After an exhilarating surge that propelled BONK into the crypto spotlight, the meme coin is now facing a significant downturn. Recent data reveals a sharp price decline, leaving investors wondering if the bears have taken control. Let’s dive into the factors driving this shift and what it means for the future of BONK.

BONK’s Rollercoaster Ride: From Boom to Bust?

- BONK experienced a meteoric rise, gaining over 600% in the past month and entering the top 100 cryptocurrencies by market capitalization.

- The surge was largely fueled by its listing on Binance, which triggered a massive influx of buying pressure.

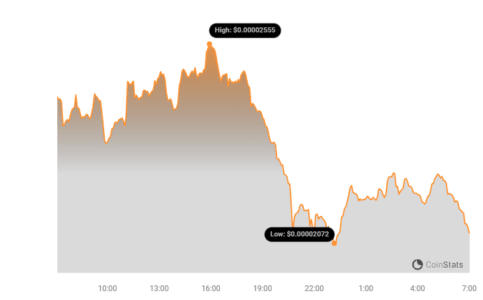

- However, the tide has turned, with BONK shedding double-digits in value within the last 24 hours.

- Whales and traders began selling off their BONK holdings soon after the Binance listing, contributing to the price drop.

A Look Back at BONK’s Ascent

Before its recent surge, BONK remained relatively obscure. The meme coin’s price action was largely uneventful until early December when it suddenly took off, even surpassing Shiba Inu in value at one point.

The Binance listing served as a major catalyst, igniting investor interest and driving up demand. But this also brought scrutiny to token unlocks.

See Also: Jupiter Airdrop (JUP) Distribution Set For January, Solana DeFi Users Get Ready

Token Unlocks reported that 64.7 trillion BONK tokens, representing 64.7% of its total supply, had been unlocked. This news coincided with the downturn, adding further pressure.

According to Coinstats, BONK was down over 20% in the last 24 hours, trading at $0.00002182 with a market cap of over $1.47 billion, ranking it as the 51st largest crypto.

Lookonchain’s data revealed that a trader sold 52.3 billion BONK, worth $927,000, shortly after the Binance listing.

It was also suspected that DWFLabs deposited 50 billion BONK, valued at $1.6 million, into Binance, further increasing selling pressure.

This influx of selling activity caused the meme coin’s price to plummet, raising concerns about its short-term prospects.

Is the BONK Bear Market Here to Stay?

Analyzing BONK’s daily chart can provide insights into the potential duration of this price decline.

The Relative Strength Index (RSI) and Money Flow Index (MFI) were both in overbought zones, suggesting the possibility of continued sell pressure. However, the MACD remained bullish, indicating some underlying strength.

Despite the price drop, BONK remains a hot topic of discussion, with high social volume and positive sentiment.

See Also: BONK Becomes Third Largest Memecoin Following Coinbase Listing

Solana’s Saga phone also benefited from the BONK frenzy. The announcement of 30 million BONK token airdrops for Saga phone owners led to a surge in demand, resulting in the complete sell-out of all Saga units.

Key Factors Influencing BONK’s Price:

- Binance Listing: Initial surge followed by profit-taking.

- Token Unlocks: Increased supply potentially diluting value.

- Whale Activity: Large sell-offs impacting market sentiment.

- Market Indicators: Overbought conditions suggesting further decline.

What’s Next for BONK?

BONK’s future remains uncertain. While the recent price drop is concerning, the meme coin’s strong social presence and the positive impact on Solana’s Saga phone suggest that it still has potential. Investors should closely monitor market indicators and be aware of the risks associated with meme coins.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.