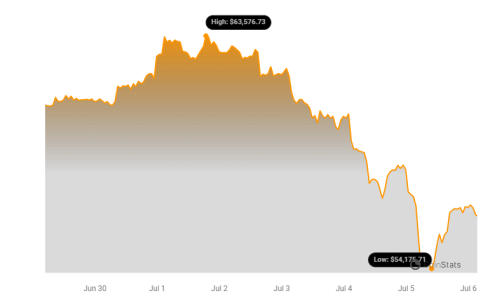

The combined weight of German BTC transfers, potential US government sell-offs, and the Mt. Gox repayment concerns seems to be impacting the market. Currently, Bitcoin is trading at $57,000 (at press time), marking a 5.39% drop in the last 24 hours.

What’s Next? Watching the Wallets and the Market

The situation is dynamic. Whether Germany intends to liquidate a significant portion of its Bitcoin holdings remains to be seen. However, these transfers are undoubtedly adding to the existing market anxieties. Keep an eye on wallet movements and market trends in the coming days. The confluence of government actions and Mt. Gox repayments could continue to shape Bitcoin’s price trajectory in the short term.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.