Hold onto your hats, crypto enthusiasts! The decentralized finance (DeFi) space is once again buzzing, but this time it’s not about soaring token prices or innovative protocols. Lido DAO, a major player in the liquid staking arena, is facing a class-action lawsuit. Let’s dive into what’s happening and what it could mean for the future of DAOs and crypto investments.

What’s the Case About? Investor vs. Lido DAO

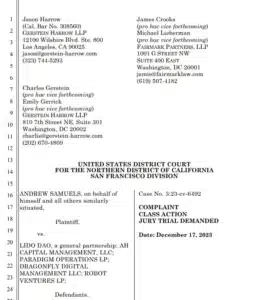

A former investor, Andrew Samuels from California, has initiated legal proceedings against Lido DAO in a San Francisco District Court. The core of the lawsuit? It revolves around the argument that Lido DAO’s native token, $LDO, is essentially an unregistered security. You can check out the official lawsuit document for all the legal nitty-gritty, but here’s the gist:

Samuels, representing a class of investors, alleges that Lido DAO, along with prominent venture capital firms and investment managers, should be held responsible for the financial losses investors faced due to the decline in the value of the $LDO token. The lawsuit paints a picture of potential mismanagement and unfair token distribution practices.

Key Arguments in the Lawsuit: Unpacking the Claims

The lawsuit is built on several key arguments that are worth understanding. Here are the main points being raised:

- Unregistered Security: The central claim is that the $LDO token operates as an unregistered security. This is a big deal because securities are subject to strict regulations to protect investors. If the court agrees, it could set a significant precedent for other DeFi tokens.

- Concentrated Token Ownership: Samuels highlights that a significant chunk of $LDO tokens – around 64% – is held by a small group of insiders, including founding members and early-stage investors. This concentration, the lawsuit argues, dilutes the influence of regular investors in the DAO’s governance.

- VC Firm Involvement: The lawsuit names prominent venture capital firms like Paradigm, AH Capital Management, Dragonfly Digital Management, and Robert Ventures as being among those holding a large share of tokens. This brings the role and influence of VCs in DAOs under scrutiny.

- Losses Due to Token Decline: Investors who bought $LDO tokens after the public sale on exchanges experienced losses as the token’s value decreased. The lawsuit aims to hold Lido DAO and associated entities accountable for these financial setbacks.

See Also: Revolut Halts Crypto Services For Business Clients In The UK Amid Regulatory Changes

Lido DAO’s Evolution and the ‘Exit Opportunity’ Narrative

The lawsuit delves into the history of Lido DAO, pointing out its initial formation as a general partnership of institutional investors. According to the plaintiff, the strategy then shifted to create an “exit opportunity” for these early investors. How did this happen?

The alleged ‘exit strategy’ involved:

- Public Token Sale: Lido DAO facilitated the public sale of $LDO tokens by listing them on centralized crypto exchanges.

- Attracting Retail Investors: This move opened the doors for a wider range of investors, including individuals like the plaintiff, to invest in $LDO.

- Subsequent Token Value Decline: Unfortunately for many, the token’s market value later declined, leading to losses for those who invested after the public sale.

Why Could $LDO Be Considered a Security? The Centralization Argument

A crucial aspect of the lawsuit is the argument that $LDO tokens could be classified as securities. What’s the basis for this claim?

The lawsuit suggests that $LDO might meet the definition of a security because:

- Centralized Management: There’s an assertion that a central group manages and controls the Lido DAO project and the $LDO token.

- Profit Expectation: Investors purchased $LDO tokens with the expectation of making profits. This expectation, according to the lawsuit, was primarily driven by the actions and decisions of this central management group.

If these points are proven in court, it could have significant ramifications for Lido DAO and potentially for other DAOs operating in the crypto space. The classification of a token as a security brings with it a whole host of regulatory obligations.

What’s at Stake for Lido DAO?

This lawsuit poses a serious challenge to Lido DAO. Here’s why:

- Legal and Financial Burden: Defending against a class-action lawsuit is expensive and time-consuming. Lido DAO will need to allocate resources to legal representation and potentially face financial penalties if they lose the case.

- Reputational Damage: The lawsuit can tarnish Lido DAO’s reputation, potentially impacting user trust and future growth. Negative publicity surrounding legal battles can be detrimental in the crypto world.

- Regulatory Scrutiny: The case could attract increased regulatory scrutiny not just for Lido DAO but for the entire DeFi sector. Regulators are already grappling with how to oversee DAOs and crypto tokens, and this lawsuit could add fuel to the fire for stricter regulations.

- Precedent Setting: The outcome of this lawsuit could set a precedent for how DAOs and their tokens are treated legally, particularly in the context of securities laws. A ruling against Lido DAO could embolden similar lawsuits against other DAOs.

Despite this legal challenge, it’s important to remember that Lido DAO remains a dominant force in the liquid staking market. Its Total Value Locked (TVL) recently reached an impressive all-time high of $22 billion. This highlights the continued popularity and utility of Lido’s services, even amidst the current legal uncertainty.

As of now, Lido DAO has not released any official statement regarding the lawsuit. The crypto community is keenly watching how this legal drama unfolds, as it could have far-reaching implications for the DeFi landscape and the regulatory future of DAOs.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.