In the ever-turbulent world of cryptocurrency, where fortunes can be made and lost in the blink of an eye, a fascinating event has caught the attention of Shiba Inu (SHIB) enthusiasts and market analysts alike. A whopping 220 billion SHIB tokens, equivalent to a cool $3.04 million, have been withdrawn from a major US exchange by a mysterious whale. This significant transaction has sparked speculation about the intentions of this deep-pocketed investor and what it could mean for the future of the popular meme-inspired cryptocurrency. Let’s dive into the details of this intriguing development and explore its potential implications.

What Exactly Happened? The Whale’s Tale Unfolds

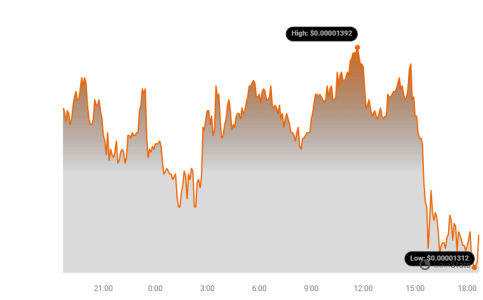

Earlier this week, the Shiba Inu token witnessed a surge in large transaction volumes, hitting a staggering 9 trillion SHIB. This period of heightened activity was marked by dramatic price swings for SHIB, initially plummeting by nearly 30% before staging a remarkable recovery and surging even higher. Amidst this volatility, a previously unknown entity, identified by the address “0x4B5”, emerged into the spotlight.

- This “whale,” as large cryptocurrency holders are often called, initiated a substantial withdrawal of approximately 220 billion Shiba Inu tokens from a prominent US exchange.

- The accumulation was strategic, executed in two main tranches. The bulk of the tokens were acquired roughly 22 hours prior to reports, followed by a subsequent withdrawal of 3.55 billion SHIB seven hours later.

- As a result of this well-timed investment, this anonymous whale is already sitting on a profit of around $114,370 in their SHIB holdings.

Coinbase Connection: Is Institutional Money Behind the Move?

Adding another layer of intrigue to this story is the origin of these tokens. According to data from Arkham Intelligence, a blockchain analytics platform, the SHIB was initially withdrawn from Coinbase Prime Custody. This is a significant detail because Coinbase Prime Custody is a service specifically designed for institutional investors and high-net-worth individuals.

What does this mean? It strongly suggests that the entity behind this massive SHIB accumulation is not just a regular retail investor. The connection to Coinbase Prime Custody hints at the involvement of:

- An Institution: Hedge funds, investment firms, or other financial institutions could be entering the Shiba Inu market.

- A Qualified Investor: High-net-worth individuals or sophisticated investors who meet specific regulatory requirements for accessing institutional-grade services.

The potential involvement of institutional money is a major talking point in the crypto world. Institutional investment is often seen as a sign of growing maturity and legitimacy for cryptocurrencies, potentially leading to increased stability and long-term growth. Could this whale transaction be an early indicator of institutional interest in Shiba Inu?

SHIB Price Surges Amid Whale Activity

While the whale’s identity remains shrouded in mystery, the market reaction to this activity is undeniable. The price of Shiba Inu has continued its upward trajectory.

- Current Price: As of writing, SHIB is trading around $0.0000137, representing a 2% increase on the day.

- Recent Gains: From the recent market low of $0.000011, SHIB has experienced a remarkable 29% surge in just about three days.

This price appreciation coincides with the period of large transaction volumes and the whale’s accumulation. While correlation doesn’t equal causation, it’s plausible that the whale’s activity and the broader market sentiment are contributing to the positive price action for SHIB.

Why are Whales Important in Crypto?

In the cryptocurrency ecosystem, “whales” – individuals or entities holding significant amounts of a particular cryptocurrency – play a crucial role. Their actions can have a substantial impact on market dynamics due to the relatively lower liquidity compared to traditional financial markets. Here’s why whale activity is closely watched:

- Market Movers: Large buy or sell orders from whales can trigger significant price swings, impacting the entire market sentiment.

- Trend Indicators: Whale transactions can sometimes signal emerging trends or shifts in market sentiment. Accumulation by whales might suggest bullish expectations, while large sell-offs could indicate bearish outlooks.

- Liquidity Providers (Sometimes): While large sell orders can decrease liquidity, large buy orders from whales can inject liquidity into the market, especially for less liquid assets.

What Could This Mean for Shiba Inu? Speculating on the Whale’s Intentions

The big question on everyone’s mind is: What does this whale intend to do with 220 billion SHIB? While we can only speculate, here are a few possibilities:

| Possible Intentions | Potential Implications for SHIB |

|---|---|

| Long-Term Investment/Holding: The whale may believe in the long-term potential of Shiba Inu and is accumulating for future gains. | Positive for SHIB. Could signal confidence in the project and potentially lead to further price appreciation as demand increases and supply on exchanges decreases. |

| Staking/Yield Farming: The whale might be planning to stake their SHIB or participate in yield farming activities to earn passive income. | Neutral to positive. Reduces circulating supply and can contribute to network security if staking is involved. |

| Future Trading: The whale could be positioning themselves for future trading opportunities, anticipating further price increases and planning to sell at a higher price point. | Mixed impact. Could lead to price volatility in the future when the whale decides to sell. However, initial accumulation is bullish. |

| Institutional Entry: If indeed an institution is behind this, it could mark the beginning of broader institutional adoption of Shiba Inu. | Highly positive. Institutional investment can bring significant capital and legitimacy to the project, driving long-term growth and stability. |

Is Shiba Inu Still a Meme Coin? Evolving Perceptions

Shiba Inu started as a meme coin, inspired by Dogecoin and the Shiba Inu dog breed. However, the project has evolved significantly since its inception. It has expanded its ecosystem with developments like:

- ShibaSwap: A decentralized exchange (DEX) for trading SHIB and other tokens within the Shiba Inu ecosystem.

- LEASH and BONE: Other tokens within the ecosystem with different functionalities and utilities.

- Shibarium (Layer-2): An upcoming Layer-2 scaling solution aimed at improving transaction speed and reducing fees on the Shiba Inu network.

- NFTs and Metaverse Ambitions: Shiba Inu is also venturing into NFTs and exploring metaverse opportunities, further expanding its reach and utility.

These developments suggest that Shiba Inu is aiming to move beyond its meme coin origins and establish itself as a more robust and functional cryptocurrency project. Institutional interest, if confirmed, could further validate this evolution.

Final Thoughts: Watching the Whale and SHIB’s Next Move

The mysterious withdrawal of 220 billion Shiba Inu from a major US exchange by a potential institutional whale is a noteworthy event in the SHIB saga. It highlights the ongoing dynamics of the cryptocurrency market, where large players can significantly influence price movements and market sentiment. Whether this whale’s move signals the beginning of a new chapter for Shiba Inu with increased institutional adoption remains to be seen.

For now, all eyes are on the “0x4B5” address and the Shiba Inu market. Will this whale continue to accumulate? Will other institutions follow suit? And how will these developments shape the future price trajectory of SHIB? The coming weeks and months will be crucial in providing answers to these questions. One thing is certain: the Shiba Inu story continues to be a fascinating one in the ever-evolving crypto landscape.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.