Hold onto your hats, crypto enthusiasts! The market is serving up another rollercoaster ride. Bitcoin (BTC), after flirting with the $70,000 mark, has taken a sharp turn south, dipping below $67,000. But here’s the twist – this price correction comes even as Bitcoin ETFs are enjoying a streak of positive inflows. Confused? Let’s break down what’s happening in the ever-dynamic world of crypto.

Bitcoin’s Price Plunge: A Quick Snapshot

Despite seeing a surge of investments into Bitcoin ETFs, the price of BTC experienced a significant correction:

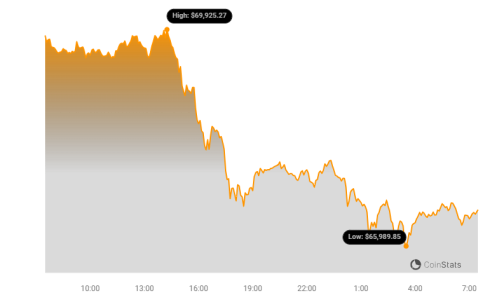

- Price Drop: Bitcoin’s price tumbled from $70,000 to $66,480.

- Percentage Decline: A 4.1% decrease in just 24 hours.

- Liquidation Frenzy: This price drop triggered massive liquidations in the Bitcoin futures market.

- Total Liquidations: A whopping $76.89 million liquidated in 24 hours.

- Long Positions Hit Hard: Long liquidations dominated, accounting for $69.71 million of the total.

So, while Bitcoin was attracting fresh capital through ETFs, its market price took a noticeable hit. What’s driving this seemingly contradictory movement?

Bitcoin ETFs: Riding a Wave of Inflows

Let’s dive into the ETF side of the story. Bitcoin spot ETFs have been on a roll, marking their fourth consecutive day of net inflows on July 29th. This positive momentum suggests sustained institutional interest in Bitcoin.

Key Highlights of Bitcoin ETF Performance:

- Consistent Inflows: Four straight days of net positive inflows.

- July 29th Inflow: A total net inflow of $124 million on a single day.

- Total Net Asset Value Soaring: Bitcoin spot ETFs now boast a total net asset value of $61.732 billion.

- BlackRock’s IBIT Leading the Charge: IBIT ETF emerged as the star performer, attracting a massive $206 million in new investments.

- Grayscale’s GBTC Sees Outflows: Not all ETFs are created equal. GBTC experienced outflows of $54.2931 million on the same day, indicating some investor preference shifts within the ETF landscape.

These figures, sourced from SoSo Value, paint a picture of robust demand for Bitcoin exposure through ETFs.

Ethereum ETFs: A Contrasting Narrative

Now, let’s switch gears to Ethereum ETFs. Here, we see a different story unfolding. While Bitcoin ETFs basked in inflows, Ethereum ETFs faced headwinds.

Ethereum ETF Outflows: Key Points

- Four Days of Outflows: Ethereum spot ETFs recorded their fourth consecutive day of net outflows on July 29th.

- Significant Outflow Volume: A total net outflow of $98.2856 million on July 29th alone.

- Grayscale’s ETHE Under Pressure: ETHE ETF bore the brunt, with a substantial $210 million withdrawn in a single day.

Silver Linings in Ethereum ETFs

However, it’s not all gloom for Ethereum ETFs. Some funds managed to buck the trend:

- BlackRock’s ETHA Inflows: Attracted $58.1696 million.

- Fidelity’s FETH Inflows: Secured $24.8242 million.

- Grayscale’s Mini ETH ETF (ETH) Positive: Even Grayscale saw some positive movement with $4.8967 million inflows into their mini ETF.

Despite these pockets of positive inflow, the overall trend for Ethereum ETFs on July 29th was clearly towards outflows, suggesting a divergence in investor sentiment compared to Bitcoin ETFs.

BTC vs. ETH ETFs: Diverging Investor Sentiment?

The contrasting performance of Bitcoin and Ethereum ETFs raises an interesting question: Are we seeing a split in investor sentiment? While institutional investors seem to be accumulating Bitcoin through ETFs, there appears to be less enthusiasm, or perhaps profit-taking, in Ethereum ETFs.

This divergence could be attributed to several factors:

- Bitcoin’s ‘Safe Haven’ Appeal: In times of market uncertainty, Bitcoin is often perceived as a safer bet compared to other cryptocurrencies.

- Ethereum’s Evolving Narrative: Ethereum’s shift to Proof-of-Stake and its ongoing development may introduce perceived risks or uncertainties for some investors.

- Profit Rotation: Investors who profited from the recent Ethereum rally might be rotating those profits into Bitcoin or other assets.

- Macroeconomic Factors: Broader economic conditions and risk appetite can influence investment decisions in both Bitcoin and Ethereum, potentially impacting them differently.

It’s crucial to remember that the cryptocurrency market is inherently volatile, and short-term price movements don’t always reflect long-term trends. The ETF data provides valuable insights into institutional flows, but it’s just one piece of the puzzle.

As CoinStats data reveals, the Bitcoin price correction also triggered significant liquidations in the futures market, highlighting the leveraged nature of crypto trading and its susceptibility to price swings. Ethereum also saw a price dip of 1.6% to $3,332, mirroring the outflows in its ETF products.

Key Takeaways

- Bitcoin price corrected despite continued ETF inflows, suggesting broader market pressures at play.

- Ethereum ETFs experienced net outflows, contrasting with Bitcoin’s ETF performance and potentially indicating diverging investor sentiment.

- Market volatility remains a key characteristic of the crypto space, as evidenced by the sharp price corrections and liquidations.

- Monitoring ETF flows, price action, and broader market sentiment is crucial for navigating the cryptocurrency landscape.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.