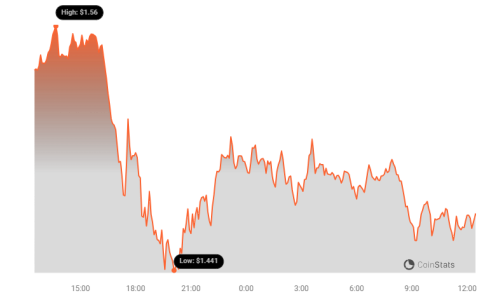

Stacks (STX), a layer-2 solution designed to bring smart contracts and decentralized applications to Bitcoin, has recently experienced a notable downturn. Amidst a wider market correction, STX has dropped nearly 23% in the past week. But is this just a temporary setback, or are there deeper factors at play? Let’s dive into the details and explore what’s influencing Stacks’ price action and what the future might hold for investors.

Stacks (STX) Price Performance: A Deep Dive

The current market environment is undeniably challenging. Major cryptocurrencies like Bitcoin and Ethereum have also seen declines, dragging the overall market down. For Stacks, this bearish pressure has amplified existing concerns, leading to the significant price drop.

- Market Correction: The broader cryptocurrency market is undergoing a correction, impacting most altcoins, including STX.

- Bearish Sentiment: Negative sentiment prevails, encouraging selling and discouraging buying.

- Bitcoin’s Influence: As a layer-2 solution for Bitcoin, Stacks is closely tied to BTC’s performance. Bitcoin’s recent dip has further pressured STX.

Why Stacks (STX) Remains Attractive: Key Developments

Despite the price drop, several positive developments suggest that Stacks still holds significant potential. These factors could act as catalysts for future growth and recovery.

Nakamoto Upgrade and the Rise of ‘Signers’

The Nakamoto upgrade, a significant milestone for Stacks, introduced the role of ‘Signers’ (validators) to the network. This has attracted considerable institutional interest.

- Institutional Adoption: As of August 1st, 39 blockchain institutions have signed up to be Signers, demonstrating strong confidence in the Stacks network.

- Xverse Partnership: The inclusion of Xverse, a Bitcoin wallet provider with BRC-20 expertise, expands Stacks’ user base and exposure to the growing Bitcoin ecosystem.

Aptos Collaboration: Expanding the Ecosystem

The partnership between Stacks and Aptos, announced at the Bitcoin Builders Conference, has generated excitement within the community.

- Aptos as a Signer: Aptos will join Stacks as a Signer, bringing the total count to 40, further strengthening the network’s security and decentralization.

- Collaboration: A working group will be established to foster collaboration between Stacks and Aptos, potentially leading to innovative solutions and integrations.

Stacks ? @Aptos live on stage at the Bitcoin Builders Conference!

? @AptosLabs Head of Ecosystem Neil Harounian talked to @StacksOrg Chairperson Brittany Laughlin about forming a working group, as well as the Aptos Foundation becoming a Signer for Stacks.

Learn more 1/3 ? pic.twitter.com/EFTsIntD6M

— stacks.btc (@Stacks) July 31, 2024

Incentivizing Participation: BTC Rewards for Signers

The Stacks network rewards Signers for their participation, further incentivizing their involvement and commitment to the network.

- Significant Rewards: Since the start of the Signer onboarding process, approximately 118 BTC (over $7 million at current prices) has been distributed to participating institutions.

Key Levels to Watch: Navigating the Market

Understanding key price levels is crucial for investors looking to navigate the current market volatility.

- $1.460 Support: The bulls are currently defending the $1.460 price floor. A successful defense of this level could signal a potential upward movement.

- Market Sentiment: Monitor the overall market sentiment and the performance of major cryptocurrencies like Bitcoin for indications of a potential trend reversal.

If the bulls can maintain the $1.460 support level, we can anticipate reduced market volatility. A successful defense could pave the way for retaking previous price levels seen in May and June.

Investors and traders should closely monitor market movements for any signs of bullish momentum.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.