Hold onto your hats, crypto enthusiasts! If you blinked, you might have missed it – Bitcoin just smashed through the $50,000 barrier! Yes, you read that right. For the first time since December 2021, the king of crypto has reclaimed this significant price level, sending ripples of excitement throughout the digital asset world. Are we witnessing the dawn of a new bull run? Let’s dive into what’s fueling this incredible surge and what it means for you.

Bitcoin’s Back Above $50K: A Look at the Numbers

Let’s get straight to the point:

- Milestone Moment: Bitcoin has officially crossed $50,000, marking its highest price point since late 2021.

- Still Room to Grow: While $50,000 is a huge achievement, remember Bitcoin still needs to climb about $19,000 to reach its all-time peak of $69,000.

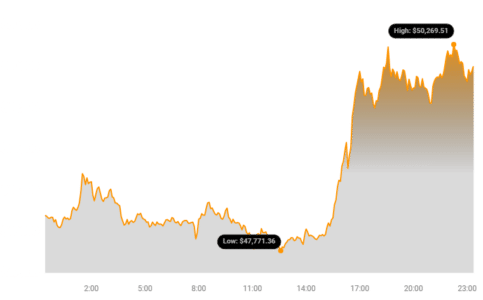

According to Coinstats data, the surge is undeniable. Take a look at this chart visualizing Bitcoin’s recent price action:

From Crypto Winter to Spring Awakening: What Sparked the Rally?

Remember the crypto winter? It wasn’t that long ago that Bitcoin was languishing around $16,000. The recent climb back to $50,000 is a testament to Bitcoin’s inherent resilience. But what exactly ignited this impressive rally?

Several key factors are at play:

- ETF Euphoria: The launch of spot Bitcoin ETFs in the US has been a game-changer. These ETFs have opened the floodgates for institutional and mainstream investors to gain exposure to Bitcoin without directly holding the asset. This influx of new capital is a major driver of the price surge.

- Halving Hype is Building: The Bitcoin halving, a pre-programmed event that reduces the reward for mining new Bitcoin by half, is fast approaching. Historically, halvings have been followed by significant price increases due to reduced supply. Savvy investors are buying up BTC now in anticipation of this supply shock.

- Exhausted Selling Pressure: Remember Grayscale’s Bitcoin ETF outflows and miner sell-offs? It seems this selling pressure is finally waning. With demand from other ETFs accelerating, buying pressure is now outweighing selling, pushing prices higher.

- Bitcoin as a Store of Value: In the face of global economic uncertainties and persistent inflation, many are turning to Bitcoin as a store of value and a hedge against traditional market volatility. This narrative strengthens Bitcoin’s appeal as a long-term investment.

Is $50,000 Just the Beginning? What’s Next for Bitcoin?

The $50,000 mark isn’t just a number; it’s a psychological milestone. Investors are watching closely, and many believe this is a strong signal for further upward momentum. But what can we realistically expect?

Here’s what market analysts are saying:

- Bullish Sentiment: The prevailing sentiment is undeniably bullish. The combination of ETF demand, the upcoming halving, and renewed institutional interest paints a positive picture for Bitcoin’s near future.

- Potential for New Highs? While no one can predict the future with certainty, the current momentum suggests that challenging the all-time high of $69,000 is within the realm of possibility. However, volatility is inherent in the crypto market, and pullbacks are to be expected.

- Focus on Fundamentals: Beyond price predictions, the underlying fundamentals of Bitcoin remain strong. Its decentralized nature, limited supply, and growing adoption continue to make a compelling case for its long-term value proposition.

As pointed out in this related article, Bitcoin Price Reclaimed $48k Level But Can The Bulls Pump BTC To $50K?, the journey to $50k was anticipated and now achieved! The question now shifts to: Can Bitcoin sustain this momentum and push even higher?

Another day, another ~$500M of net inflows into the ten spot Bitcoin ETFs. That’s ~$9.5B net in 21 trading days. At this rate they'll hit $10B by end of week. Wild. $IBIT and $FBTC both had record days. $GBTC bleed is slowing. pic.twitter.com/VjQD3Pu8Gm

— James Seyffart (@JSeyff) February 9, 2024

As highlighted in the tweet above, the inflows into Bitcoin ETFs are substantial and continuing to grow, reinforcing the bullish outlook.

Actionable Insights for Crypto Investors

So, what does all this mean for you as a crypto investor?

- Stay Informed: Keep a close eye on market developments, ETF flows, and halving news. Understanding these factors will help you make informed decisions.

- Consider Long-Term Potential: Bitcoin’s fundamentals remain strong. If you believe in the long-term potential of crypto, this surge could be a confirmation of your investment thesis.

- Manage Risk: Remember that the crypto market is volatile. Never invest more than you can afford to lose, and diversify your portfolio.

- Do Your Own Research (DYOR): Always conduct thorough research before making any investment decisions. Don’t rely solely on headlines or hype.

Disclaimer: The information provided is not trading nor financial advice. Bitcoinworld.co.in holds no liability for any trading or investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any trading or investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.