Is the crypto winter finally thawing? Bitcoin enthusiasts and analysts are increasingly optimistic, suggesting that the days of rock-bottom BTC prices might be behind us. After a period of market uncertainty, a wave of confidence is sweeping through the Bitcoin community, fueled by resilient price action and encouraging institutional developments.

“September is Not Rektember”: Bitcoin Defies Expectations

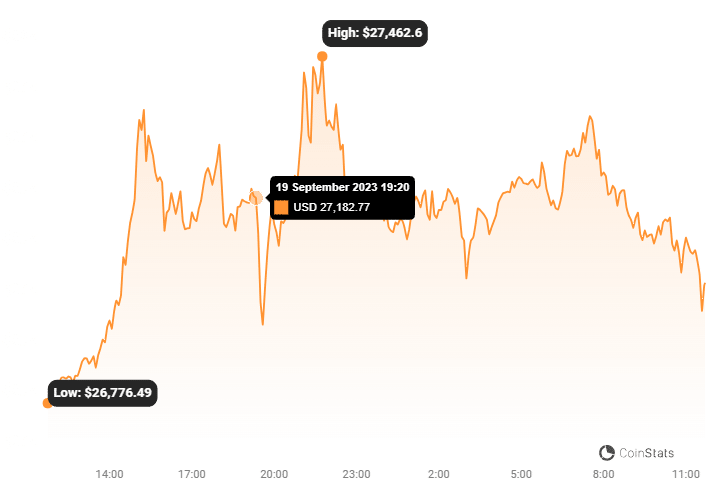

Contrary to past trends where September often brought market downturns – infamously dubbed “Rektember” in crypto circles – this year seems different. Prominent Bitcoin analysts are confidently stating that the cryptocurrency has weathered the storm and established a firm bottom. Data from Cointelegraph Markets Pro and TradingView reinforces this sentiment, indicating that Bitcoin’s primary battleground is now above the $26,600 mark, a crucial breakout point.

Macroeconomic Headwinds? Bitcoin Remains Unfazed

Interestingly, even recent macroeconomic data from the United States, which hinted at persistent inflation, failed to dampen Bitcoin’s spirits. Instead of reacting negatively, Bitcoin mirrored the positive momentum in traditional markets, showcasing its growing resilience and potential decoupling from conventional financial anxieties. This unexpected strength has further bolstered the bullish narrative.

Expert Voices: No More Lows for BTC?

Adding to the optimistic chorus, Michaël van de Poppe, founder and CEO of trading firm Eight, has voiced his belief that BTC/USD is unlikely to revisit previous lows. In a post on X (formerly Twitter), he pointed towards a potential bullish breakout for Bitcoin, while cautioning against complacency and the need to monitor for any retests of prior support levels.

Van de Poppe highlighted the significant news of Deutsche Bank, Germany’s largest lender, applying for a crypto custody license. This institutional move further validates the growing acceptance and integration of cryptocurrencies into mainstream finance. He suggests that the $25,000 level is now a critical line in the sand for Bitcoin bulls. Navigating above this point is crucial to avoid potential market pitfalls.

Key Takeaways from van de Poppe’s Analysis:

- $25,000 as a Pivotal Level: Maintaining price levels above $25,000 is crucial for bullish momentum.

- $25,600 – $25,900 Range: Holding this range is essential to prevent stop-loss triggers and pave the way for substantial upward movement.

- Institutional Adoption: Deutsche Bank’s crypto custody license application signals growing institutional interest and confidence in crypto assets.

The Power of the 200-Week EMA

Despite currently trading below several key moving averages (MAs), Bitcoin continues to find strong support at the 200-week exponential moving average (EMA). This level has proven to be a significant foundation, particularly since March, which analysts identify as the beginning of the current bullish phase.

Van de Poppe emphasizes the importance of this indicator, stating, “The probability of this cycle’s low point being behind us has grown significantly. Why? Well, we’re once again holding above the 200-Week EMA, and it’s likely that we’ll close above it again this time around.”

What is the 200-Week EMA and Why Does it Matter?

The 200-week EMA is a long-term moving average that represents the average price of Bitcoin over the past 200 weeks. It’s a widely watched indicator by traders and analysts because:

- Long-Term Trend Indicator: It helps to identify the overall long-term trend of Bitcoin.

- Support and Resistance: Historically, the 200-week EMA has acted as a significant support level during bear markets and resistance during bull markets.

- Market Sentiment: Holding above the 200-week EMA is generally seen as a bullish sign, indicating underlying strength in the market.

$26,800: The Next Hurdle for Bitcoin

Looking ahead, van de Poppe identifies $26,800, the previous day’s high, as the immediate price level Bitcoin needs to conquer to sustain its upward trajectory. He concludes with a positive outlook, “September is proving to be a month of progress, not regression, and it seems we will continue to build on our current momentum.”

Wyckoff Method: A Textbook Bullish Setup?

Adding another layer of bullish analysis, trading resource Stockmoney Lizards employs the Wyckoff method to interpret Bitcoin’s price action over the past year. They compare it to a prolonged “accumulation” phase, a period where smart money accumulates assets before a significant price increase.

The Wyckoff method is a technical analysis approach that attempts to identify market phases and predict future price movements based on supply and demand dynamics. Key phases in the Wyckoff accumulation schematic include:

- Spring: A price dip below previous lows to shake out weak hands before a major uptrend.

- Breakout: A decisive move above resistance levels, signaling the start of an uptrend.

- Throwback (or Retest): A temporary pullback to previous resistance levels (now support) to confirm the breakout.

Stockmoney Lizards pinpointed the “Spring” in Bitcoin’s price action to late 2022, when BTC/USD reached its cycle low. They further observed a breakout in March and a subsequent throwback, aligning perfectly with textbook Wyckoff behavior.

Wyckoff Accumulation Phases in Bitcoin (According to Stockmoney Lizards):

| Phase | Bitcoin’s Price Action | Wyckoff Interpretation |

| Spring | BTC/USD low point in late 2022 | Shakeout of weak hands |

| Breakout | Price surge at the end of March | Start of uptrend |

| Throwback | Recent price pullback | Confirmation of breakout and new support |

This analysis suggests that Bitcoin is currently in a strong position to potentially enter a new uptrend, based on established technical patterns and market behavior.

Conclusion: Is Bitcoin Ready for a Bull Run?

The confluence of positive expert analysis, resilient price action above key support levels like the 200-week EMA, and institutional interest from players like Deutsche Bank paints an increasingly bullish picture for Bitcoin. While the cryptocurrency market remains volatile and subject to unforeseen events, the current sentiment suggests that the bottom may indeed be in. Whether this translates into a full-blown bull run remains to be seen, but the indicators are certainly pointing towards a more optimistic future for Bitcoin and the broader crypto market. Keep an eye on those key levels – $25,000, $25,600-$25,900, and $26,800 – as Bitcoin navigates this potentially transformative phase.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.