Is Bitcoin buzzing with activity again? You bet! Recent data reveals a significant resurgence in Bitcoin Inscriptions, and it’s sending ripples through the network, especially when it comes to miner transaction fees. Let’s dive into what’s fueling this inscription frenzy and how it’s impacting the Bitcoin ecosystem.

Bitcoin Inscriptions: Back in the Spotlight

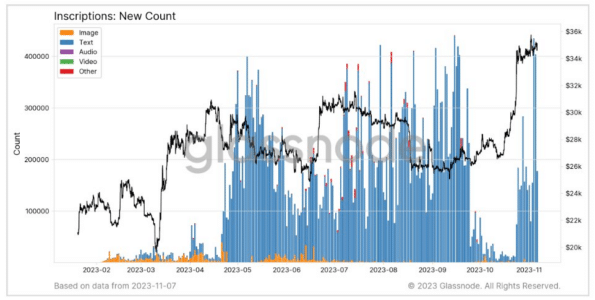

According to crypto analyst James V. Straten, Bitcoin Inscriptions are making headlines once more. In a recent post on X, Straten highlighted a dramatic increase in daily Bitcoin Inscriptions, now hitting a staggering 400,000. But what exactly are these ‘Inscriptions’?

Simply put, Bitcoin Inscriptions are a way to directly embed data onto the Bitcoin blockchain. Think of it as etching information permanently onto each satoshi, the smallest unit of Bitcoin. This data can be anything – text, images, audio, or even video! This innovative concept has paved the way for exciting applications, including:

- BRC-20 Tokens: These are tokens created directly on the Bitcoin blockchain using inscriptions, offering a new way to issue and trade tokens within the Bitcoin ecosystem.

- Bitcoin NFTs: Non-Fungible Tokens are also finding a home on Bitcoin through inscriptions, allowing for unique digital assets to be stored and traded on the network.

Essentially, Inscriptions are expanding the utility of the Bitcoin blockchain beyond simple financial transactions. But this increased activity has network-wide implications.

Why Inscriptions Matter: Impact on the Bitcoin Network

Because inscriptions are recorded directly within Bitcoin blocks, just like regular transactions, they influence various network metrics. The type of data inscribed plays a crucial role in how much blockchain space they consume. Let’s break it down:

- Text-based Inscriptions: These are relatively small in size and don’t demand much blockchain memory.

- Image and Media Inscriptions: These are data-heavy, especially images and videos, requiring more block space.

Initially, the inscription trend was heavily skewed towards image-based NFTs. However, with the emergence of new applications like BRC-20 tokens, smaller, text-based inscriptions have gained significant traction. The chart below visually represents this shift, showing the total number of Bitcoin Inscriptions and the changing distribution of inscription types over the past year.

As you can see, Bitcoin Inscriptions enjoyed a surge in popularity from May to September, followed by a dip in October. But guess what? They’re back!

Echoing the recent cryptocurrency market trend that pushed Bitcoin’s price close to $35,000, inscription activity has rebounded. Straten points out that daily inscription counts are once again hitting the 400,000 mark, reminiscent of the peak frenzy earlier in the year.

Miner Revenue: Transaction Fees to the Rescue?

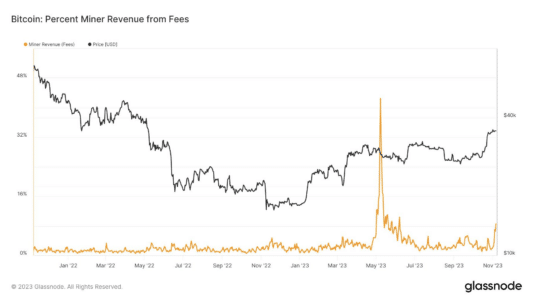

This surge in inscription activity isn’t just a novelty; it’s significantly impacting the Bitcoin network’s economics. Inscriptions, being treated as standard transactions, contribute to network congestion and, consequently, higher transaction fees.

The following chart vividly illustrates how miner transaction fees have spiked during periods of intense inscription activity.

Traditionally, block rewards have been the primary income source for Bitcoin miners, with transaction fees often contributing a modest 2% to 4% of their total earnings. However, during inscription frenzies, transaction fees become a much more substantial portion of miner revenue. With the current inscription surge, miners are once again reaping the benefits of increased transaction fees, boosting their income.

Looking ahead, as block rewards diminish over time due to Bitcoin’s halving schedule and the eventual exhaustion of mineable Bitcoin, transaction fees will become the cornerstone of miner revenue. Bitcoin Inscriptions, therefore, might be offering a glimpse into a future where transaction fees, driven by innovative applications and network activity, sustainably support the Bitcoin network’s validators.

Read Also: Bitcoin Miners Face 52.5% Reward Cut As Bitcoin Halving Closes In

Bitcoin Price Update

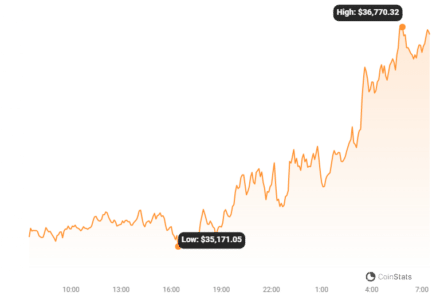

Adding to the positive sentiment, Bitcoin’s price is showing strength. As of now, Bitcoin is trading around $35,200, marking a 3% increase over the past week. This price momentum, coupled with increased miner revenue from inscriptions, paints a bullish picture for the Bitcoin ecosystem.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

In Conclusion: Inscriptions and the Future of Bitcoin

The resurgence of Bitcoin Inscriptions is more than just a fleeting trend. It’s a powerful demonstration of Bitcoin’s evolving utility and its potential to support a thriving ecosystem beyond simple transactions. While inscriptions contribute to increased transaction fees – a boon for miners – they also highlight the need for ongoing scalability solutions for the Bitcoin network. As Bitcoin continues to mature, innovations like inscriptions and their impact on network economics will be crucial in shaping its long-term sustainability and growth. Keep an eye on this space – Bitcoin Inscriptions are likely to remain a significant part of the Bitcoin narrative.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.