Buckle up, crypto enthusiasts! We’re on the cusp of a major event in the Bitcoin world – the halving. For Bitcoin miners, this isn’t just another day at the digital office; it’s a pivotal moment that’s about to reshape their earnings. Imagine your paycheck getting slashed – that’s essentially what the halving means for block rewards, with a hefty 52.5% cut looming.

Industry experts are watching closely, and one voice offering crucial insights is Bob Burnett, the CEO of Barefoot Mining. Let’s dive into what Burnett and the numbers are telling us about this game-changing event and how it’s set to impact the Bitcoin mining landscape.

- Bitcoin halving is poised to significantly reduce miner rewards by 52.5%.

- Bob Burnett, CEO of Barefoot Mining, shares his expert perspective on the halving’s potential consequences for Bitcoin miners.

The Bitcoin Halving Countdown: What’s the Big Deal?

Think of Bitcoin miners as the unsung heroes of the crypto world, diligently verifying transactions and adding new blocks to the blockchain. Their reward? Newly minted Bitcoin. Currently, for every block they successfully mine, they receive 6.25 BTC. But this reward isn’t fixed forever. Roughly every four years, or after every 210,000 blocks, the Bitcoin protocol triggers a ‘halving’ event. This event cuts the block reward in half.

With less than 25,000 blocks to go, the next halving is generating considerable buzz and, understandably, some anxiety among miners. Once it hits, the reward drops to 3.125 BTC per block. This reward reduction directly impacts miner profitability, making efficiency and strategic planning more crucial than ever.

When Exactly Will the Halving Happen? The Date Speculation Game

Currently, the Bitcoin blockchain is cruising past block height 815,315. We’re roughly 24,685 blocks away from the next subsidy epoch, the highly anticipated ‘reward halving.’ Predicting the exact date is a bit like crypto fortune-telling, with various experts throwing their hats into the ring.

Some analysts and Bitcoin enthusiasts are pointing towards April 20, 2024, while others suggest a slight nudge to April 24, 2024. And then there are the optimists, fueled by recent faster block processing times, who believe it could even happen sooner, maybe around March 23, 2024. Adding to the intrigue, recent block intervals have been impressively short, with one clocked at just eight minutes and 8.4 seconds!

Bob Burnett of Barefoot Mining recently stepped into the spotlight to clear up a common misconception about Bitcoin’s production rate. In a tweet, Burnett highlighted that the average block time isn’t the widely assumed 10 minutes.

In reality, blocks are being mined faster, leading to approximately 146.7 blocks per day instead of the expected 144. This quicker pace means daily Bitcoin production is actually around 966 BTC when factoring in both block rewards and transaction fees, exceeding the projected 900 BTC.

Halving the Reward, Not the Output: Burnett’s Perspective on Miner Revenue

Burnett’s analysis brings a nuanced understanding to the halving’s impact. Yes, the block reward will be sliced in half. However, it’s not all doom and gloom for Bitcoin miners. There’s a silver lining: transaction fees.

Transaction fees, which miners also collect, will cushion the blow, preventing the total daily Bitcoin output from plummeting to a straight 50% reduction. Burnett estimates that post-halving, the daily output will likely settle around 507.6 Bitcoin.

Let’s break down the numbers:

| Metric | Pre-Halving | Post-Halving (Estimated) |

|---|---|---|

| Daily Bitcoin Production (Blocks) | 146.7 | 146.7 (approx.) |

| Block Reward | 6.25 BTC | 3.125 BTC |

| Daily Bitcoin Output (with fees) | 966 BTC | 507.6 BTC (approx.) |

| Reduction in Output | – | 52.5% |

This 52.5% reduction is a crucial detail for miners and traders alike, offering a more precise picture than a simple 50% cut. These nuances are vital for understanding market liquidity and revenue projections.

Burnett is optimistic about the future, stating, “I feel there is a decent chance that fees will increase materially in the next epoch.” He envisions a scenario where rising transaction fees could actually boost daily Bitcoin production figures over time.

His long-term outlook is even more bullish. Burnett anticipates that by 2027, transaction fees could rival the block subsidy, potentially pushing daily output back up to the current 900+ Bitcoin level. If this optimistic prediction materializes, Burnett believes, “the mining business will roar.”

Read Also: Institutional Interests and Custody Can Kill Bitcoin – Arthur Hayes

Navigating the Halving: Strategies for Bitcoin Miners

The Bitcoin halving is not a surprise; it’s a pre-programmed event. Yet, it presents significant challenges and opportunities for Bitcoin miners. While the broader crypto market speculates on price movements, miners are focused on the immediate impact on their bottom line.

The halving will undoubtedly squeeze profit margins, especially for less efficient mining operations. Miners who thrive will be those who are proactive and strategic. This includes:

- Efficiency is King: Investing in energy-efficient mining hardware is paramount to reduce operational costs.

- Optimizing Energy Sources: Seeking out locations with access to cheaper energy, including renewable sources, becomes even more critical.

- Strategic Planning: Meticulous financial planning and risk management are essential to weather the period of reduced rewards.

- Exploring Revenue Diversification: Some miners might explore alternative revenue streams within the crypto ecosystem.

As Burnett’s insights suggest, savvy miners are already crunching the numbers and preparing for the shift. The path forward will be paved with careful calculations, technological upgrades, and strategic adaptations to ensure profitability in the post-halving era.

Bitcoin Mining’s Future: Adapting to the Halving and Beyond

The upcoming halving underscores Bitcoin’s inherent dynamics – a blend of challenges and opportunities for miners. It’s a reminder that the Bitcoin ecosystem is designed to evolve, and participants must adapt to thrive.

As industry leaders like Bob Burnett provide clarity and data-driven perspectives, the path forward becomes clearer. For Bitcoin miners, the halving is a catalyst for innovation, efficiency, and strategic realignment. The crypto world watches in anticipation as miners gear up for this significant milestone, ready to navigate the changing tides of the Bitcoin ecosystem and ensure its continued robustness.

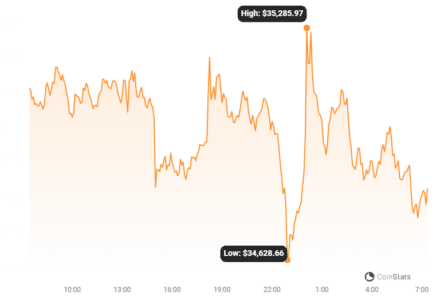

As of now, Bitcoin is trading around $34,824, according to Coinstats.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.