Are Bitcoin miners jumping ship? Well, not exactly ‘ship,’ but some are reportedly switching gears in the crypto mining world. According to Ki Young Ju, the CEO of CryptoQuant, Bitcoin miners are hedging their bets by mining alternative cryptocurrencies as Bitcoin’s hashprice plunges to record lows. Let’s dive into what this means for the crypto market and why miners are making this strategic pivot.

Why Are Bitcoin Miners Shifting to Altcoins?

The core reason behind this shift is the dwindling profitability of Bitcoin mining. Hashprice, which essentially measures how much a miner can earn for their hashing power, has hit rock bottom. This makes Bitcoin mining less lucrative, especially with the rising costs of operations.

Understanding Hashprice: The Miner’s Profitability Gauge

- Definition: Hashprice is the expected revenue a miner can generate from 1 TH/s (terahash per second) of hashing power in a day. It’s a crucial metric to gauge mining profitability.

- Impact of Low Hashprice: A low hashprice signals reduced earnings for miners for the same amount of computational work. This can strain their profit margins, especially when electricity and hardware costs remain constant.

- Miner Response: In response to low hashprice, miners might consider:

- Optimizing Operations: Trying to reduce operational costs, such as electricity consumption.

- Upgrading Equipment: Investing in more efficient mining hardware, although this can be a significant upfront cost.

- Switching to Altcoins: Mining other Proof-of-Work (PoW) cryptocurrencies that might offer better profitability at the moment.

Ki Young Ju highlighted this trend in a recent tweet, stating:

“Bitcoin hashprice hit an all-time low. Many mining companies slowed mining rig investments, with some switching to other PoW coins to hedge against market uncertainty… This doesn’t mean the end of the cycle. And they’re not long-term bearish; they’re just hedging and waiting for buy-side liquidity to recover, in my opinion.”

Hedging Against Market Uncertainty: A Smart Move?

Switching to mine other PoW coins can be seen as a strategic move by miners to hedge against the current market downturn and uncertainty. Here’s why:

- Diversification of Revenue: By mining a variety of cryptocurrencies, miners are not solely reliant on Bitcoin’s price and hashprice. If Bitcoin mining becomes less profitable, revenue from other coins can offset losses.

- Exploiting Market Opportunities: At times, certain altcoins might offer higher profitability due to various factors like price surges, lower mining difficulty, or specific network conditions. Miners can capitalize on these short-term opportunities.

- Maintaining Operational Cash Flow: Switching to more profitable coins ensures a consistent revenue stream to cover operational expenses and maintain business continuity during Bitcoin’s price slumps.

Miner Capitulation: A Precursor to a Bull Run?

Interestingly, Ki Young Ju also points out that this trend of miners capitulating – or in this case, adapting – can be a characteristic sign that precedes a Bitcoin bull run. Historically, miner capitulation has often been followed by market recovery and subsequent bull markets.

Miner Capitulation and Bull Runs: The Connection

- Miner Capitulation Defined: It refers to a phase where miners, facing unprofitability, are forced to sell their Bitcoin holdings to cover costs or even shut down operations. This selling pressure can further depress prices in the short term.

- Market Bottom Signal: Miner capitulation is often seen as a signal that the market might be nearing a bottom. When miners, who are integral to the Bitcoin network, start to capitulate, it can indicate extreme bearish sentiment.

- Reduced Selling Pressure: Once the capitulation phase ends, the selling pressure from miners decreases. If demand starts to pick up, the reduced supply can contribute to price recovery and the beginning of a bull run.

Ethereum’s Altseason Signal: Is ETH Leading the Charge?

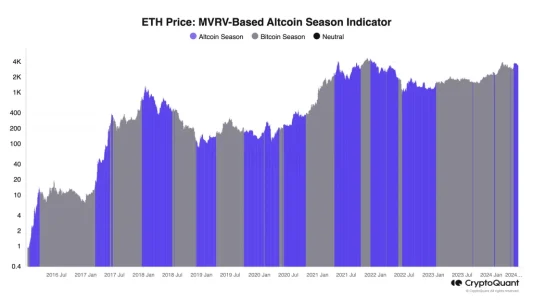

Adding another layer to the crypto narrative, Ki Young Ju recently highlighted that Ethereum’s Market Value to Realized Value (MVRV) indicator is signaling the potential start of an altseason. This could mean that while Bitcoin is facing miner profitability challenges, the broader altcoin market might be gearing up for a surge.

MVRV Indicator: Spotting Undervalued or Overvalued Assets

- Definition: MVRV is the ratio of a cryptocurrency’s market capitalization to its realized capitalization. Realized capitalization is calculated by valuing each coin at the price it was last moved on-chain.

- Interpretation:

- High MVRV: Suggests the asset might be overvalued as the market cap is significantly higher than the realized cap.

- Low MVRV: Indicates the asset might be undervalued, with the market cap being lower than the realized cap.

- Rising MVRV: Can signal increasing market momentum and potential for price appreciation.

According to Ju:

“We’re entering early altcoin season. ETH MVRV is rising faster than Bitcoin (BTC) MVRV, suggesting ETH market is heating up relative to its on-chain fundamentals. Given the current ETF situation, this might be an ETH-only season. Historically, when ETH surges, other altcoins tend to follow.”

This suggests that Ethereum could be leading the charge in the early stages of an altseason, potentially driven by factors like the Ethereum ETFs and its strong on-chain fundamentals. Historically, Ethereum’s performance often sets the stage for broader altcoin rallies.

Current Market Snapshot

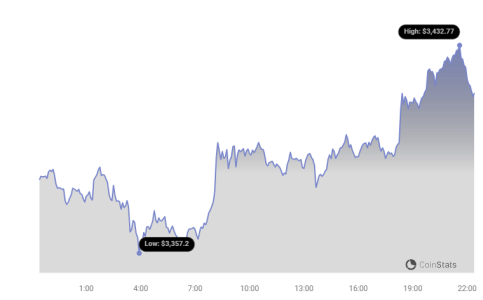

As of writing, Bitcoin (BTC) is trading around $60,681, while Ethereum (ETH) is priced at approximately $3,416. These price points are crucial to consider in the context of miner profitability and potential altseason momentum.

What Does This Mean for the Crypto Market?

The shift of Bitcoin miners towards altcoins, coupled with signals of a potential altseason led by Ethereum, paints an interesting picture for the crypto market. Here are some key takeaways:

- Market Dynamics are Shifting: Bitcoin’s dominance might be temporarily challenged as miners explore alternative revenue streams.

- Altcoin Season Potential: Ethereum’s MVRV and historical trends suggest that altcoins could see significant gains, especially if ETH continues to lead.

- Strategic Miner Adaptability: Miners are demonstrating resilience and adaptability by responding to market conditions and optimizing their operations.

- Potential Bullish Signal: Miner capitulation, even in this modified form of switching to altcoins, can be interpreted as a sign that the market is approaching a bottom, potentially setting the stage for future growth.

Conclusion: Navigating the Evolving Crypto Landscape

The crypto market is ever-evolving, and the current trend of Bitcoin miners exploring altcoins is a testament to its dynamic nature. While Bitcoin faces hashprice pressures, strategic pivots by miners and the potential for an altseason offer new opportunities and shifts in market focus. Whether this miner adaptation truly signals a pre-bull run phase remains to be seen, but it undoubtedly adds an intriguing layer to the ongoing crypto narrative. Keep an eye on hashprice trends, Ethereum’s performance, and broader altcoin market movements to stay ahead in this exciting and unpredictable space!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.