Bitcoin is back in the spotlight, and for good reason! The leading cryptocurrency has smashed through the $37,000 barrier, a level unseen in over a year and a half. This surge, especially hot on the heels of a 30% jump in October, has the crypto world buzzing. But amidst the excitement, a sense of cautious skepticism lingers. Is this a genuine bull run, or are we seeing a temporary price spike? Let’s dive into what’s fueling this rally and what market experts are saying.

Bitcoin’s Breakout: A Look at the Numbers

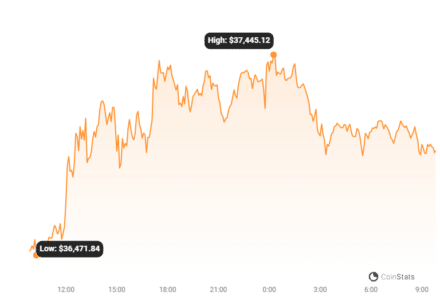

Bitcoin’s price action has been nothing short of impressive. After crossing $37,000, it briefly dipped slightly to around $36,900. The immediate target now? The psychological barrier of $40,000.

- Reached $37,000 for the first time in 18 months.

- Follows a strong 30% gain in October.

- Currently hovering around $36,900.

- Eyes are now set on breaking the $40,000 mark.

Skepticism Amidst the Surge: Are Traders Worried?

While the price charts are flashing green, not everyone is convinced this is a straightforward bull run. Many traders and market observers are expressing caution. Why the skepticism?

The Volume Discrepancy: A Red Flag?

One of the primary concerns highlighted by on-chain monitoring resource Material Indicators is the lack of robust trading volume to support this price surge. Think of it like this: a price increase should ideally be backed by a corresponding increase in the number of Bitcoin being traded. When the price goes up rapidly, but trading volume doesn’t keep pace, it can indicate a less organic, and potentially less sustainable, price movement.

Here’s a breakdown of the volume concern:

- Price Surging, Volume Lagging: Bitcoin’s price is climbing rapidly, but trading volume isn’t showing the same momentum.

- Support and Resistance Levels: Current support is around $33,000, while resistance is anticipated in the $42,000 range.

- Material Indicators’ Warning: They point out a “red signal” – price appreciation on diminishing volume, a pattern historically associated with negative outcomes.

Material Indicators sums it up concisely: “…there is no denying the fact that price has been challenging a number of different local top signals, but there is also no denying that something doesn’t seem right about this move.”

Whale Selling Pressure: Are Big Players Cashing Out?

Adding to the cautious sentiment, renowned trader Skew has observed continued selling pressure from large Bitcoin holders, often referred to as ‘whales’. This selling activity is particularly noticeable as Bitcoin approaches the significant $40,000 threshold. Whale selling can exert downward pressure on prices, potentially counteracting the bullish momentum.

Read Also: Solana Rallies, Soared Above $54: What Is Next For SOL?

Open Interest on the Rise: Fueling the Fire or Adding Instability?

Another crucial factor in understanding this Bitcoin surge is the increasing Open Interest (OI) in Bitcoin futures. According to CoinGlass data, total Bitcoin futures OI has reached a staggering $17 billion, the highest level since mid-April.

Financial commentator Tedtalksmacro highlights the importance of OI in the recent rapid price increase.

Here’s the gist of the Open Interest impact:

- Rising OI: Open Interest in Bitcoin futures is at its highest since April, indicating increased speculative activity.

- Amplifying Price Moves: High OI can amplify price movements, both upwards and downwards.

- Bearish Market Behavior: Tedtalksmacro notes that in bearish phases, the market tends to reject these OI surges, leading to range-bound and volatile trading.

Navigating the Bullish Uncertainty

The current Bitcoin market presents a mixed bag of signals. While the price surge is undeniably exciting for many, the concerns about trading volume, whale selling, and the role of open interest cannot be ignored.

Key Takeaways:

- Bullish Price Action: Bitcoin has broken through significant resistance levels and is aiming for $40,000.

- Volume Concerns: Low trading volume relative to the price increase raises questions about the sustainability of the rally.

- Whale Selling: Continued selling pressure from large holders could temper further price gains.

- Rising Open Interest: High OI adds complexity and potential volatility to the market dynamics.

Looking Ahead: What’s Next for Bitcoin?

Market participants are now in a wait-and-see mode, closely monitoring these crucial factors. Will the bullish momentum continue to overpower the headwinds? Or will the lack of volume and whale selling prove to be significant obstacles? The coming days and weeks will be critical in determining whether Bitcoin’s surge is a sustainable bull run or a temporary mirage. Stay tuned as we continue to track Bitcoin’s journey in this dynamic market!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.