Remember the wild days of meme coin mania and DeFi’s gold rush back in 2021? Amidst the hype, a chilling event shook investor confidence: the AnubisDAO rug pull. Nearly three years have passed since that infamous day when $60 million vanished into thin air, leaving investors reeling. But just when we thought this chapter was closed, the blockchain whispers a new development. Suspicious transactions, linked to the original heist, have suddenly resurfaced, raising тревожные questions. Are the perpetrators back? Is this the start of another potential scam? Let’s dive into what’s happening.

AnubisDAO: A Flashback to the $60 Million DeFi Heist

For those unfamiliar, AnubisDAO emerged in October 2021, riding the wave of meme coin frenzy. Capitalizing on the mystique of the ancient Egyptian god Anubis, the project promised a blend of liquidity bonding mechanisms with a Shiba Inu token treasury. It sounded innovative, and the initial token sale on Copper seemed promising. But the promise was short-lived.

In a DeFi nightmare come true, within a mere 24 hours of launch, a staggering 13,597 ETH was siphoned from the sale pool to an unknown Ethereum address. Just like that, $60 million belonging to eager investors disappeared in what became one of the most significant rug pulls in DeFi history. The anonymous creators vanished, leaving behind a trail of broken trust and empty wallets.

Suspicious Activity: What’s Happening Now?

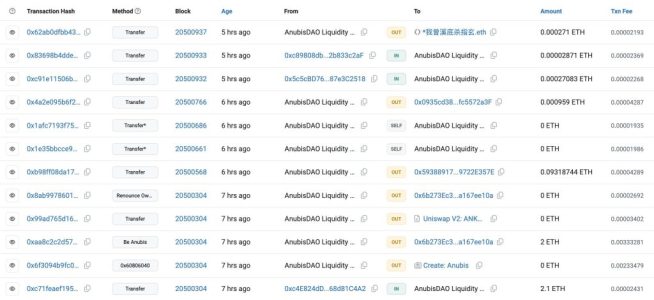

Fast forward to today, and the AnubisDAO saga takes an unexpected turn. Etherscan, the blockchain explorer, has flagged 12 transactions linked to the original rug pull address, labeled “AnubisDAO Liquidity Rug 1.” Of these, seven transactions, totaling approximately 2.1 ETH, have been moved to new addresses. While 2.1 ETH is a fraction of the original $60 million, the activity itself is raising eyebrows and sparking concerns within the crypto community.

- Recent Etherscan data reveals 12 transactions connected to the 2021 AnubisDAO rug pull.

- Seven of these transactions involved transfers totaling 2.1 ETH.

- These movements are occurring nearly three years after the initial $60 million theft.

You can see the transaction details directly on Etherscan here.

Why Are These Transactions Suspicious?

The timing and nature of these transactions are what make them particularly suspicious. After lying dormant for almost three years, why are these funds suddenly moving now? Several possibilities are being discussed within the crypto community:

- Money Laundering Attempts: Criminals often move stolen funds in small increments over time to try and obscure their origin and eventually launder the money. 2.1 ETH could be a small step in a larger laundering operation.

- Testing the Waters: The perpetrators might be testing if anyone is still actively monitoring these addresses. Moving a small amount could be a way to gauge the level of scrutiny before attempting larger transfers.

- New Scam in the Works? The resurfacing of these funds could be linked to a new scam. The individuals behind AnubisDAO might be attempting to leverage the notoriety of the original rug pull for a new fraudulent scheme, or simply trying to cash out a small portion hoping no one notices after so long.

The Crypto Community Reacts: Deja Vu?

Unsurprisingly, the crypto community is on high alert. Memories of the 2021 rug pull are still fresh for many, and the reappearance of these transactions has triggered a sense of unease. Social media platforms and crypto forums are buzzing with discussions, with many users expressing concern about a potential repeat scam.

Back in 2021, user 0xSisyphus even offered a bounty of 1,000 ETH for information leading to the recovery of the stolen funds. While the bounty may still stand, the focus now is shifting towards understanding the motives behind these recent transactions and preventing any further exploitation.

Lessons Learned from AnubisDAO

The AnubisDAO rug pull serves as a stark reminder of the risks inherent in the decentralized and often unregulated world of DeFi. Here are some key takeaways:

- Due Diligence is Paramount: Always conduct thorough research before investing in any crypto project, especially new and unaudited ones. Understand the team, the technology, and the tokenomics.

- Anonymous Teams are Red Flags: While anonymity isn’t always malicious, it significantly increases the risk. Projects with transparent and reputable teams are generally safer.

- High APYs and Hype Can Be Traps: Be wary of projects promising unrealistic returns or relying heavily on hype and FOMO (Fear of Missing Out). Legitimate projects focus on sustainable growth and real utility.

- Security Audits Matter: Look for projects that have undergone reputable security audits. Audits can help identify vulnerabilities in the smart contracts and reduce the risk of exploits.

- Diversification is Key: Never invest more than you can afford to lose, and diversify your crypto portfolio to mitigate risk.

Moving Forward: Staying Vigilant in DeFi

The resurgence of suspicious transactions linked to AnubisDAO highlights the ongoing need for vigilance and caution in the crypto space. While DeFi offers exciting opportunities, it also comes with significant risks. Staying informed, doing your own research, and exercising caution are crucial for navigating this evolving landscape safely.

Will these recent transactions lead to any significant developments in the AnubisDAO case? Only time will tell. But one thing is clear: the crypto community remains watchful, hoping to prevent history from repeating itself.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.