The world of decentralized finance (DeFi) has once again been shaken. On October 23rd, Freeway, a platform known for its high-yield “Supercharger” services, announced a sudden halt to its offerings. Citing “unprecedented volatility” in the foreign exchange and cryptocurrency markets, the move has triggered alarm bells and sparked discussions of a potential rug pull. Is this a temporary measure to navigate turbulent waters, or is it something more concerning? Let’s dive into the details.

Why Did Freeway Suspend Its Services?

Freeway’s official statement points to a strategic shift in asset management. The platform intends to diversify its holdings to better weather market fluctuations and ensure the long-term viability of its ecosystem. Here’s a breakdown of their stated reasoning:

- Market Volatility: Freeway claims extreme volatility in both traditional and crypto markets necessitated a change in strategy.

- Asset Diversification: The platform aims to allocate capital across a broader range of assets.

- Sustainability Focus: This diversification is presented as a measure to secure the platform’s future and profitability.

- Supercharger Suspension: As a result of this portfolio reallocation, the popular “Supercharger” service, which promised significant annual percentage yields (APY), has been temporarily suspended.

An important announcement regarding the Freeway platform. pic.twitter.com/jGSiPG8KyC

— Freeway (@FreewayFi) October 23, 2022

“Superchargers” and Sky-High APYs: Too Good to Be True?

Freeway’s main draw was its “Superchargers,” virtual simulations that promised eye-watering returns of up to 43% APY. These were accessible using both fiat currencies and cryptocurrencies. While the platform stated its intention to eventually repurchase these yield-generating products, the immediate suspension has left users in limbo.

The official statement offers little clarity, concluding with a cryptic: “While we complete this process we cannot comment further beyond this statement.” This lack of transparency has fueled speculation and concern within the crypto community.

Is This Another DeFi Rug Pull? The Concerns Raised

Enter the crypto-sleuth known as “Fatman.” He has publicly labeled the situation a potential “$100 million rug pull.” Adding to the unease, reports indicate that the Freeway team’s profiles have been removed from their official website. This action, combined with the sudden service suspension, has understandably heightened suspicions.

Friendly reminder that Freeway is a Ponzi scheme and you should take your money out before they inevitably announce they are insolvent. https://t.co/iUaEa06QyQ

— FatMan (@FatManTerra) October 23, 2022

Fatman had even urged users to withdraw their funds a day before the official announcement, further solidifying his stance on the platform’s potential instability.

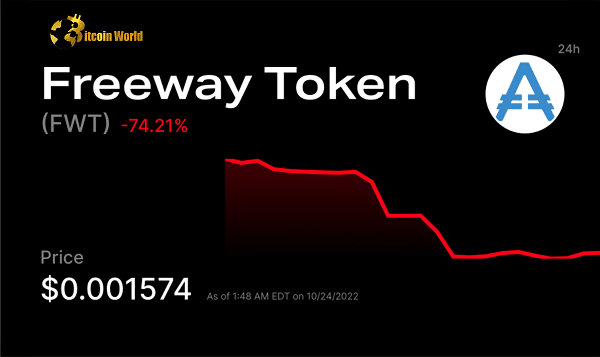

The Impact on Freeway’s Token: FWT’s Dramatic Plunge

The market reaction to Freeway’s announcement has been swift and brutal. The value of Freeway’s native token, FWT, has experienced a dramatic downturn. Take a look at the numbers:

- Massive Price Drop: FWT plummeted by over 80% in roughly twelve hours.

- Pre-Suspension Price: FWT was trading around $0.007 before the service interruption.

- Post-Suspension Low: The token price crashed to approximately $0.001 on Monday morning.

- Lingering Losses: As of now, FWT has not recovered significantly from this sharp decline, remaining down nearly 87% from its previous value.

What Happens Next? Navigating the Uncertainty

The future of Freeway remains uncertain. Will this prove to be a temporary restructuring phase, or is it indeed a case of a DeFi platform collapsing and potentially leaving users with significant losses? Only time will tell. However, this situation serves as a stark reminder of the risks inherent in the DeFi space, particularly when dealing with platforms offering exceptionally high yields.

Key Takeaways and Actionable Insights:

- High Yields, High Risks: Be wary of platforms promising unrealistically high APYs. These often come with significant underlying risks.

- Transparency Matters: Lack of clear communication and sudden changes in team visibility are red flags.

- Do Your Own Research (DYOR): Thoroughly investigate any DeFi platform before investing. Understand the underlying mechanisms and the team behind it.

- Community Sentiment: Pay attention to discussions within the crypto community. While not always definitive, widespread concerns can be indicative of potential problems.

- Diversification is Key: Don’t put all your eggs in one basket. Spread your investments across different assets and platforms to mitigate risk.

In Conclusion: A Cautionary Tale for the DeFi World

The Freeway situation is a developing story that highlights the volatile nature of the DeFi landscape. Whether it ultimately proves to be a strategic maneuver or a rug pull, it underscores the critical importance of due diligence and risk management for anyone participating in this space. The dramatic fall of FWT serves as a painful lesson in the potential downsides of chasing high yields without a thorough understanding of the underlying risks. Stay informed, stay vigilant, and always remember that in the world of crypto, caution is your best friend.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.