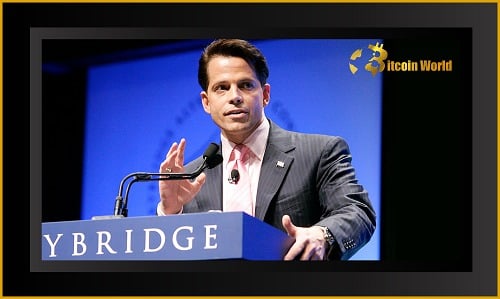

In the ever-turbulent world of cryptocurrency, opinions are as varied as the digital assets themselves. Recently, a prominent voice has emerged to champion one of the biggest names in the crypto exchange arena: Coinbase. Anthony Scaramucci, the founder of SkyBridge Capital, is making headlines by urging investors to resist the urge to short Coinbase (NASDAQ: COIN) stock. But why is ‘The Mooch’ so bullish on Coinbase, especially amidst market fluctuations and skepticism from other financial heavyweights?

Who is Anthony Scaramucci and Why Should You Care About His Coinbase Opinion?

For those unfamiliar, Anthony Scaramucci isn’t just another talking head. He’s the founder and managing partner of SkyBridge Capital, a significant global alternative investment firm. Think of them as seasoned navigators in the complex world of finance, dealing with everything from hedge funds to real estate, and increasingly, digital assets. According to SkyBridge Capital’s own description, they are an “SEC-registered investment adviser and worldwide alternative investment manager that invests in hedge funds, digital assets, private equity, and real estate.” So, when Scaramucci speaks about investment strategies, particularly in the crypto space, people listen.

Scaramucci vs. Chanos: A Crypto Showdown?

Scaramucci’s recent stance is particularly noteworthy because it directly contradicts the views of another well-known hedge fund founder, Jim Chanos. Chanos has expressed skepticism and even outright mistrust of Coinbase. In a recent interview with CNBC Overtime, Scaramucci made it clear he’s on the opposite side of the crypto fence from Chanos when it comes to Coinbase. He argues that Coinbase isn’t just another player; it’s a leader in the burgeoning crypto industry with massive potential for future expansion.

Here’s the crux of Scaramucci’s argument:

- Market Leadership: Scaramucci believes Coinbase is at the forefront of the crypto revolution.

- Growth Potential: He projects significant growth for Coinbase as the overall crypto market expands.

- Dismissing Margin Concerns: Even with potentially shrinking profit margins in the short term, Scaramucci is confident in the long-term market growth benefiting Coinbase immensely.

He’s essentially saying, “Don’t get bogged down by short-term dips; look at the bigger picture.”

Coinbase vs. Enron: Scaramucci Shuts Down Comparisons

One of the more pointed aspects of Scaramucci’s defense of Coinbase was his rejection of any comparisons to Enron. Jim Chanos famously made a fortune by betting against Enron before its dramatic collapse in 2001, a company mired in scandal and fraud. Scaramucci emphatically stated that drawing parallels between Coinbase and Enron is inaccurate and unfair, primarily because Coinbase, unlike Enron, hasn’t been accused of any fraudulent activities.

In essence, Scaramucci is saying, “Don’t equate market volatility or business challenges with outright fraud. Coinbase is operating legitimately within a rapidly evolving market.”

Decentralization and Traditional Finance: Scaramucci Highlights the Shift

Scaramucci didn’t stop at just defending Coinbase. He also suggested that Chanos might be missing the nuances of the decentralized market. He pointed to Goldman Sachs’ recent move into the crypto space as a significant indicator of the changing times. Goldman Sachs, a traditional financial giant, is reportedly participating in over-the-counter (OTC) Bitcoin trading with Galaxy Digital. Scaramucci sees this as a clear signal of traditional financial institutions embracing crypto-related products and services.

Key Takeaway: Goldman Sachs’ involvement signifies a growing acceptance of cryptocurrency by mainstream finance, potentially paving the way for further growth and stability in the crypto market, which would benefit platforms like Coinbase.

What Does This Mean for Bitcoin Traders and the Crypto Community?

Scaramucci’s bullish stance on Coinbase and the broader crypto market offers several points for consideration for Bitcoin traders and the crypto community:

- Confidence Boost: A prominent figure like Scaramucci publicly supporting Coinbase can instill confidence in the platform and the wider crypto market, especially during periods of uncertainty.

- Long-Term Vision: His emphasis on long-term growth encourages investors to look beyond short-term price fluctuations and consider the potential of the crypto industry.

- Institutional Adoption: The mention of Goldman Sachs highlights the increasing institutional interest in crypto, suggesting a move towards greater mainstream acceptance and potentially larger investment inflows.

- Debate and Discussion: The contrasting views of Scaramucci and Chanos spark important conversations about the risks and opportunities within the crypto market, encouraging more informed decision-making among investors.

Related Posts – XRP Price Goes Up After Unexpected Reappearance On Coinbase

Final Thoughts: Is Coinbase a Buy or a Short?

Anthony Scaramucci is firmly in the ‘buy’ camp when it comes to Coinbase, urging investors to resist shorting COIN stock. He sees Coinbase as a leading platform poised to benefit from the continued expansion of the cryptocurrency market. While dissenting opinions like Jim Chanos’ exist and market volatility is inherent in the crypto world, Scaramucci’s perspective offers a compelling argument for the long-term potential of Coinbase. Whether you agree with him or not, his insights provide valuable food for thought for anyone navigating the exciting and often unpredictable world of crypto investment.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.