In a whirlwind of cryptocurrency market fluctuations, one token is painting the charts green while others see red. Yes, we’re talking about Avalanche (AVAX)! While Bitcoin and many major altcoins experienced a bumpy ride, AVAX has been on a notable uptrend, showcasing resilience and sparking excitement among investors. Let’s dive into what’s fueling this surge and what it means for the future of Avalanche.

AVAX Bucking the Trend: A 24-Hour Price Rally

Imagine this: the broader crypto market is experiencing a bout of volatility, with over $500 million in leveraged positions getting liquidated across Bitcoin and other major altcoins. Yet, amidst this turbulence, Avalanche’s AVAX token is charting its own course. Over the past 24 hours, AVAX has impressively rallied by over 6%, proving its mettle in a challenging market environment.

- Avalanche’s AVAX token has shown remarkable strength, surging over 6% in the last 24 hours.

- This rally occurs despite significant market-wide volatility, which saw over $500 million in liquidations in Bitcoin and major altcoin leveraged positions.

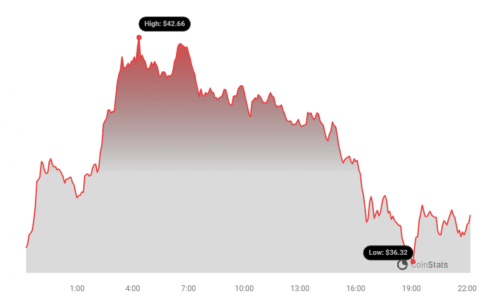

Starting Monday on a high note, AVAX climbed over 7% to approximately $42.66. While it has slightly retraced to around $37.6 (according to Coinstats), this surge is still significant, especially considering the overall market downturn.

Market Downturn? No Problem for AVAX!

The global cryptocurrency market capitalization has seen a notable dip of over 6%, currently hovering around $1.6 trillion. This broad downturn makes AVAX’s positive performance even more noteworthy. While the overall market sentiment might be cautious, AVAX is clearly attracting attention and investor interest.

Compared to its altcoin peers, AVAX has emerged as a clear outperformer. This impressive performance has not gone unnoticed, with numerous cryptocurrency analysts taking to platforms like X (formerly Twitter) to express their bullish outlook on the token’s future.

What’s Fueling the AVAX Rally? Decoding the Bullish Signals

So, what’s behind this impressive AVAX surge? Let’s break down some of the key factors:

- Rise in Large Transactions: According to insights from Bitcoinworld.co.in, there’s a noticeable uptick in substantial AVAX transactions. “The number of large AVAX transactions is on the rise, peaking at nearly 1,000 transactions bigger than $100k last week. While this is still not close to levels of the last bull market, it is a positive sign for the bulls.” This increase in large-value transactions suggests growing confidence and potentially accumulation by larger investors.

- Real-World Asset Tokenization Buzz: Adding to the positive sentiment, CoinShares analyst Max Shannon highlights a significant development from November. “In November, JPMorgan and Apollo also announced news that Avalanche would be used to test real world asset tokenization, which is likely supportive of price action,” Shannon explained to The Block. The involvement of major financial institutions like JPMorgan and Apollo in exploring real-world asset tokenization on the Avalanche blockchain is a strong vote of confidence and a potential long-term growth catalyst.

See Also: FTX and Alameda Move $23.59 Million In Digital Assets Into 4 Top Exchanges

A Word of Caution: Is the AVAX Surge Sustainable?

While the bullish factors are compelling, it’s crucial to consider all perspectives. Not everyone is convinced that this AVAX rally is here to stay. YouHodler Chief of Markets, Ruslan Lienkha, offers a contrasting viewpoint:

“We noticed that AVAX correlates with major cryptos such as bitcoin, but reacts with some delay, so we believe this time is not an exception and finally the token will follow bitcoin’s dynamic,” Lienkha told The Block.

This perspective suggests that AVAX’s current gains might be temporary and that it could eventually follow Bitcoin’s price movements, potentially leading to downside pressure. It’s a reminder that even in crypto, what goes up can sometimes come down, and correlation with market leaders like Bitcoin remains a significant factor.

Market Volatility Bites: Bitcoin and Altcoins Retrace Gains

Indeed, the broader cryptocurrency market experienced a significant downturn. Bitcoin and other major digital assets retraced a week’s worth of gains within just 24 hours, with BTC dipping below the $41,000 mark. This sharp decline triggered substantial liquidations of long positions on centralized exchanges.

Data from The Block’s Data Dashboard highlights the severity of Monday’s ‘long-squeeze,’ with over $85 million in Bitcoin long positions liquidated. The volatility continued, leading to even larger liquidations across the entire crypto market.

Liquidation Tsunami: Over $500 Million Wiped Out

Today’s market volatility resulted in a staggering over $500 million in liquidations across the cryptocurrency landscape. CoinGlass data further breaks down this figure, revealing that:

- Long positions bore the brunt: More than $440 million worth of long positions were liquidated.

- Short positions less impacted: Approximately $60 million in short positions were liquidated.

This massive liquidation event underscores the inherent risks associated with leveraged trading in the cryptocurrency market and the potential for rapid and significant price swings.

Final Thoughts: AVAX – A Beacon of Hope or a Fleeting Rally?

Avalanche’s recent price surge amidst broader market volatility is undoubtedly a positive sign for AVAX holders and the Avalanche ecosystem. Factors like increasing large transactions and positive developments in real-world asset tokenization are providing solid bullish momentum. However, the cautionary note from analysts regarding correlation with Bitcoin and potential market corrections reminds us that the crypto market is inherently dynamic and unpredictable.

As always, navigating the crypto market requires careful research, a balanced perspective, and an understanding of both the potential opportunities and the inherent risks. Keep a close eye on AVAX, but remember to stay informed about the broader market trends and manage your investments wisely.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.