Bitcoin Short-Term Holders Selling at a Loss: What It Means for the Market

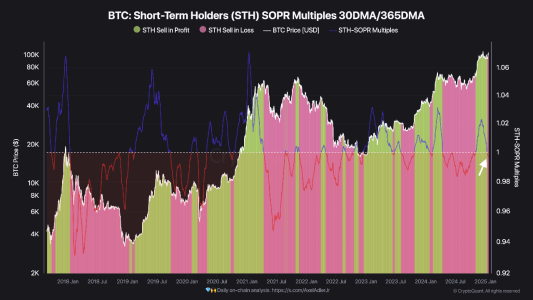

In a recent analysis shared by Markfost, Bitcoin’s Spent Output Profit Ratio (SOPR) for short-term holders (STHs) has entered negative territory. This shift indicates that investors who have held Bitcoin for less than 155 days are selling their assets at a loss.

The SOPR, a key metric in crypto analysis, measures whether holders are selling at a profit or a loss. Historically, periods of negative SOPR for STHs have presented potential buying opportunities, but they also signal heightened market volatility.

Understanding the SOPR Indicator

What Is SOPR?

The Spent Output Profit Ratio (SOPR) evaluates the profitability of spent Bitcoin by comparing the sale price to the purchase price:

- SOPR > 1: Sellers are making a profit.

- SOPR < 1: Sellers are incurring a loss.

Significance of Negative SOPR for STHs

When short-term holders sell at a loss, it reflects market uncertainty or capitulation. According to Markfost, this behavior has historically aligned with:

- Market Bottoms: Negative SOPR often indicates oversold conditions.

- Potential Declines: If losses persist, it may trigger further sell-offs.

What’s Happening with Bitcoin’s STHs?

1. Selling at a Loss

- Short-term holders are selling Bitcoin for less than they paid, contributing to the negative SOPR reading.

- This behavior reflects a lack of confidence among recent buyers, possibly driven by market corrections or external factors.

2. A Potential Buying Opportunity

- Historically, when STHs have sold at a loss, it has marked a buying opportunity for long-term investors.

- If STHs decide to hold rather than sell, their positions could form a support level for Bitcoin’s price.

3. Risk of Further Declines

- Markfost warns that continued selling pressure from short-term holders could lead to a deeper market correction.

Factors Influencing STH Behavior

Market Volatility

- Recent fluctuations in Bitcoin’s price have likely contributed to panic selling among STHs.

- Negative sentiment and fear of further declines may amplify selling pressure.

Macroeconomic Conditions

- Global economic factors, including inflation and interest rate policies, often influence crypto markets.

- Uncertainty surrounding U.S. crypto regulations under the Trump administration may also be impacting investor sentiment.

Profit-Taking vs. Loss-Cutting

- Some STHs may be cutting their losses to reallocate funds, while others could be influenced by short-term profit-taking strategies.

Historical Context: Negative SOPR as a Buying Signal

Previous Instances of Negative SOPR

- During the 2020 COVID-19 crash, negative SOPR for STHs coincided with Bitcoin trading near $4,000, presenting a prime buying opportunity.

- Similar patterns were observed during market corrections in 2018 and 2022, where negative SOPR readings signaled temporary market bottoms.

Implications for Long-Term Investors

- Negative SOPR periods often align with accumulation phases for long-term holders (LTHs), who capitalize on discounted prices.

What’s Next for Bitcoin?

Scenarios to Watch

- STHs Hold Instead of Selling

- If STHs stop selling at a loss and hold their positions, Bitcoin could find support at its current levels, stabilizing the market.

- Continued Selling Pressure

- Persistent selling by STHs could push Bitcoin prices lower, potentially testing key support levels.

Key Levels to Monitor

- Analysts suggest that current price levels may act as a psychological barrier, with significant support forming if buyers step in.

Investor Takeaways

For Long-Term Investors

- Opportunities: Negative SOPR for STHs historically represents a favorable entry point.

- Patience: Waiting for confirmation of market stabilization can mitigate risks.

For Short-Term Traders

- Caution: Negative SOPR signals increased market uncertainty, requiring careful risk management.

- Strategies: Monitoring Bitcoin’s price action and support levels can help inform short-term decisions.

Conclusion

The negative SOPR reading for Bitcoin’s short-term holders underscores a critical moment in the market. While it may indicate a buying opportunity for long-term investors, the risk of continued sell-offs remains.

Understanding the behavior of STHs and tracking key market indicators will be crucial for navigating this phase of uncertainty. Whether the market stabilizes or experiences further declines, Bitcoin’s resilience and historical patterns suggest long-term potential for recovery and growth.

To learn more about innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.