The crypto world, while brimming with innovation and opportunity, also unfortunately attracts bad actors. In a stark reminder of the risks involved, the ORDEX token recently plummeted to zero in under an hour, leaving investors reeling from a classic ‘rug pull’ scam. Let’s dive into what happened, how much was lost, and most importantly, how you can protect yourself from similar schemes.

What Happened to ORDEX Token? A DeFi Disaster

Imagine watching your investment evaporate in less than 60 minutes. That’s the harsh reality faced by ORDEX token holders. Reports indicate that fraudsters executed a rug pull, causing the token’s value to crash to absolute zero. Here’s a quick breakdown of the ORDEX rug pull incident:

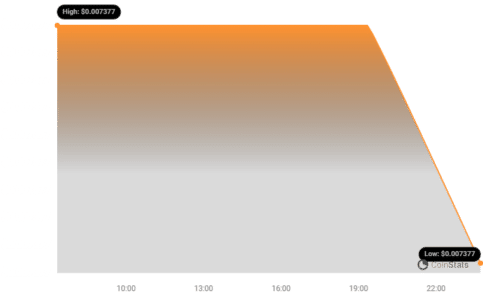

- Sudden Price Crash: The ORDEX token price experienced a catastrophic drop to $0 in under an hour.

- Significant Losses: This rapid devaluation resulted in investors losing over $70,000.

- Rug Pull Confirmation: Crypto security firm PeckShield highlighted the incident, confirming it as a rug pull.

- Exploited Decentralized Exchange: The rug pull occurred on Uniswap, a popular decentralized exchange (DEX).

The Ordinal DEX (ORDEX) token’s dramatic fall is visually represented in this chart:

This incident underscores a critical point: while Ordinals and new crypto narratives capture excitement, they also unfortunately attract scammers looking to exploit unsuspecting investors.

See Also: The Price Of Solana (SOL) Up More Than 4% In 24 Hours

ORDEX Rug Pull: How Did the Scam Unfold?

According to PeckShield, the rug pull was executed by an address starting with “0xea81”. This address swapped a massive one quadrillion ORDEX tokens for 30.96 Ethereum (ETH), valued at approximately $70,600. This massive sell-off triggered the price collapse, effectively draining liquidity and leaving other investors with worthless tokens.

PeckShield further highlighted a crucial detail in their alert:

“The #rugpull token shares the same name as the legitimate ones”

#PeckShieldAlert #rugpull @ordex_market $ORDEX appears to be a rugpull

The price of $ORDEX has dropped -100% in less than 1 hour

The exploiter 0xea81…55a1 swapped 1 Quadrillion $ORDEX for 30.96 $ETH (~$70.6K)

The #rugpull token shares the same name as the legitimate oneshttps://t.co/CZSQ9w1g1l pic.twitter.com/LzF6Q6l83Y

— PeckShieldAlert (@PeckShieldAlert) December 24, 2023

Echoes of the Past: The Fake GEMINI Token Scam

Sadly, the ORDEX rug pull isn’t an isolated incident. Just recently, on December 7th, a similar scam unfolded involving a fake GEMINI token.

#PeckShieldAlert #rugpull Fake $GEMINI token

The price of $GEMINI has dropped -100% in less than 1 hour

The exploiter 0x3658…a919 swapped 4.2 Quadrillion $GEMINI for 133.97 $WETH (~$277K)https://t.co/k10n21g8bC pic.twitter.com/e5q7d9QvXW

— PeckShieldAlert (@PeckShieldAlert) December 7, 2023

PeckShield reported that in the GEMINI scam, the perpetrators converted a staggering 4.2 quadrillion fake GEMINI tokens into 133.97 Wrapped Ethereum (WETH) before executing their rug pull. This highlights a recurring pattern: scammers often create fake tokens mimicking legitimate projects to deceive investors.

Ticker Symbol Tricks: Don’t Be Fooled

Scammers are getting increasingly sophisticated. One common tactic is to use ticker symbols that are very similar to those of well-known and trusted projects. Think about it – a slight misspelling can easily go unnoticed, especially in the fast-paced world of crypto trading.

For instance, remember the Islamic Coin (ISLM) imposter project? Using the ticker “ISLAMIC” (very close to ISLM), these fraudsters operated on the BNB chain. On October 11th, they dumped a massive one quadrillion “ISLAMIC” tokens, stealing over $150,000. This underscores the importance of meticulous verification.

See Also: Curve Finance To Refund Affected Users In July Hack Exploit

How to Protect Yourself from Rug Pulls: Investor Safety Tips

So, how can you navigate the DeFi space safely and avoid becoming a victim of rug pulls? Here are some crucial steps to take:

- Double-Check Ticker Symbols: When using decentralized exchanges, always meticulously verify the ticker symbol. Ensure it precisely matches the legitimate project you intend to invest in. Cross-reference with official project websites and reputable crypto data aggregators.

- Verify Contract Addresses: Don’t just rely on ticker symbols. Dig deeper and verify the token’s contract address on blockchain explorers like Etherscan or BscScan. Legitimate projects will have their contract addresses publicly available and easily verifiable.

- Research Market Capitalization: Be extremely cautious of tokens with exceptionally low market capitalization. These are often easier to manipulate and are prime targets for rug pulls. While low cap tokens can offer high potential gains, they also come with significantly higher risks.

- Due Diligence is Key: Before investing in any crypto project, conduct thorough research. Understand the project’s team, whitepaper, tokenomics, and community. Look for red flags like anonymous developers, unrealistic promises, and lack of transparency.

- Use Reputable Data Aggregators: Utilize crypto data aggregator tools like CoinGecko, CoinMarketCap, or Coinstats to get detailed information about tokens, including verified contract addresses and official links.

- Community Sentiment: Check the project’s community sentiment on platforms like Twitter, Reddit, and Telegram. Are there genuine discussions and engagement, or are there signs of artificial hype and bot activity?

Stay Vigilant, Stay Safe

The ORDEX rug pull is a painful reminder that vigilance is paramount in the crypto space. While DeFi offers exciting opportunities, it also demands caution and informed decision-making. By understanding the risks, practicing due diligence, and staying informed, you can significantly reduce your chances of falling victim to scams and rug pulls. Remember, if something seems too good to be true, it probably is. Always prioritize the safety of your investments.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.