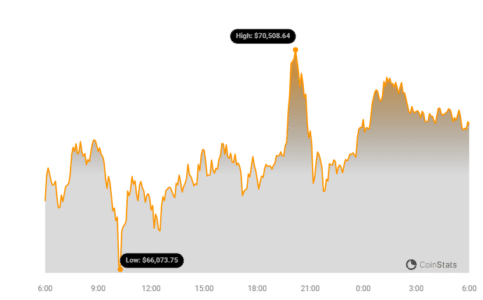

Hold onto your hats, crypto enthusiasts! Bitcoin (BTC), the king of cryptocurrencies, has experienced a bit of a rollercoaster ride recently. After a fantastic rally that saw it nearly kiss its all-time high, Bitcoin’s price took a temporary breather, dipping below the $69,000 mark. While it has since bounced back above $70,000, this slight stumble has sparked conversations and raised eyebrows across the crypto community. Let’s dive into what’s causing these price fluctuations and what it could mean for the near future.

BTC Price Chart | Source: Coinstats

BTC Price Chart | Source: Coinstats[/caption>

Why Did Bitcoin’s Price Take a Dip? Unpacking the Factors

So, what exactly caused this momentary dip in Bitcoin’s price? It’s not just one single factor, but rather a combination of elements playing together. Let’s break down the key reasons:

- Inflation Worries are Back on the Radar: Remember inflation? It’s still a hot topic, and recent economic data has reignited concerns. New data from the Labor Department’s Bureau of Labor Statistics revealed that consumer prices jumped by 0.4% last month, and a concerning 3.2% compared to last year. These figures are higher than economists predicted, suggesting that inflation might be stickier than initially hoped.

- Interest Rate Hike Speculations: Higher-than-expected inflation figures often lead to speculation about central bank actions. In this case, the data has raised concerns that the Federal Reserve (the Fed) might delay or reduce the extent of interest rate cuts anticipated for this year. Many had hoped for rate cuts as early as May, but this now seems less certain. Higher interest rates can make riskier assets like Bitcoin less attractive compared to safer, yield-bearing investments.

- Grayscale’s $400 Million Bitcoin Move: Another significant factor contributing to the price pressure is activity from Grayscale, a major player in the crypto investment space. Data indicates that Grayscale moved a substantial amount of Bitcoin, estimated around $400 million worth, to Coinbase, a leading cryptocurrency exchange. This movement is widely interpreted as preparation for selling.

See Also: Bitcoin Miner Revenue Reaches All-Time Highs

Grayscale and the GBTC ETF: Understanding the Selling Pressure

To understand Grayscale’s actions, we need to delve a little deeper into their Bitcoin Trust ETF (GBTC). GBTC was initially a closed-end fund, meaning investors couldn’t easily redeem their shares. However, in January, it was converted into a spot Bitcoin ETF. This conversion, while a positive development for the crypto market overall, has a side effect: it allows investors who held GBTC shares before the conversion to redeem them for actual Bitcoin.

This redemption process is what’s causing the selling pressure. Investors who may have been holding GBTC for a long time, perhaps at a lower entry price, are now taking profits and redeeming their shares. As Grayscale sells Bitcoin to meet these redemptions, it increases the supply of Bitcoin in the market, potentially pushing the price down.

Is This Just a Minor Setback or a Bigger Correction?

The million-dollar question, or perhaps the $70,000 question, is whether this price dip is just a temporary blip on Bitcoin’s radar or a sign of a more significant correction to come. Here’s a balanced perspective:

- The Bullish Case: Despite the Grayscale outflows, it’s crucial to remember that Bitcoin ETFs, excluding Grayscale, are seeing record-breaking net inflows. This indicates strong and continued institutional and retail investor interest in Bitcoin. The demand for Bitcoin through ETFs remains robust, suggesting underlying bullish sentiment. Furthermore, Bitcoin has shown resilience, quickly recovering above $70,000 after the dip.

- The Cautious Case: Inflation is a real concern, and if it persists, it could indeed prompt the Fed to maintain or even increase interest rates. This macroeconomic environment could create headwinds for Bitcoin and other risk assets. Grayscale’s selling pressure might also continue for some time as investors continue to redeem GBTC shares.

What’s the Takeaway for Bitcoin Investors?

So, what should Bitcoin investors make of all this? Here are a few key takeaways:

- Volatility is Normal: Bitcoin, and the crypto market in general, is known for its volatility. Price swings, both upwards and downwards, are part of the game. This recent dip is a reminder of that inherent volatility.

- Long-Term Perspective is Key: For long-term investors, short-term price fluctuations should be viewed in the context of the bigger picture. Bitcoin’s fundamentals, including its scarcity and increasing adoption, remain strong.

- Diversification and Risk Management: It’s always wise to diversify your investment portfolio and manage risk appropriately. Don’t put all your eggs in one basket, and only invest what you can afford to lose.

- Stay Informed: Keep yourself updated on market news, economic data, and developments in the crypto space. Knowledge is power in the world of crypto investing.

Looking Ahead: Bitcoin’s Resilience and Future Outlook

While Bitcoin has faced some headwinds recently, its ability to quickly recover from the dip below $69,000 is a testament to its underlying strength and investor confidence. The cryptocurrency market is dynamic and influenced by various factors, from macroeconomic conditions to institutional flows. The interplay between inflation data, interest rate expectations, and ETF activities will likely continue to shape Bitcoin’s price action in the short term.

However, the long-term narrative for Bitcoin remains compelling. As adoption grows and institutional interest deepens, Bitcoin’s role as a digital store of value and a hedge against inflation could become even more pronounced. This recent price dip serves as a valuable reminder of the market’s inherent volatility, but also as an opportunity to assess your investment strategy and stay informed about the ever-evolving crypto landscape.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.