In the ever-evolving world of cryptocurrency, where fortunes are made and lost in the blink of an eye, the story of a Bitcoin whale awakening after years of slumber is nothing short of captivating. Imagine a digital time capsule, holding a treasure chest of Bitcoin, untouched for over a decade. This is precisely what unfolded recently, sending ripples through the crypto community and sparking discussions about long-term crypto investment and market dynamics.

What Happened? The Bitcoin Whale’s Movements

After nearly 12 years of inactivity, a Bitcoin wallet, considered ‘ancient’ in crypto years, stirred to life. On a recent Sunday, this deep-pocketed investor decided to relocate a significant portion of their holdings. According to the vigilant crypto tracking service, Whale Alert, the wallet moved a substantial 998.73 BTC to one address and a smaller sum of 1.263 BTC to another. These transactions marked the end of a long dormancy period for this particular Bitcoin stash.

Let’s break down the key events:

- Wallet Age: Nearly 12 years dormant.

- Transaction Date: Recent Sunday (as per original article context).

- Total BTC Moved: 1000 BTC (998.73 BTC + 1.263 BTC).

- Tracking Source: Whale Alert.

A Glimpse into the Past: Bitcoin in 2012

To truly grasp the magnitude of this event, we need to rewind to September 2012. This was when the whale initially accumulated this 1,000 Bitcoin hoard. Back then, Bitcoin was a nascent technology, a digital curiosity for many. According to data from BitInfoCharts, the entire 1,000 BTC stack was worth a mere $12,223. Yes, you read that right – just over twelve thousand dollars for one thousand Bitcoins!

Consider this comparison:

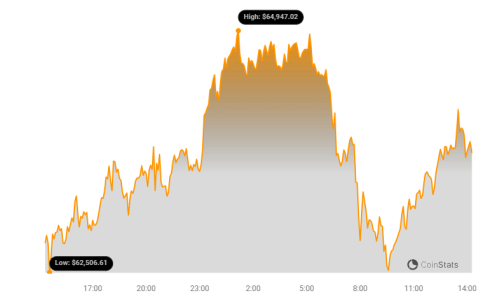

| Metric | September 2012 | Present Day (Article Writing Time) |

|---|---|---|

| Bitcoin Price | Approximately $12.22 | $64,682 |

| Value of 1000 BTC | $12,223 | Over $64.7 Million |

The sheer contrast is astounding. This long-term hodler witnessed their investment appreciate by an incredible 530,000%! It’s a testament to the potential of early investment in disruptive technologies like Bitcoin.

Why Now? Speculations on the Whale’s Move

The million-dollar question (or rather, the multi-million dollar question) is: Why now? Why did this Bitcoin whale choose to move their funds after such a long period of dormancy? The crypto world is rife with speculation. Here are a few potential reasons:

- Profit Taking: After witnessing such a monumental price surge, the whale may have decided to take profits. Locking in gains after such a long hold is a rational financial move.

- Portfolio Diversification: The whale might be diversifying their investments, moving Bitcoin to acquire other assets, either within or outside the crypto space.

- Security Concerns: While Bitcoin wallets are generally secure, long-term storage can come with risks. Moving funds to a new wallet or storage solution could be a security precaution.

- Market Outlook: The whale might have a particular market outlook, believing it’s an opportune time to reposition their Bitcoin holdings.

Of course, the true reason remains a mystery, known only to the whale themselves. However, such large transactions always prompt market observers to analyze potential implications.

Dusting Attacks: A Potential Privacy Concern

Interestingly, the report mentions that the dormant wallet had received trace amounts of Bitcoin over the years. These tiny transactions are suspected to be dusting attacks. But what exactly are these ‘dusting attacks’?

Dusting attacks are a malicious tactic used by scammers. They involve sending extremely small amounts of cryptocurrency (the ‘dust’) to numerous wallet addresses. The goal? To:

- Track Transactions: By monitoring the movement of these dust amounts, attackers attempt to trace the transaction history of the targeted wallets.

- Unmask Wallet Owners: The ultimate aim is to deanonymize wallet holders, linking wallet addresses to real individuals or companies.

- Exploit Privacy Breaches: Once a wallet owner is identified, scammers may employ various tactics like phishing or cyber-extortion to steal funds.

While the amounts involved in dusting attacks are negligible, the privacy implications can be significant. It highlights the importance of being aware of such threats in the crypto space.

Ancient Whales on the Move: A Growing Trend?

This recent awakening isn’t an isolated incident. The article points out other instances of ancient Bitcoin wallets becoming active:

- Recent Friday: A wallet with 25 BTC (worth $1.43 million) activated after 10+ years.

- July 9th: A wallet holding 24 BTC (worth $1.44 million) activated after 11+ years.

These instances suggest a potential trend of long-dormant Bitcoin holders moving their assets. Whether this is due to market conditions, personal circumstances, or other factors, it’s a phenomenon worth watching in the crypto market.

Key Takeaways and What This Means for Crypto

The awakening of this Bitcoin whale and others like it offers several important insights:

- The Power of Long-Term HODLing: This story is a powerful illustration of the potential returns of holding Bitcoin for the long term, especially for early adopters.

- Market Dynamics: Large whale movements can influence market sentiment, although the impact of this particular transaction appears to be minimal so far.

- Privacy in Crypto: The mention of dusting attacks underscores the ongoing need for vigilance regarding privacy and security in the crypto space.

- Bitcoin’s Enduring Value: Despite market volatility, Bitcoin continues to hold significant value and attract long-term investment.

In Conclusion: The Legend of the Awakened Whale

The tale of the awakened Bitcoin whale is more than just a news story; it’s a crypto legend in the making. It’s a reminder of Bitcoin’s incredible journey, from a niche digital currency to a multi-billion dollar asset class. It highlights the life-changing potential of early investment and the enduring appeal of Bitcoin as a store of value. As more ancient whales stir from their crypto slumber, the market will undoubtedly be watching, wondering what stories these digital relics will tell.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.