Centralized Crypto Exchanges Hit Record $11.3 Trillion Monthly Trading Volume

Cryptocurrency trading volumes on major centralized exchanges (CEXs) have reached an all-time high, according to CCData. In December 2024, the total spot and derivatives trading volume hit $11.3 trillion, a 7.58% increase from the previous month’s $10 trillion milestone. This surge reflects growing market activity fueled by renewed investor interest in cryptocurrencies.

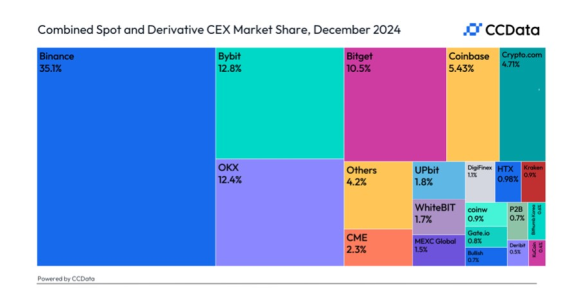

Despite retaining its leadership in both spot and derivatives markets, Binance’s market share declined, marking a notable shift in exchange dynamics.

Key Metrics from December’s Record Trading Volume

| Metric | Volume | % Change from November 2024 |

|---|---|---|

| Total Trading Volume | $11.3 trillion | +7.58% |

| Spot Trading Volume | $3.73 trillion | +8.10% |

| Derivatives Volume | $7.58 trillion | +7.33% |

Binance Leads But Sees Market Share Decline

Spot Trading

- Volume: Binance led with $946 billion in spot trading.

- Market Share: Dropped to 25.4%, its lowest since January 2021.

Derivatives Trading

- Volume: Binance accounted for 39.9% of derivatives trading.

- Market Share: Also saw a decline as competitors gained traction.

Reasons Behind the Volume Surge

1. Increased Market Participation

- Institutional Inflows: Renewed interest from institutional investors has driven volumes across spot and derivatives markets.

- Retail Activity: Improved sentiment following Bitcoin’s surge to nearly $100,000 has reinvigorated retail trading.

2. Derivatives Market Growth

- Hedging and Speculation: Derivatives continue to dominate trading activity, offering tools for hedging and leveraging positions.

3. Crypto ETF Launches

- The approval of spot Bitcoin ETFs and other crypto ETFs has drawn significant capital into the market, bolstering trading volumes.

Market Dynamics: Binance’s Declining Share

Factors Contributing to Binance’s Decline

- Increased Competition: Exchanges like OKX, Bybit, and Bitget are gaining market share by offering competitive fees and innovative products.

- Regulatory Scrutiny: Binance has faced regulatory challenges in multiple jurisdictions, affecting its global dominance.

Key Competitors

- OKX: Notable growth in both spot and derivatives trading, particularly in Asia.

- Bybit and Bitget: Strong performance among professional traders due to their advanced features and liquidity.

Comparison: Spot vs. Derivatives Markets

| Market | December 2024 Volume | % of Total Volume | Growth Trend |

|---|---|---|---|

| Spot Trading | $3.73 trillion | 33% | Stable Growth |

| Derivatives Trading | $7.58 trillion | 67% | Rapid Expansion |

Implications of the Record Trading Volumes

1. Increased Liquidity

- Higher trading volumes enhance market liquidity, improving price stability and execution speeds.

2. Strengthened Institutional Adoption

- Record volumes signal that institutional players are increasingly comfortable participating in the crypto market.

3. Competitive Pressures on Exchanges

- With Binance’s market share under pressure, competitors are likely to innovate further to attract users.

Future Outlook

1. Sustained Growth in Derivatives Markets

- As derivatives trading continues to dominate, exchanges may introduce more sophisticated products, such as perpetual futures and options.

2. Expansion of Spot ETFs

- The rise of spot Bitcoin ETFs could further boost spot trading volumes in 2025.

3. Regional Growth Opportunities

- Emerging markets, particularly in Asia and Latin America, are expected to drive future volume growth.

Conclusion

The record-breaking $11.3 trillion trading volume on centralized crypto exchanges underscores the growing maturity and adoption of the cryptocurrency market. While Binance remains a leader, its declining market share highlights the increasing competitiveness of the sector.

As institutional interest and product innovation continue to shape the industry, centralized exchanges are poised for further growth, even as they face challenges from competitors and regulatory pressures.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.