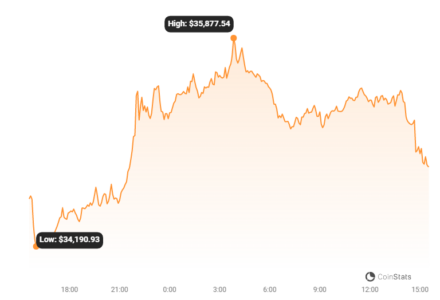

Is Bitcoin back? The world’s leading cryptocurrency is making headlines again, surging to an impressive $35,902 on November 1st – a level unseen in the last 18 months. This remarkable 25% increase in just two weeks has the crypto community buzzing. But is this a fleeting spike or the beginning of a sustained bullish trend? Let’s dive into the factors driving this surge and what it means for the future of Bitcoin and the broader crypto market.

Bitcoin Surges to $35,902: Is This the Start of a Bullish Trend?

Bitcoin’s recent performance has ignited a wave of optimism among investors. The question on everyone’s mind: Is this the start of a new bull run? After a period of relative stability, the market is keenly observing Bitcoin’s movements, searching for signals of a persistent upward trend. The cryptocurrency’s ability to maintain its current momentum or face a correction will be crucial in determining its short-term trajectory.

Beyond Bitcoin, this price surge has sparked renewed interest in alternative cryptocurrencies, leading to discussions about the broader implications for the entire digital asset market. This serves as a potent reminder of the inherent volatility and unpredictability within the crypto space.

Positive Momentum Strengthens Bullish Market Sentiment

Analysts are closely monitoring Bitcoin’s bullish signals. Since the beginning of 2023, Bitcoin has demonstrated an upward trajectory, characterized by rising highs and lows – a technical indicator of buyer dominance. While the cryptocurrency faces resistance around the $35,000 mark, suggesting a potential short-term pullback, the overall market momentum remains strong, with Bitcoin achieving significant high points that indicate substantial demand.

Read Also: Chinese Police Reveals $300 Million Cryptocurrency Scam! Scammers Used This Stablecoin!

What’s Fueling the Bitcoin Surge? Decoding the Key Factors

Several factors are contributing to the current optimistic outlook in the Bitcoin market:

- Federal Reserve’s Pause on Interest Rate Hikes: The Fed’s decision to hold off on further interest rate increases typically benefits asset values, including cryptocurrencies. This makes Bitcoin more attractive to investors seeking growth opportunities outside traditional interest-bearing assets.

- Potential Approval of a Spot Bitcoin ETF: Asset manager Bernstein suggests that the approval of a spot Bitcoin ETF could propel Bitcoin’s value to an impressive $150,000 by 2025. An ETF would bring Bitcoin into mainstream financial portfolios, potentially diverting a significant portion of its supply into the ETF market.

- The 2024 Bitcoin Halving Event: The upcoming halving event, which reduces the rate at which new Bitcoins are created, is generating excitement. Historically, halvings have preceded price increases due to the increased scarcity of new Bitcoins.

Bitcoin: A Digital Safe Haven in Uncertain Times?

In a world grappling with economic uncertainty and doubts about traditional safe-haven assets, Bitcoin is emerging as a potential sanctuary for capital. Its increasing reputation as a reliable store of value is attracting investor attention, positioning Bitcoin as an appealing alternative to traditional assets.

With its decentralized nature and a limited supply of 21 million coins, Bitcoin is viewed as a hedge against inflation and economic instability. The underlying blockchain technology provides transparency and security, further enhancing its appeal in a financial landscape where trust is paramount. This combination of scarcity, technological innovation, and growing recognition of Bitcoin’s resilience is attracting both individual and institutional investors seeking alternative ways to preserve and grow their wealth.

Looking Ahead: What’s Next for Bitcoin?

While current market trends indicate a positive outlook, it’s crucial to exercise caution in the volatile crypto market. Rapid price increases are often followed by corrections, so investors should remain vigilant and adaptable. However, the convergence of favorable macroeconomic conditions – the potential approval of a Bitcoin ETF, the upcoming halving, and Bitcoin’s growing status as a safe-haven asset – creates a powerful combination that could indeed trigger a significant bull run.

In the cryptocurrency world, where optimism is often tempered with realism, these developments could mark the dawn of a new era for Bitcoin and the broader crypto market.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.