Bitcoin [BTC] has been on a rollercoaster, hasn’t it? With prices soaring and market buzz reaching fever pitch, everyone’s talking about buying, selling, and trading. But this frenzy has sparked something else too – a significant jump in Bitcoin network transactions. And guess what comes with more transactions? You got it, higher transaction fees!

Why Are Bitcoin Transaction Fees Climbing?

Think of Bitcoin transactions like sending letters. To get your letter prioritized and delivered quickly, you add a stamp – that’s your transaction fee. In the Bitcoin world, these fees are the incentives for miners. Miners are the hardworking folks who validate transactions and add them to the Bitcoin blockchain. The more transactions they validate, the more fees they earn. And lately, they’ve been earning quite a bit more!

Data from Hashrate Index, analyzed by Bitcoinworld, reveals a compelling trend: as Bitcoin’s popularity surges, so do transaction fees. This isn’t just a random fluctuation; it’s becoming a crucial element in the Bitcoin ecosystem, especially as we look towards the future.

Increasing Fees: A Bigger Slice of the Pie for Miners

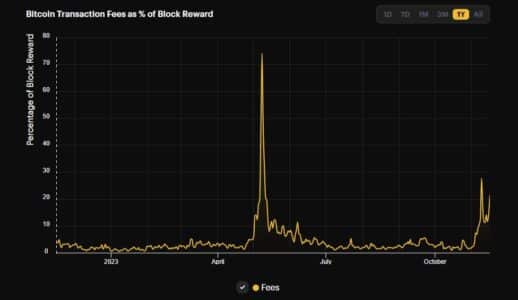

Here’s the interesting part: transaction fees are now making up a larger chunk of what miners earn. On November 16th, a notable 21% of block rewards came from transaction fees. And it’s not just a one-day wonder – for the week leading up to that, the share consistently stayed above 10%. This is a significant jump, marking the second multi-week period in 2023 where fees have contributed over 10% to mining rewards. The last time we saw spikes like this was during the Ordinals craze back in May.

Read Also: Polygon Gas Fees Spike 1000% Amid Ordinals-inspired Token Craze

Why Should Bitcoin Miners Be Cheering?

So, why is this surge in fees something to celebrate, especially for Bitcoin miners? Bitcoin enthusiast Charlie Spears on X (formerly Twitter) calls these developments “huge,” and he’s got a point. To understand why, we need to think about the Bitcoin halving.

Bitcoin’s block rewards – the new BTC miners receive for adding blocks to the blockchain – are designed to decrease over time. Currently, miners get 6.25 BTC per block. But around April 2024, the halving will slash this reward to 3.125 BTC. That’s a significant reduction in income for miners!

This is where transaction fees become increasingly vital. As Charlie Spears highlights, with block subsidies shrinking, the proportion of revenue from transaction fees is expected to rise, potentially averaging between 20% and 30% post-halving. This shift is not just a minor adjustment; it’s a fundamental change in the Bitcoin mining revenue model.

For years, the reliance on transaction fees has been a hot topic in the Bitcoin community. Bitcoin is designed to be deflationary, with a hard cap of 21 million coins. Once all 21 million BTC are mined (expected in the distant future), miners will rely entirely on transaction fees to sustain their operations. Therefore, higher transaction fees are not just a short-term gain; they are increasingly crucial for the long-term health and security of the Bitcoin network. They ensure that miners are incentivized to continue validating transactions and maintaining the blockchain, even as block rewards diminish.

Ordinals and the Expanding Bitcoin Blockspace

Another factor contributing to this evolving landscape is the rise of Ordinals. Charlie Spears emphasizes how events like the Ordinals frenzy are expanding the utility of the Bitcoin blockchain. What are Ordinals, and how do they relate to blockspace?

In simple terms, Ordinals allow for the inscription of data onto individual satoshis (the smallest unit of Bitcoin), effectively bringing NFTs to Bitcoin. This has led to increased demand for blockspace, as users compete to include their Ordinal inscriptions in blocks.

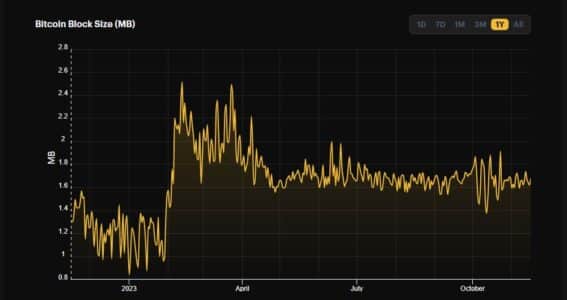

Bitcoinworld’s observations confirm a noticeable increase in the average block size limit since Ordinals came into play. Before Ordinals, blocks were typically in the range of 1–1.14 MB. However, in the last eight months, the average block size has jumped to around 1.6 MB, peaking at 2.5 MB in February.

This increase in blockspace is significant. Larger blocks mean miners can include more transactions in each block. In a post-halving world with reduced block rewards, this ability to process more transactions and collect more fees becomes even more critical for miners to offset potential revenue losses. It’s a clever way for the Bitcoin network to adapt and ensure its continued operation and security.

Looking Ahead: Transaction Fees and Bitcoin’s Future

The recent surge in Bitcoin transaction fees isn’t just a temporary blip. It’s a sign of the Bitcoin network maturing and evolving. As block rewards decrease, transaction fees are stepping up to play a more dominant role in incentivizing miners and securing the network. While higher fees might sometimes be a point of discussion for users, they are undeniably essential for the long-term sustainability of Bitcoin.

Events like the Ordinals craze are also showcasing new use cases for the Bitcoin blockchain, driving demand for blockspace and further highlighting the importance of a robust fee market. As Bitcoin continues to grow and adapt, understanding the dynamics of transaction fees will be key to navigating its future.

So, the next time you hear about Bitcoin transaction fees going up, remember it’s not just about the cost of sending BTC. It’s about ensuring the network remains strong, secure, and sustainable for years to come. And for Bitcoin miners, those rising fees are definitely something to smile about as they gear up for the halving and beyond.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.