Buckle up, crypto enthusiasts! The Bitcoin rollercoaster continues its wild ride. Just when we thought we were cruising along, Bitcoin (BTC) took a dip, falling below the $67,000 mark. And guess who’s making headlines amidst this price shuffle? Bitcoin miners. Reports are surfacing that these key players have been selling off their BTC holdings to the tune of over $83 million recently. Let’s dive deep into what’s happening, why miners are selling, and what it means for the overall Bitcoin market.

Miner Moves: Why the $83M Bitcoin Sell-Off?

- Profit Taking & Risk Management: Bitcoin miners, like any business, need to manage their finances. After periods of price appreciation, selling some holdings can be a strategic move to lock in profits and secure operational funds. With BTC experiencing recent volatility, this could be a prudent step to de-risk.

- Market Correction Concerns: The recent price drop, particularly the notable dip on June 11th, might have triggered concerns about a deeper market correction. Miners could be preemptively selling to avoid potential further losses if they anticipate continued downward pressure.

- Operational Costs: Mining Bitcoin is energy-intensive and requires significant capital expenditure for hardware and infrastructure. Selling BTC helps miners cover these ongoing operational costs, especially when market conditions become uncertain.

Interestingly, while miners are selling, these transactions aren’t immediately visible on regular crypto exchanges. This is largely due to the nature of these sales happening Over-the-Counter (OTC). Let’s break down what OTC sales mean and why they matter.

OTC Sales: The Hidden Bitcoin Movement

When we talk about Over-the-Counter (OTC) sales, we’re referring to private, off-exchange transactions, often involving large volumes of assets. In the context of Bitcoin miners, OTC sales involve direct deals with institutional investors or private buyers, bypassing public exchanges. This explains why you might not see a sudden surge in exchange outflows despite significant miner selling activity.

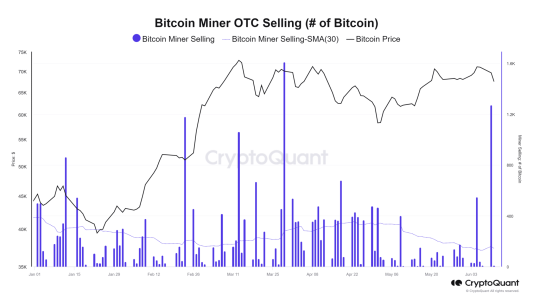

Analyzing Bitcoin miner metrics reveals a fascinating picture. While the overall miner reserve, which sits around 1.8 million BTC, has seen slight reductions, the outflow of BTC to exchanges from miner wallets has actually decreased. Confusing, right? This is where OTC sales come into play. The decline in miner reserves, coupled with reduced exchange outflows, strongly suggests that miners are primarily using OTC desks to offload their Bitcoin.

Recent data from CryptoQuant highlights a significant OTC sale event, the largest since late March, involving approximately 1,200 BTC. This substantial OTC activity signals potential miner capitulation – a scenario where miners sell their holdings due to financial strain or to secure profits amid market downturns. These OTC transactions, while not immediately impacting exchange volumes, contribute to a decrease in the overall Bitcoin miner reserve, influencing market dynamics behind the scenes.

Bitcoin’s Price Action: Riding the Waves of Sell-offs

So, how has Bitcoin’s price reacted to these miner sell-offs? Looking at the daily chart, the past week has painted a somewhat bearish picture. Between June 6th and 7th, Bitcoin’s price dipped from the $70,000 range to around $68,000. However, the more significant drop occurred on June 11th, pushing the price down by over 3% and landing it in the $67,000 zone.

At this juncture, Bitcoin was flirting dangerously close to its short-term moving average, a crucial support level around $65,000. As of now, Bitcoin is showing signs of a slight recovery, currently trading around $68,778. Whether this is a temporary bounce or the start of a sustained uptrend remains to be seen.

Further confirming the bearish trend, Bitcoin’s Relative Strength Index (RSI) has fallen below the neutral line to approximately 47. An RSI below 50 typically indicates bearish momentum, suggesting that sellers currently have more control in the market.

The Silver Lining: Bitcoin’s Enduring Appeal

Despite the miner sell-off and price decline, there’s a notable silver lining: Bitcoin continues to attract significant interest. This resilience suggests that underlying market sentiment remains positive, even amidst short-term bearish trends.

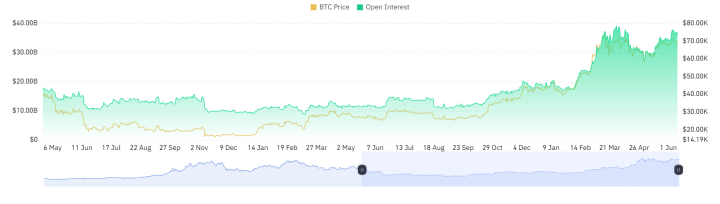

Analyzing the Open Interest chart from Coinglass, we see a figure of around $34 billion. To put this in perspective, Bitcoin’s Open Interest ATH was around $39 billion, achieved in March when BTC prices were above $70,000. The fact that Open Interest remains high, even after the price drop, indicates that capital is still flowing into the Bitcoin market. Many traders seem to be viewing the price dip as a buying opportunity.

Comparing the current Open Interest to its ATH reinforces the idea that positive sentiment around Bitcoin hasn’t significantly diminished. Traders are still engaged and optimistic about Bitcoin’s long-term potential, even as short-term price fluctuations play out.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.