The recent distribution of Bitcoin Cash (BCH) and Bitcoin (BTC) from Mt. Gox, facilitated through Kraken, has sent ripples through the crypto market. Following these withdrawals, BCH experienced a 5% dip. But is this just a temporary setback, or a sign of things to come? Let’s dive into the details and explore what this means for BCH’s price and future.

Why Did Bitcoin Cash Drop After the Mt. Gox Repayments?

The Mt. Gox repayment program, a long-awaited event for creditors, finally commenced. Kraken, one of the exchanges involved, received a substantial 48,641 BTC from Mt. Gox and began distributing assets to the victims. Kraken’s CEO, David Ripley, confirmed the successful distribution. Consequently, creditors started withdrawing their newly acquired BCH and BTC, leading to increased selling pressure and a subsequent price decrease for Bitcoin Cash.

Adding to the mix, Mt. Gox has also transferred more BTC to Bitstamp, another exchange involved in the repayment process. This influx of Bitcoin could further influence market prices, creating additional volatility.

BCH Price Analysis: Potential Reversal on the Horizon?

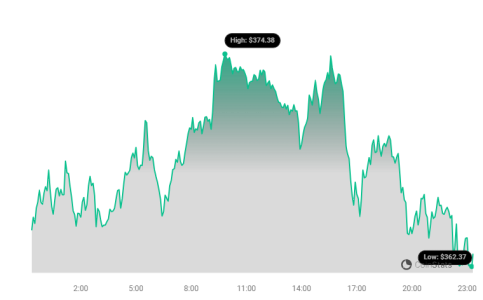

Despite the recent downturn, the technical indicators suggest a potential bullish reversal pattern may be forming. Let’s break down the key levels and patterns to watch:

- Inverse Head and Shoulders: The price action indicates the possible completion of the right shoulder of an inverse head-and-shoulders pattern, a classic bullish signal.

- Neckline Break: A break above the neckline at $395 could trigger a significant upside swing towards the next major resistance level around $529, representing a potential 41% surge.

- Key Resistance: Watch for resistance around $395 (the neckline), which aligns with the 50-day and 200-day EMAs.

- Key Support: If bears take control, strong support levels exist around $360 and $300, where the price has previously bounced.

Technical Indicators: What Are They Saying?

Let’s examine the technical indicators to get a clearer picture of BCH’s current momentum:

- Relative Strength Index (RSI): The RSI currently sits at 46.44 and has crossed below its 14-day simple moving average (SMA), suggesting a weakening of bullish momentum.

- Trading Volume: According to CoinStats, BCH trading volume has decreased by 19% in the last 24 hours, indicating reduced buying interest among investors.

- Volume Spike: However, there was a notable increase in volume during the formation of the right shoulder, potentially signaling accumulation and a possible upcoming breakout.

Mt. Gox Creditors Cashing Out: Is It a Good Sign for the Market?

The Mt. Gox repayment program is a significant event for the crypto community. Mt. Gox is using five exchanges, including Kraken and Bitstamp, to reimburse creditors. Reports from Kraken users on Reddit confirm successful Bitcoin withdrawals.

While the initial withdrawals may cause temporary price fluctuations, the repayment program signifies accountability and resolution, which is ultimately a positive sign for the long-term health of the crypto market.

Arkham reported that Bitstamp received 5110 BTC ($340.1 million) from 4 separate wallet addresses, further highlighting the scale of the repayment process.

https://twitter.com/ArkhamIntel/status/1815681016050147533

The Bottom Line: What’s Next for Bitcoin Cash?

The recent 5% dip in BCH’s price is linked to increased withdrawal activity from Mt. Gox creditors on Kraken. However, a bullish market structure suggests a potential 41% rally to $529. Keep an eye on the key levels and technical indicators to gauge the direction of BCH’s price in the coming days and weeks. A significant change in buying pressure will be crucial for a potential upside breakout.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.