After a rocky start to the year that had many whispering about a crypto winter redux, Bitcoin (BTC) is showing strong signs of life! Remember those gloomy days of January when BTC lingered around $33,000? Well, fast forward to today, and we’re seeing Bitcoin flexing its muscles, confidently breaking past the $41,000 mark as of February 5th. Could this be the start of a massive bullish trend? Let’s dive into the data and see what’s fueling this potential crypto comeback!

Has Bitcoin Really Turned Bullish? Decoding the Market Signals

For weeks, analysts have been keeping a close eye on market indicators, and finally, some are flashing green. Historical data suggests that reclaiming the $40,000 level is a significant milestone. But what else is contributing to this optimistic outlook?

- Price Surge: Bitcoin has not just nudged past $40,000; it’s confidently broken through, signaling a potential shift in momentum. This move suggests buyers are stepping in and overpowering the previous bearish sentiment.

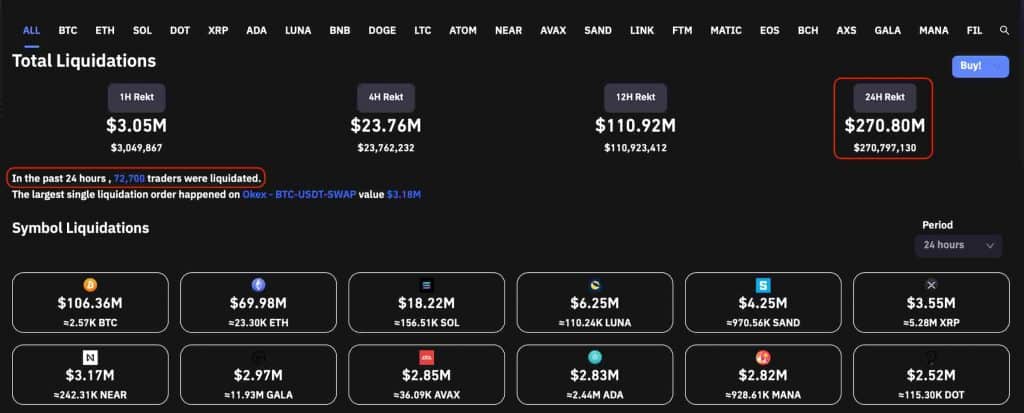

- Liquidation Data Speaks Volumes: Let’s talk liquidations. According to Coinglass, a staggering 72,700 traders were liquidated in just 24 hours, totaling a whopping $270.8 million across the crypto market.

What does this liquidation data mean? Massive liquidations often occur during periods of high volatility and price reversals. In this case, it indicates that many traders were positioned bearishly (expecting prices to fall), and Bitcoin’s sudden surge triggered their stop-loss orders, leading to liquidations. This “shakeout” can sometimes clear the path for further upward movement as leveraged bearish positions are eliminated.

Breaking down the liquidation numbers further:

- Bitcoin (BTC) Liquidations: Dominated the charts with $106.36 million liquidated.

- Ethereum (ETH) Liquidations: Followed with a significant $69.98 million in liquidations.

These figures highlight the intensity of the recent price action and the impact it had on leveraged traders.

Bitcoin’s Price Action: A Break from Stagnation

Currently trading around $41,432, Bitcoin has demonstrated impressive gains. Let’s look at the numbers:

- 24-Hour Gain: Up by a solid 9.17%.

- Weekly Gain: An even more impressive 9.53% increase over the last week.

But the story doesn’t end there. Bitcoin’s recent performance is even more noteworthy when you consider:

- Breaking the $40,000 Resistance: For weeks, Bitcoin seemed stuck in a rut, unable to decisively break above the $40,000 barrier. This recent surge signifies a potential end to that stagnation and the beginning of a new phase.

- Recovery from Lows: Since hitting a six-month low in late January, Bitcoin has bounced back with vigor, gaining over 25%. This rebound from a significant low point adds further credence to the bullish narrative.

Social Media Buzz: Is Twitter Predicting a Bull Run?

Beyond price charts and liquidation data, another interesting indicator is social media sentiment. And guess what? Bitcoin is buzzing on Twitter!

This week, Bitcoin became the most talked-about cryptocurrency on Twitter, racking up a massive 3,134,852 mentions. This surge in social media attention often reflects growing public interest and, potentially, increased buying pressure.

What’s Next for Bitcoin? Bull Rally or Bear Trap?

While the recent price action and market indicators are undeniably bullish, it’s crucial to remember that the crypto market is known for its volatility. Is this the start of a sustained bull run, or could it be a bear trap – a temporary price surge designed to lure in bulls before another downturn?

Factors supporting a continued bull run:

- Positive Momentum: Breaking key resistance levels like $40,000 creates positive momentum and can attract further investment.

- Increased Institutional Interest: Rumors and announcements of institutional adoption can fuel bull runs. Keep an eye out for news in this space.

- Reduced Fear and Greed: If market sentiment continues to shift from fear to greed (or at least neutrality), it can support further price appreciation.

Factors that could lead to a bear trap:

- Macroeconomic Headwinds: Global economic uncertainty, inflation concerns, and potential interest rate hikes can negatively impact all markets, including crypto.

- Regulatory Uncertainty: Unclear or negative regulatory developments can spook investors and trigger sell-offs.

- Profit-Taking: After a significant price surge, some investors may take profits, leading to a temporary pullback.

Final Thoughts: Cautious Optimism for Bitcoin?

Bitcoin’s recent price recovery is undoubtedly encouraging for crypto enthusiasts. The break above $40,000, coupled with liquidation data and social media buzz, paints a potentially bullish picture. However, it’s essential to approach the market with cautious optimism. The crypto landscape is dynamic and influenced by numerous factors.

Actionable Insights:

- Stay Informed: Keep track of market news, technical analysis, and fundamental developments in the crypto space.

- Manage Risk: Never invest more than you can afford to lose. Crypto investments are inherently risky.

- Diversify: Don’t put all your eggs in one basket. Consider diversifying your crypto portfolio.

Is the bull market officially back? It’s still too early to say definitively. But Bitcoin’s recent performance certainly gives bulls reason to cheer and bears reason to reconsider. Keep watching the charts, stay informed, and navigate the crypto markets wisely!

Related Posts – Ferrari joins the NFT universe through a collaboration with a Swiss…

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.